Last week’s review of the macro market indicators which following the June FOMC meeting and Options Expiration gave the market a shock to the downside, but not deep. It could now look forward to the Brexit vote and then summer. Elsewhere looked for gold (NYSE:GLD) to consolidate with an upward bias while crude oil (NYSE:USO) moved higher after a digestive pullback. The US Dollar Index (NYSE:UUP) looked to consolidate sideways at the bottom of the range while US Treasuries (NYSE:TLT) were biased higher.

The Shanghai Composite (NYSE:ASHR) and Emerging Markets (NYSE:EEM) were running in place with the Chinese market biased to lean lower and Emerging Markets higher. Volatility (NYSE:VXX) looked to remain near the top of the lower range keeping the bias lower for the equity index ETFs SPY, IWM and QQQ, mildly. Their charts suggested intermediate term consolidation with a short term downward bias for the SPY (NYSE:SPY) and NASDAQ:QQQ, but the NYSE:IWM looked a bit stronger.

The week played out calmly until the result of the Brexit vote released a maelstrom of activity. It ended with gold leaping higher while crude oil fell back lower. The US dollar jumped higher Friday along with Treasuries. The Shanghai Composite drifted sideways, dropping at the end of the week, while Emerging Markets gapped lower after making a higher high.

Volatility spiked to 4 month highs before pulling back. The Equity Index ETFs all crept higher through Thursday, running up the last 30 minutes into the close. But all gapped down Friday, with the SPY, IWM and QQQ giving back a month of gains, and falling to support levels. What does this mean for the coming week? Lets look at some charts.

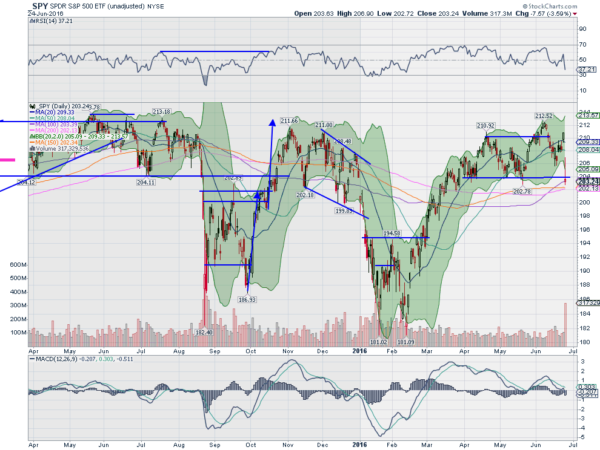

SPY Daily

The SPY started the week with an inside candle with a lower shadow. This was a signal for a reversal higher. And it delivered Tuesday gapping up and holding there. Wednesday saw further consolidation and then Thursday a move higher, especially in the last hour, over the 20 day SMA and 210. Then Brexit happened. The large gap down left an Island top. It recovered somewhat intraday but then drifted lower into the close, ending near the low of the day and down over 3% for the first time in 210 days.

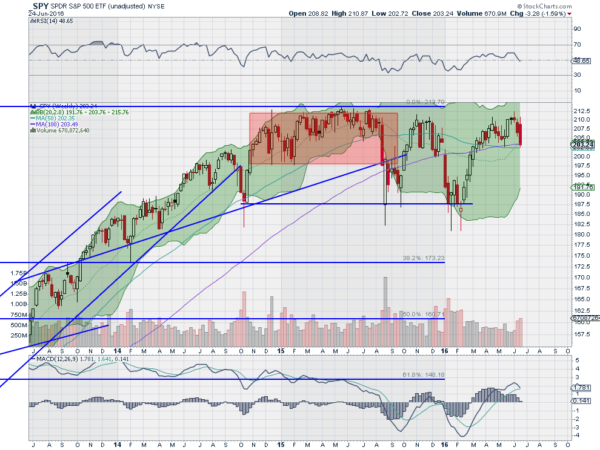

The daily chart shows a RSI moving into the bearish zone and the MACD falling, both supporting more downside. The price finished outside of the Bollinger Bands® but they did open to the downside. The weekly chart shows a strong down move to the 50 and 100 week SMA’s. This is still in the range where there has been a lot of prior price activity. The RSI on this timeframe is testing the mid line from above and the MACD is turned lower, nearing a cross down.

Another turn back at the highs. There is resistance at 206 and 207.60 followed by 208.50 and 210.75. Support lower comes at 201.50 and 200 before 198.75. Consolidation of the Move Higher with Downward Short Term Bias.

SPY Weekly

The week was marked by the Cavaliers winning the NBA title, and the Summer solstice ushering in the new season, and all was well early in the week, then the Brexit vote changed all that as the equity markets, and all other markets dumped Friday. Leave it to the Brits to screw up a great week (just kidding). With a one day turn now equities look weak.

Elsewhere look for gold to continue higher while crude oil consolidates with a pullback in the uptrend. The US Dollar Index remains stuck in a sideways consolidation while US Treasuries are moving back higher. The Shanghai Composite and Emerging Markets are stuck in consolidative ranges with the Chinese market biased to break the range to the upside while Emerging Markets are biased to break theirs lower.

Volatility looks to remain elevated in the coming week keeping the bias lower for the equity index ETFs SPY, IWM and QQQ. Their charts all look better to the downside in the short term, with the QQQ at intermediate support and the SPY breaking its intermediate support. All 3 printed possible reversal candles though so stay nimble. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.