Last week’s review of the macro market indicators heading into March options expiration saw equity markets looking strong and ready for more upside. Elsewhere looked for gold to consolidate in its uptrend while crude oil continued higher. The US Dollar Index looked better to the downside short-term in consolidation, while US Treasuries were biased lower.

The Shanghai Composite was consolidating in a broad range while emerging markets were biased to the upside. Volatility looked to remain subdued and falling back to normal levels, putting a breeze at the back of the equity index ETFs SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all looked good for more upside as well on both time frames. Use this information as you prepare for the coming week and trad’em well.

The week played out with gold drifting lower before rebounding to end the week higher, while crude oil continued the run higher. The US dollar took a beating, while treasuries rebounded in their channel lower. The Shanghai Composite pushed higher, while emerging markets started the week retrenching before launching higher.

Volatility continued lower, making a new 4 and a half month low. The equity index ETFs continued to show strength, with the SPY posting the strongest gains, ending back over its 200-day moving average, and the QQQ moving higher while the IWM consolidated at its recent highs.

What does this mean for the coming week? Lets look at some charts.

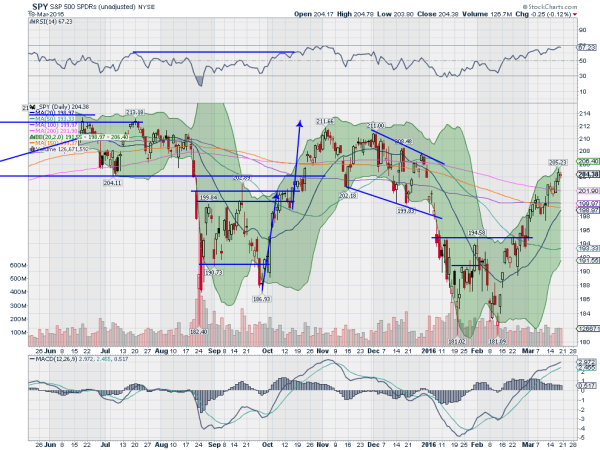

SPY Daily

The SPY started the week at its 200-day SMA and held there for 2 days. This was just short of filling the gap down from January 4th and brought to mind the possibility of a top. But Wednesday saw a renewed move higher and continued the rest of the week, filling that gap and then some. There is now separation from the 200-day SMA. The RSI on the daily chart is rising and bullish, with the MACD rising too. These support more upside. The “W” I have been talking about for 3 weeks would complete at 207.60.

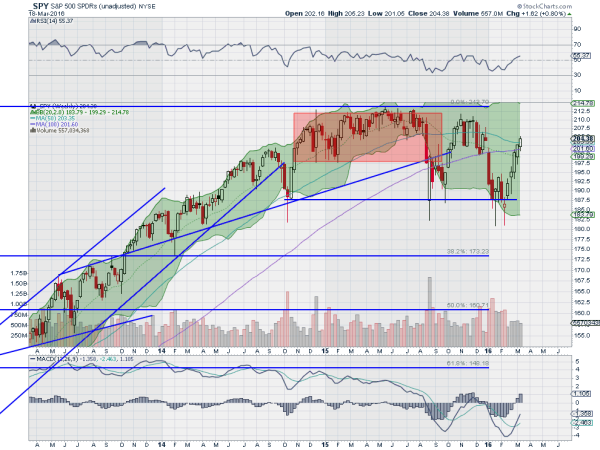

SPY Weekly

On the weekly chart, the 5th consecutive weekly candle higher after the hammer is a real show of strength that is less apparent on the daily chart. The RSI on the longer timeframe is through the mid line and rising towards the bullish zone, with the MACD crossed up and rising. There is resistance above at 206 and 207.60 followed by 208.50 and 210, then 211 and the all-time high. A move over 211 would reestablish the uptrend. Support lower comes at 203.75 and 201.50 followed by 200 and 199. Continued uptrend.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.