Last week’s review of the macro market indicators, as the markets headed into the Memorial Day weekend and the unofficial start of summer, saw equities looking strong, but not quite free of caution.

Elsewhere looked for gold to continue lower while crude oil continued to the upside. The US Dollar Index looked to improve while US Treasuries continued to consolidate.

The Shanghai Composite was also in consolidation mode but with a downward bias, while iShares MSCI Emerging Markets (NYSE:EEM) were biased to the upside in the short term.

Volatility (NYSE:VXX) looked to remain subdued, keeping the bias higher for the equity index ETFs SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ).

Their charts also suggested more upside and were stronger-looking on the weekly timeframe, with rising pennants on the daily timeframe giving minor caution of a short-term pullback or consolidation.

The week played out with gold drifting lower before jumping Friday to end the week higher, while crude oil held in a tight range under the round number, 50. The US dollar was also stable until getting drubbed Friday, while Treasuries started the week stable then moved up to 3-month highs. The Shanghai Composite finally broke its sideways range to the upside, while Emerging Markets also moved higher late in the week.

Volatility remained low with a very short-term spike Friday that reversed quickly. The equity index ETFs were flat to drifting higher all week. Leadership was transferred to the IWM, with the QQQ slightly behind and the SPY stuck at the round number, 210.

What does this mean for the coming week? Lets look at some charts.

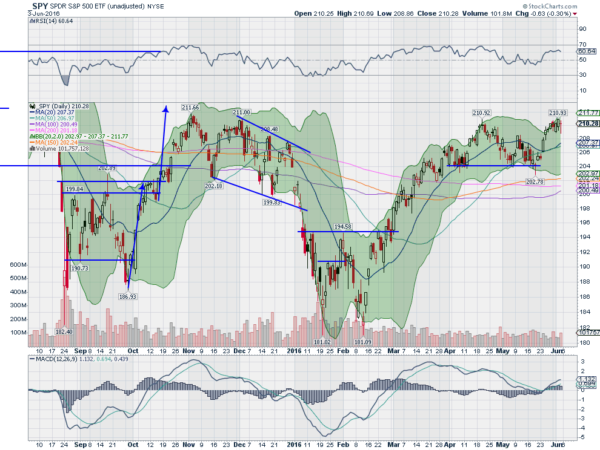

SPY Daily

The SPY started the week pulling back from the Bollinger Bands® but quickly found support. It pressed back higher then to a new 6-month high Thursday before a small pullback to end the week. In all, a consolidated week. The RSI on the daily chart is holding after moving into the bullish zone with the MACD rising. The Bollinger Bands® are opening and have turned to the upside.

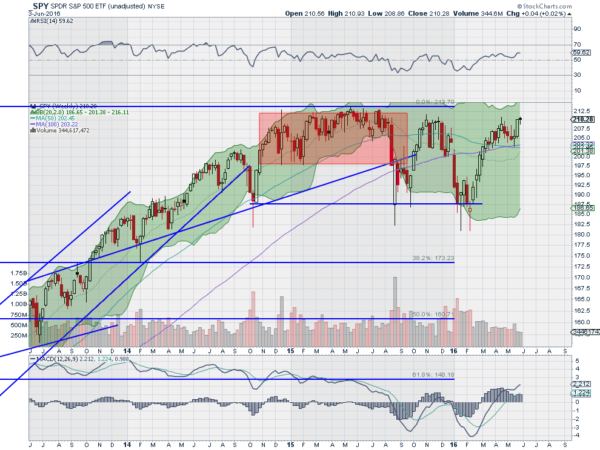

On the longer weekly timeframe the consolidation shows up as a small-bodied candle at the highs. The RSI on this timeframe is hanging just under a move into the bullish zone, with the MACD rising. Still no higher high on a longer-term basis. There is resistance at 210.75 and 211.50 followed by 213 and 213.78. Support lower comes at 208.50 and 207.60 followed by 206.

Consolidation in the upward move continues.

SPY Weekly

Heading into the first full week of June, the equity indexes look solid. Elsewhere look for gold to bounce higher in consolidation while crude oil consolidates its move higher, holding at the round number 50. The US Dollar Index looks better to the downside short-term in its broad consolidation while US Treasuries are strong and look to move higher. The Shanghai Composite has a short-term bias higher and may have broken a long-term pattern to the upside, while Emerging Markets continue to move up.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts show some variation in the short run with the IWM leading to the upside, perhaps catching up, while the QQQ has a short-term upward bias in consolidation and the SPY looks to be muddled in consolidation after its move higher.

Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.