Last week’s review of the macro market indicators noted with another Fed rate hike behind it and now the prospect of trade wars, the equity markets finished the week breaking down and looking weak. Elsewhere looked for Gold to continue in its uptrend while Crude Oil ($USO) also moved higher. The US Dollar Index ($DXY) seemed content to move sideways while US Treasuries ($TLT) were biased to continue to the upside.

The Shanghai Composite ($ASHR) and Emerging Markets ($EEM) were biased to the downside within broad consolidation. Volatility (iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) looked to remain elevated keeping the bias lower for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts showed short term weakness continuing and for the first time in years the prospect of intermediate term weakness in the SPY (NYSE:SPY) and iShares Russell 2000 (NYSE:IWM). The PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) remained the best chart on the longer timeframe.

The week played out with Gold moving higher Monday before reversing to new lows while Crude Oil peaked and pulled back slightly. The US Dollar continued to mark time in a tight range while Treasuries moved higher. The Shanghai Composite gapped down to the February lows and held there while Emerging Markets held firm over support.

Volatility held a tight range over the 20 level, keeping pressure on equities. The Equity Index ETF’s moved in wild ranges to start the week, both up and down, before settling Thursday and then moving back higher Friday. The SPY held on its test over the 200 day SMA, and all three may have made higher lows again. What does this mean for the coming week? Lets look at some charts.

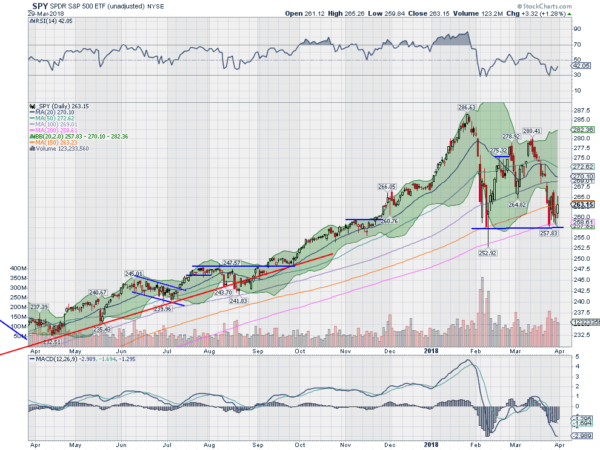

The SPY ended the prior week with a sharp two day move lower to the 200 day SMA. Closing on the low it looked ugly coming into the short week. But Monday saw a bounce back above the Friday open. It was not out of trouble though as it printed a bearish engulfing candle Tuesday, back near the 200 day SMA. Wednesday printed a small body candle retesting the 200 day SMA and then Thursday gapped up and moved higher, completing a Morning Star reversal.

Broadly the SPY just consolidated over the 200 day SMA with a strong finish. Now it needs to follow through next week and break the consolidation to show strength. The daily chart shows the RSI pushing up off of oversold territory with the MACD leveling. So momentum is improving, but not outright bullish.

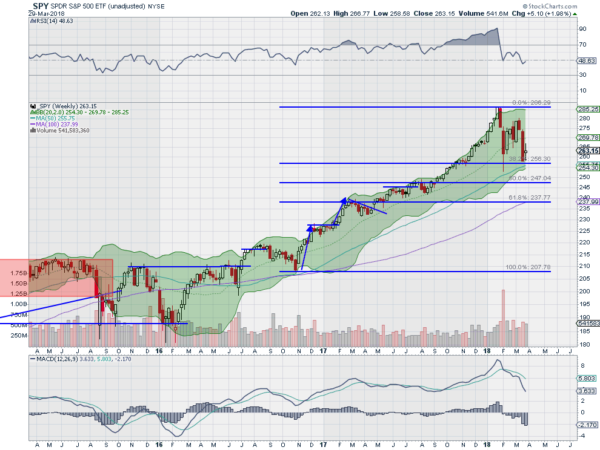

The weekly chart shows a doji Harami, an inside candle and possible reversal candle. Notably, if this bottom holds and it does reverse, it also confirms a Positive RSI Reversal, giving a target to 285.32. The RSI broke the mid line but is turning back higher and remains in the bullish zone with the MACD continuing to move lower, but still very positive. There is resistance above at 265 and 267 then 269 and 272. Support lower comes at 262.50 and 260 then 257 and 255. Consolidation.

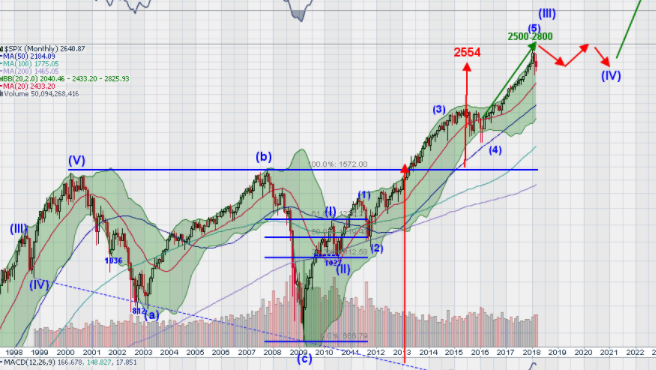

As the books close on the 1st Quarter of trading the equity indexes had their first down quarter in over 2 years and are hanging onto long term bullish trends by a thread. Elsewhere look for Gold to consolidate with a downward bias while Crude Oil turns from an uptrend to consolidation. The US Dollar Index continues to move sideways while US Treasuries are biased higher. The Shanghai Composite and Emerging Markets look to continue to consolidate, the Shanghai Composite at the retest of lows and Emerging Markets at their highs.

Volatility looks to remain elevated keeping pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts show that the bleeding has stopped in the short run, but no strength for a reversal at this point. That said the longer trend remains to the upside. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.