Last week’s review of the macro market indicators which heading into the week saw the equity markets on the verge of a major reversal higher. Elsewhere looked for gold to continue higher in its uptrend along with crude oil. The US dollar index looked weak short-term in consolidation while US Treasuries were biased lower. The Shanghai Composite and Emerging Markets were biased to the upside in the short run.

Volatility looked to continue toward the normal range with a bias lower, adding a breeze to the backs of the equity markets. The equity index ETFs SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), looked better to the upside, with the SPY and IWM showing strength in their break of the range higher, while the QQQ lagged behind but also looked better to the upside.

The week played out with gold moving in a tight range but holding its ground while crude oil slowed as it came into resistance. The US dollar moved lower while treasuries crept up early only to fall back and end the week lower. The Shanghai Composite met resistance at a lower high and started a pullback while Emerging Markets took a brief pause in their rally before resuming it Friday.

Volatility bounced off of last Friday’s lows but then fell back near even on the week. The Equity Index ETFs started the week heading lower in bull flags, consolidating their gains before breaking to the upside to end the week high. What does this mean for the coming week? Lets look at some charts.

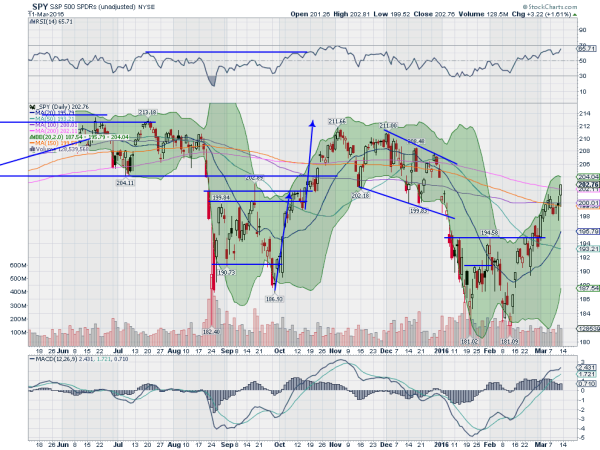

SPY Daily, SPY

The SPY started the week confirming the spinning top that ended last week higher with a strong candle. But Tuesday saw a push lower to the gap from January 6th, suggesting a possible lower high and reversal. Wednesday’s Hammer suggested a reversal and brought a possible bull flag into play that teased with a higher close Thursday. The spinning top though brought more indecision. Friday’s move higher was a decisive break of the flag and moved deep into the gap from January 4th.

The daily chart shows the RSI and MACD bullish and pushing higher. I have often talked about a “W” that would target 207.80, but the measured move out of the flag also looks higher to 205.70. It is also important to note that the move Friday closed the SPY over the 200 day SMA for the first time since December 29th.

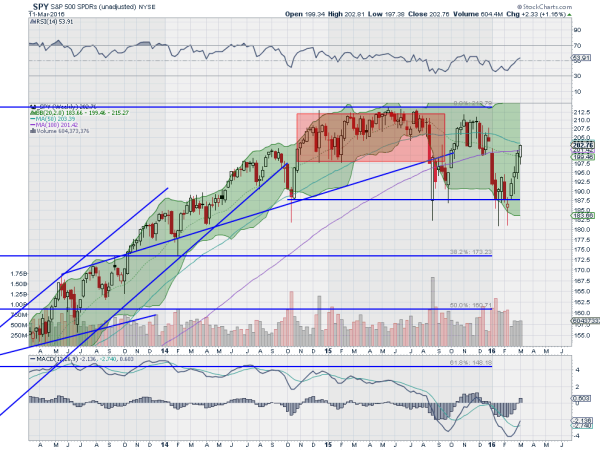

The weekly chart shows some positive signals as well. The RSI is pushing back over the mid line and the MACD is crossing up. A move over the 50 week SMA would be a big plus. There is resistance higher at 203.75 and 206 followed by 207.60 and 208.50. Support lower stands at 201.50 and 200 followed by 199 and 198.50 then 196. Continued movement higher.

SPY Weekly, SPY

Volatility looks to remain subdued and falling back to normal levels, putting a breeze at the back of the equity index ETFs SPY, IWM and QQQ. Their charts all look good for more upside as well on both timeframes. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.