Last week’s review of the macro market indicators noted as June began that the equity markets were looking stronger with small caps and tech leading the way higher. Elsewhere looked for Gold (GLD) to continue to move lower while Crude Oil (USO) joined it continuing its drop. The US Dollar Index (DXY) continued to show strength, but was pausing in its move higher while US Treasuries (TLT) were biased lower in a channel.

The Shanghai Composite (ASHR) was drifting lower as were Emerging Markets (EEM), with the former closing in on a new 52 week low while the latter was just retesting a major break out. Volatility (VXX) looked to remain subdued keeping the bias higher for the equity index ETFs: SPY, IWM and QQQ. The IWM had shown strength making new all-time highs, while the QQQ looked to be ready to takeover leadership for the short run. The SPY, however, was holding at resistance. A break out would be a major spark to the broad market.

The week played out with Gold consolidating in a narrow range around 1300, while Crude Oil found support mid week and mounted a reversal. The US dollar pulled back, resetting momentum lower, while Treasuries moved continued the move lower. The Shanghai Composite bounced off of a retest at the April lows and closed its gap, while Emerging Markets continued to hold over support but without showing any strength.

Volatility drifted back down to January lows, keeping the bias higher for equities. The Equity Index ETFs all took advantage of that environment with the IWM and QQQ racing to new all-time highs and the SPY rising to nearly 3 month highs. What does this mean for the coming week? Lets look at some charts.

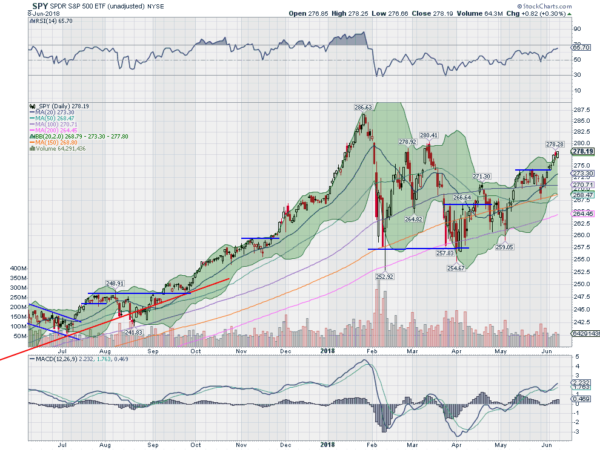

SPY Daily

The SPY came into the week lagging the IWM and QQQ, and at resistance for the 3rd time since the beginning of May. It started to catch up right away Monday with a push to a 2½ month high and kept on going. It ended the week nearing the March high and looking strong.

The daily chart shows the RSI rising in the bullish zone with the MACD rising and positive. The Bollinger Bands® had squeezed in and are now opening and shifting to the upside to allow a move. This looks strong.

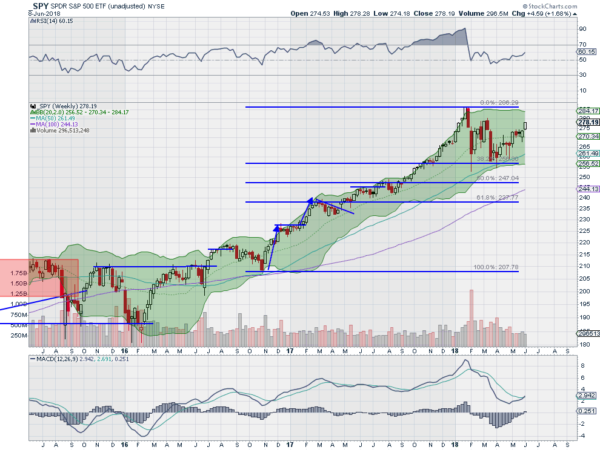

On the longer weekly chart, there is continuation out of consolidation. The RSI is lifting up off of the mid line with the MACD crossing up and positive. The Bollinger Bands are still flat but there is room nearly to the all-time high before touching the top. There is resistance at 279 and 280 then 283 and 286.50. Support lower comes at 277.50 and 274.50 then 272.50 and 271.40 before 269. Continued Uptrend.

SPY Weekly

Heading into the FOMC June meeting and monthly Options Expiration the equity markets look strong. Elsewhere look for Gold to continue to consolidation around 1300 while Crude Oil consolidates after pulling back. The US dollar Index looks to continue lower while US Treasuries are biased lower in broad consolidation.

The Shanghai Composite is consolidating at 52 week lows and Emerging Markets remain in a pullback in the uptrend. Volatility looks to remain very low keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts show the IWM the strongest and leading on the longer time frame with the SPY and QQQ building strength as well.

Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.