Last week’s review of the macro market indicators saw heading into March options expiration week, the equity markets seemed to have completed their reset after the most recent leg higher. Elsewhere looked for gold (NYSE:GLD) to continue in its downtrend while crude oil (NYSE:USO) also continued lower. The US dollar index looked to continue to pullback while US Treasuries (NASDAQ:TLT) were biased lower, possibly ready to break consolidation.

The Shanghai Composite was pulling back in the uptrend and Emerging Markets (NYSE:EEM) were biased to the downside. Everything lower so far. Volatility (NYSE:VXX) looked to remain at abnormally low levels, keeping the wind at the backs of the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts showed the SPY and QQQ reversing short term pullbacks and the IWM arrested its drop. Longer term the SPY and QQQ remained strong, while the IWM had cracked and moved lower.

The week played out with gold probing lower but finding support and rebounding to end the week up while crude oil also found support, but did not get the same bounce. The US dollar found support early but then resumed lower after the FOMC meeting while Treasuries recovered from what is for now a false breakdown. The Shanghai Composite moved higher back to and over its key moving average while Emerging Markets continued up to new 20 month highs.

Volatility remained in a tight range at abnormally low levels for yet another week. The Equity Index ETF’s started the week quietly and then moved up into and through the FOMC Meeting. The SPY gave it all back and the QQQ gave back most of the gain through Friday though while the IWM held higher. What does this mean for the coming week? Lets look at some charts.

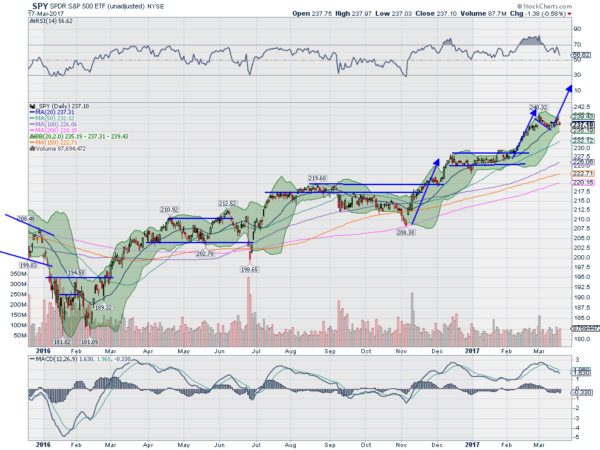

SPY Daily

The SPY had been building a bull flag and ended the last week popping up out of it. It started the week holding that gain but with no follow through. Tuesday saw it pullback to the 20 day SMA, back at the flag lows. Wednesday saw a strong move to the upside after the FOMC raised rates as expected. But the SPY pulled back Thursday and then gapped lower and dropped more Friday. It ended the week lower.

The daily chart shows that it remained in a tight range of just over 3 points, so consolidation is a good description of the week. The Bollinger Bands® have squeezed in on the daily chart, often a precursor to a move. The RSI has reset lower and continues to point down, while the MACD is slowly moving lower. Both are falling in bullish ranges. This would suggest a mild pullback if one happens.

The weekly picture looks like consolidation after a 6 week run higher. The doji like candle spells indecision in price which can work out either direction over time. The RSI on the longer timeframe is pulling back from a technically overbought condition, still strong in the bullish zone, while the MACD is starting to level out. There is resistance at 239.80 and a Measured Move above to 248 should it start moving higher again. Support lower may come right here at 237.10 or 236 followed by 233.70 and 232.20. Consolidation in the Uptrend.

SPY Weekly

With the March FOMC meeting and Options Expiration in the rear view mirror, the markets look to have come through unscathed, although with a new leader. Elsewhere look for gold to continue in its short term uptrend while crude oil bounces off of support. The US dollar index looks to continue lower while US Treasuries are back into consolidation in the downtrend. The Shanghai Composite continues to drift slowly higher and Emerging Markets are fire moving higher.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The SPY and QQQ look to consolidate on the shorter timeframe just as the IWM is ready to take over leadership to the upside. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.