Last week’s review of the macro market indicators suggested, heading into the week that the equity markets would continue to look a bit vulnerable on the daily timeframe but strong on the weekly timeframe.

Elsewhere looked for gold (ARCA:GLD) to continue lower while Crude Oil (NYSE:USO) consolidated with a slight downward bias. The US Dollar Index (NYSE:UUP) also was in broad consolidation with an upward bias while US Treasuries (ARCA:TLT) looked to continue lower. The Shanghai Composite (NYSE:ASHR) was back off to the races higher with a chance of consolidation while Emerging Markets (ARCA:EEM) looked to continue to the downside.

Volatility (ARCA:VXX) looked to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts suggested that the IWM was strong and taking over leadership while the QQQ looked strongest on the longer timeframe. The SPY might need more sideways consolidation before resuming higher.

The week played out with gold pushing lower Monday before rebounding to end the week up while crude oil continued the consolidation. The US dollar moved slightly lower while Treasuries found found support mid week and bounced. The Shanghai Composite pushed higher while Emerging Markets began to consolidate at nested support levels. Volatility made a move back lower before reversing at the end of the week. The Equity Index ETF’s halted their falls and reversed to resistance before a Friday pullback.

What does this mean for the coming week? Lets look at some charts.

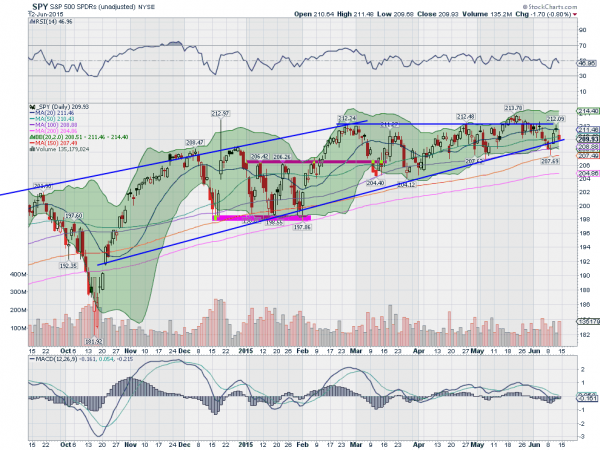

SPY Daily

The SPY had an up and down week, or maybe more accurately a down and up and down week. It started the week feeding the bears as it fell through the rising trend support level from October. By Tuesday it was at the lower Bollinger Band® and 100 day SMA, printing a doji candle after touching the 150 day SMA. The doji shows indecision and after a downward trend suggests a possible reversal higher.

It did just that Wednesday and started toward resistance. Thursday was another doji at resistance that confirmed lower Friday. The price ended right back at that support level and virtually unchanged on the week. The daily chart shows the RSI falling back after moving just above the mid line while the MACD continues to approach a bullish cross. A mixed bag on this timeframe.

The weekly chart shows the doji for the full week, just above the 20 week SMA and near the top of the consolidation zone. The RSI continues to hold over the mid line while the MACD has crossed down. Mixed on this timeframe on momentum as well. There is resistance higher at 210.25 and 211 followed by 212.50 and 213.78. Support lower may come at 209 and 208 followed by 206.40 and 204.40. Continued Consolidation in the Long Term Uptrend.

SPY Weekly

Heading into June Options Expiration week the Equity markets look weak in general short term. Elsewhere look for gold to continue lower while crude oil consolidates in the uptrend. The US Dollar Index is also in broad consolidation but with a downward bias while US Treasuries are trending lower but might be ready for a bounce. The Shanghai Composite remains strong and rising while Emerging Markets are biased to the upside short term in the downtrend.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts suggest that will take some work for the SPY and QQQ which look weak in the short term and flat intermediate, while the IWM trends higher. Use this information as you prepare for the coming week and trad’em well.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.