Last week’s review of the macro market indicators noted heading into March options expiration week the equity markets were looking strong, with the QQQ at all-time highs and the IWM and SPY (NYSE:SPY) near their highs and almost out of danger. Elsewhere looked for Gold (GLD (NYSE:GLD)) to consolidate in a broad range while Crude Oil (USO (NYSE:USO)) consolidated with a longer term bias lower. The US Dollar Index (DXY) was treading water in a downtrend while US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) consolidated in their downtrend.

The Shanghai Composite (ASHR) and Emerging Markets (EEM) were both consolidating, the former from a bounce and the latter at the highs. Volatility (VXX) continued to drift lower easing the path for equities. The equity index ETF’s SPY, iShares Russell 2000 (NYSE:IWM) and QQQ all posted stellar performance for the week, printing bullish Marubozu candles, with the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) ending at all-time highs. The SPY and IWM were close to new highs and should they print them the all clear signal would sound for equities.

The week played out with Gold bouncing around in a tight range, testing the downside late in the week, while Crude Oil started lower and recovered late, but also stayed in a tight range. The US Dollar continued to mark time moving sideways while Treasuries moved higher but meet resistance and stalled. The bounce in the Shanghai Composite dried up and it retreated while Emerging Markets held in a tight range over support.

Volatility settled in, still slightly elevated, relieving some pressure on equities. The Equity Index ETF’s all started the week pushing higher. The QQQ even made a new all-time high. But all started to reverse by Tuesday and worked lower the rest of the week. The IWM became the exception Friday moving back higher but unable to take the other indexes with it. What does this mean for the coming week? Lets look at some charts.

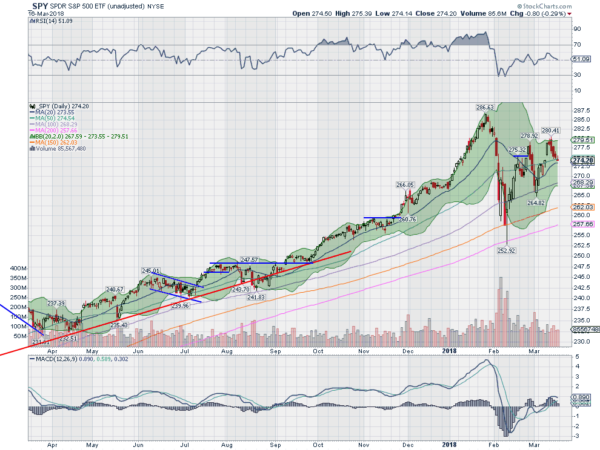

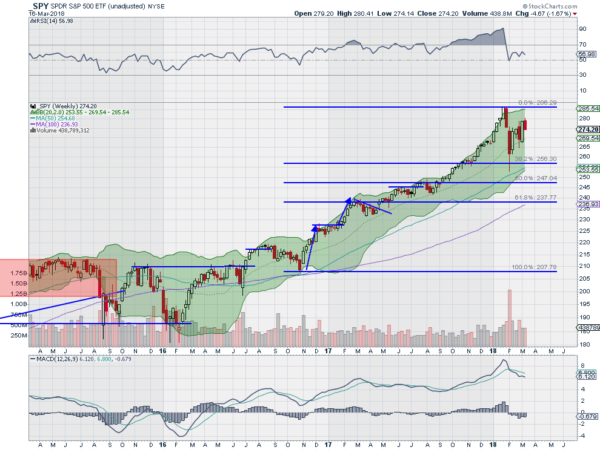

The SPY had a 6 day streak rising off of the 100 day SMA as the week started. Monday saw a move higher intraday, establishing a higher high, but no strength. That was repeated Tuesday morning with a move higher early but this time it pulled back further. That continued Wednesday and through the rest of the week, in tighter and tighter candles.

It ended the week down, closing the gap from the prior week and at the 50 day SMA. The daily chart shows the RSI running flat over the mid line in the bullish zone, with the MACD also flat-lined but positive. The Bollinger Bands® are tightening and moving parallel sideways. No directional strength on this timeframe.

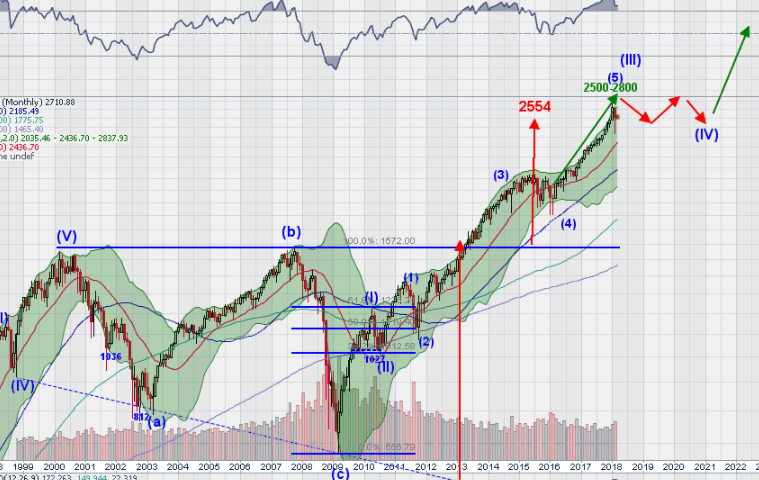

The longer weekly timeframe shows a channel higher. It could turn into a bear flag but the Bollinger Bands are driving higher with the MACD flat after a pullback and the RSI holding over the mid line in the bullish zone. There is resistance at 279 and 280 followed by 283.30 above. Support lower comes at 272.50 and 269 the 267. Maybe we get some direction next week with options expiration out of the way. Broad Consolidation in Uptrend.

With March Options Expiration done and spring around the corner the Equity Index ETF’s look mixed but positive. Elsewhere look for Gold to consolidate with a downward bias while Crude Oil consolidates in a tight range. The US Dollar Index is also consolidating in a downtrend, trying hard to reverse it, while US Treasuries are showing signs of a potential reversal to the upside. The Shanghai Composite and Emerging Markets continue to consolidate, the former around long term support and resistance, and the latter at the highs.

Volatility looks to continue to drift lower easing the pressure on the equity markets. Their charts all show retrenchment in the short term, with the IWM trying to reverse and lead them all higher. On the longer picture the IWM and QQQ look strong with the SPY stuck in broad consolidation. Use this information as you prepare for the coming week and trad’em well

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.