Last week’s review of the macro market indicators saw that with the March FOMC meeting and Options Expiration in the rear view mirror, the markets looked to have come through unscathed, although with a new leader. Elsewhere looked for gold (NYSE:GLD) to continue in its short term uptrend while crude oil (NYSE:USO) bounced off of support. The US dollar index looked to continue lower while US Treasuries (NASDAQ:TLT) were back into consolidation in the downtrend.

The Shanghai Composite continued to drift slowly higher and Emerging Markets (NYSE:EEM) were on fire moving higher. Volatility (NYSE:VXX) looked to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). The SPY and QQQ looked to consolidate on the shorter timeframe just as the IWM was ready to take over leadership to the upside.

The week played out with gold continuing higher early and then meeting resistance while the crude oil faded and it moved lower. The US dollar took another step down to the February low while Treasuries moved higher in their consolidation range. The Shanghai Composite moved sideways while Emerging Markets held at their recent highs. Volatility moved slightly higher, becoming a teenager ahead of the close Friday.

The Equity Index ETF’s started the week flat but then all fell Tuesday in moves not seen 6 months, the first 1% down day in over 100 day. They stabilized Wednesday, and the QQQ led the way higher with the SPY and IWM reluctantly drifting up. What does this mean for the coming week? Lets look at some charts.

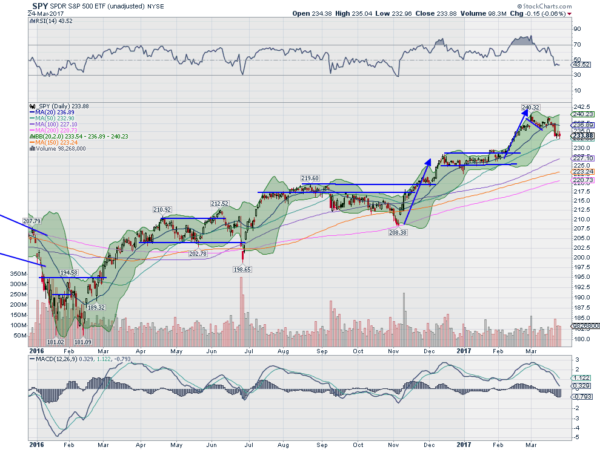

SPY Daily

The SPY started the week in consolidation at the highs and over the 20 day SMA. Monday it moved below that 20 day SMA but held in the consolidation range. Tuesday it had its first 1% down day in over 100 days, pulling it near the 50 day SMA. It held at that level the rest of the week, eventually touching the 50 day SMA as it rose Friday. That ended the week about 2.5% off of the high. The daily chart shows the RSI is leveling at 40, the edge of the bullish zone, while the MACD is falling, but still positive.

The weekly chart shows a pullback from consolidation and 3 tight range candles. The RSI is pulling back from an overbought condition while the MACD is turning lower. There is support lower at 233.70 and 232.20 followed by 229.40 and 227.75. Resistance above stands at 236 and 237.10 followed by 239.80. Pullback in Uptrend.

SPY Weekly

Heading into the end of the first quarter equity markets have shown some signs of cracking, with the IWM the worst. Elsewhere look for gold to continue in its uptrend while crude oil continues lower. The US dollar index also looks to continue lower while US Treasuries continue higher in their consolidation range. The Shanghai Composite looks to continue a slow grind up and Emerging Markets continue to look strong.

Volatility looks to remain low but drifting higher into more normal levels. This could hold back equities in the very short term. The equity index ETF’s SPY, IWM and QQQ, all had their biggest pullbacks of the year, leaving the IWM at the edge of support, the SPY pulling back and the QQQ consolidating. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.