Last week’s review of the macro market indicators suggested, heading into June, that the equity markets were mixed, with the NASDAQ:QQQ strong, but the ARCA:SPY and ARCA:IWM showing some short term weakness. Elsewhere looked for gold (ARCA:GLD) to continue to hold between 1180 and 1200, while crude oil (NYSE:USO) consolidated with an upward bias. The US dollar index (NYSE:UUP) looked to continue higher, while US Treasuries (ARCA:TLT) also were looking stronger, possibly breaking their downtrend.

The Shanghai Composite (NYSE:ASHR) was in pullback mode in the uptrend but at a good support level, while Emerging Markets (ARCA:EEM) were falling and looked weak. Volatility (ARCA:VXX) looked to remain subdued, keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts were a bit mixed, with all better on the weekly timeframe than the daily, and the QQQ’s the strongest short term, while the SPY and IWM might pullback.

The week played out with gold holding in the range, until breaking it to the downside Friday, while crude oil moved lower in its range before a rebound Friday. The US dollar broke its flag lower but found support, while Treasuries broke hard to the downside. The Shanghai Composite resumed the uptrend, ending the week at a new 7 year high, while Emerging Markets continued lower.

Volatility spiked to a 1 month high before settling back Friday. The Equity Index ETFs started the week steady, but then diverged, with the SPY and QQQ moving lower but closing the week with possible reversal candles, while the IWM virtually remained steady. What does this mean for the coming week? Let's look at some charts.

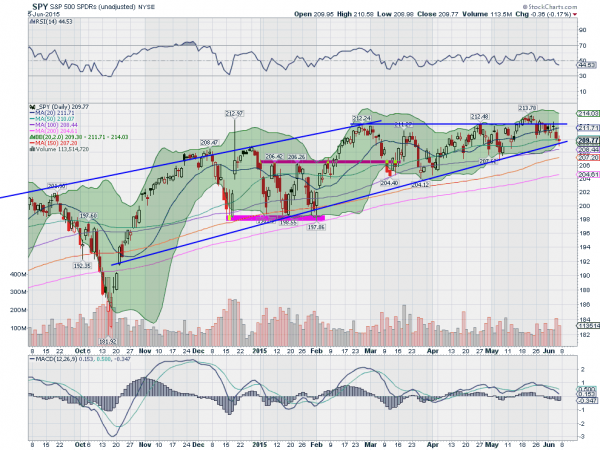

SPY Daily

The SPY started the week with an inside day, after ending the prior week with a 2 day pullback from resistance. A possible reversal signal. This was followed by a Spinning Top and then a reversal higher Wednesday back to resistance. But it was short lived, as the rest of the week the SPY moved lower, finding support Friday at the rising trend support line from late October.

The Spinning Top Friday signals indecision, and a possible reversal.

This is also at the bottom of a long rising channel. The RSI on the daily chart continues to head lower, but remains in the bullish zone over 40, with the MACD falling. This is a mixed view. The Bollinger Bands® are squeezing in to catch the price and support it.

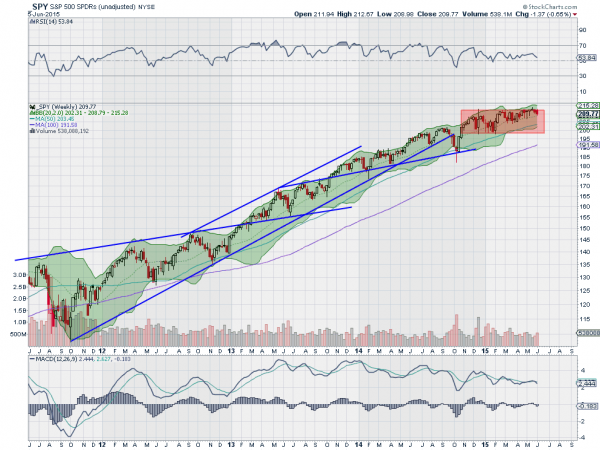

The weekly picture shows the rise along the 20 week SMA, tightening against the red consolidation box. On this timeframe, the RSI is falling but in the bullish zone as well, with the MACD crossed down and falling. There is support lower at 209 and 208, followed by 206.40 and 204.40. Resistance higher stands at 211 and 212.50, followed by 213.78. Continued Consolidation in the Uptrend.

SPY Weekly

Heading into next week, the equity markets continue to look a bit vulnerable on the daily timeframe but strong on the weekly timeframe. Elsewhere, look for gold to continue lower, while crude oil consolidates with a slight downward bias. The US dollar index also is in broad consolidation with an upward bias, while US Treasuries look to continue lower. The Shanghai Composite is back off to the races higher with a chance of consolidation, while Emerging Markets look to continue to the downside.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts suggest that the IWM is strong and taking over leadership, while the QQQ looks strongest on the longer timeframe. The SPY may need more sideways consolidation before resuming higher. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.