Last week’s review of the macro market indicators saw the equity indexes looking strong. Elsewhere looked for gold to continue higher along with crude oil. Both showed risk of a short-term pullback. The US Dollar Index looked to test the bottom of the consolidation range while US treasuries (iShares 20+ Year Treasury Bond (NYSE:TLT)) continued lower in their wedge.

The Shanghai Composite and iShares MSCI Emerging Markets (NYSE:EEM) were biased to the upside with risk of the emerging markets running a little lower first. Volatility (iPath S&P 500 VIX Short-Term Futures (NYSE:VXX)) looked to remain subdued and biased lower, keeping the bias higher for the equity index ETFs SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts looked strong, especially on the weekly timeframe. The SPY is finally over its 200-day SMA, and late week action suggests possible rotation into the IWM to come next.

The equity index ETFs started the week consolidating at the prior week’s highs, and then digested with a pullback. This resulted in the SPY falling back to the 200-day SMA, and the IWM and QQQ dropping back from contact with their 200-day SMAs. What does this mean for the coming week? Lets look at some charts.

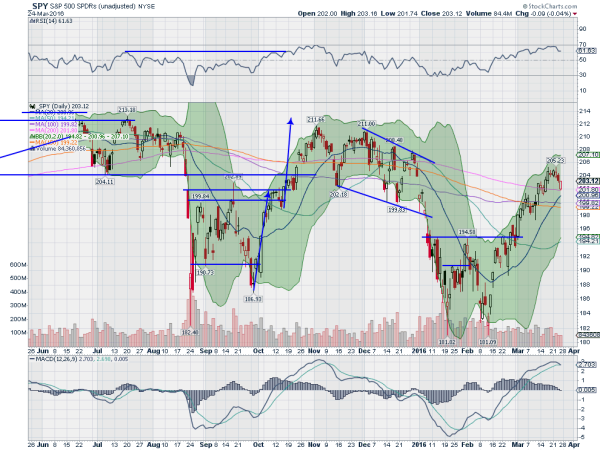

SPY Daily

The SPY came into the week following an inside doji to end the prior week. That proved to be unimportant as it moved sideways in a narrow range the next day. Wednesday saw a crack to the downside and follow through Thursday, touching the 200-day SMA. It held there and moved higher the rest of the day, finishing on the high and with a bullish hollow red candle. The hollow red candle shows intraday strength and will have many leaning higher next week.

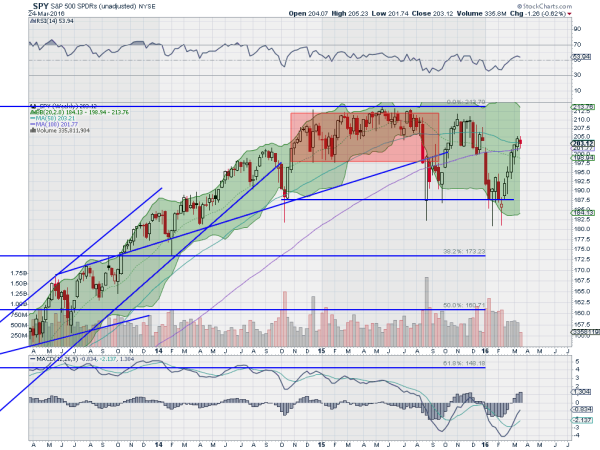

The RSI on the daily chart is bullish but leveling and the MACD is looking to cross down, a bearish signal. Mixed views on this timeframe. On the weekly chart the SPY printed an inside week and held over the 100-week SMA. Note that the volume has trended lower over the entire run higher, thought to be a sign of a weak bounce, as it currently sits at a lower high.

It has not reversed yet and the MACD is running higher, but with the RSI leveling just over the mid line, where it has stalled before. There is resistance higher at 203.75 and 206 followed by 207.60 and 208.50. Support lower comes at 201.5 and 200 followed by 199 and 198.5 before 196. Pullback in the intermediate uptrend may continue.

SPY Weekly

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.