Last week’s review of the macro market indicators suggested, heading into June Options Expiration week, that the Equity markets looked weak in general short term.

Elsewhere looked for gold (ARCA:GLD) to continue lower, while crude oil (NYSE:USO) consolidated in the uptrend. The US dollar index (NYSE:UUP) was also in broad consolidation, but with a downward bias, while US Treasuries (ARCA:TLT) were trending lower, but might be ready for a bounce. The Shanghai Composite (NYSE:ASHR) remained strong and rising, while Emerging Markets (ARCA:EEM) were biased to the upside short term in the downtrend.

Volatility (ARCA:VXX) looked to remain subdued, keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts suggested that it would take some work for the SPY and QQQ, which looked weak in the short term and flat intermediate, while the IWM trended higher.

The week played out with gold steady before a push higher to end the week up, while crude oil continued to be range bound. The US dollar continued the move lower, while Treasuries held just above last week’s level. The Shanghai Composite is showing a strong pullback, while Emerging Markets again found support and bounced.

Volatility started the week higher, but fell back quickly, ending close to unchanged. The Equity Index ETF’s ignored this mix and just moved higher, with the SPY and QQQ seeing some selling Friday, while the IWM printed a new all-time high and held. What does this mean for the coming week? Let's look at some charts.

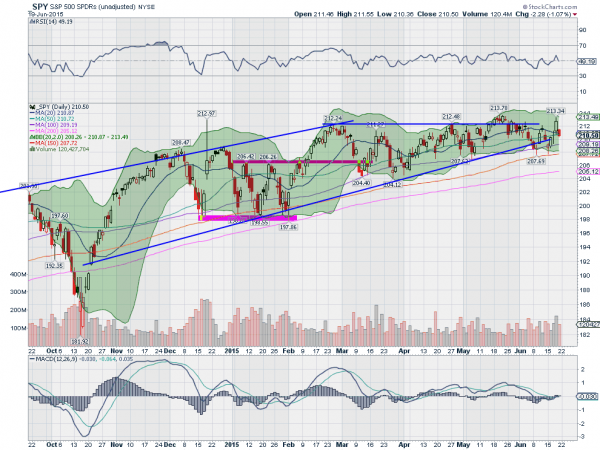

SPY Daily

The SPY started the week lower, with a touch at the 150 day SMA by the lower shadow of the candle Monday. The Hammer then was confirmed higher Tuesday and followed through within pennies of the all-time high close at Thursday’s close. It was set up to pullback though, as it went ex-dividend Friday, and then continued lower closing the week up a tad. The daily chart shows the RSI continuing along the mid line, with the MACD trying to cross up. Both look neutral.

The weekly chart shows the price still hanging in the top of the consolidation box. The Bollinger Bands® are squeezing though, often a precursor to a move in price. The RSI on this timeframe is holding over the mid line in the bullish zone with the MACD falling. There is resistance higher at 211 and 212.50, followed by 213.35. Support lower comes at 210.25 and 209, followed by 208 and 206.40. Continued Consolidation in the Long Term Uptrend.

SPY Weekly

As the markets head out of June Options Expiration and officially into summer, equities continue to churn with an upward bias.

Elsewhere, look for gold to be biased to the upside short term in its consolidation, while crude oil consolidates with an upward bias. The US dollar index looks headed lower in its broad consolidation of the long move up, while US Treasuries may be consolidating in their downtrend. The Shanghai Composite may be beginning its long awaited correction, or just doing its 4th 10% plus move lower before another launch higher, while Emerging Markets are biased and may be consolidating after their move lower.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The IWM continues to look the strongest on the short time frame, as it sits at all-time highs, with the QQQ strong as well on the weekly timeframe and the SPY stuck in a funk consolidating. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.