Last week’s review of the macro market indicators saw that heading into the first full week of June, equity markets looked strong. Elsewhere looked for gold (GLD (NYSE:GLD)) to push higher in consolidation while crude oil(USO (NYSE:USO)) moved lower in its consolidation. The US dollar index (DXY) continued to look weak and moving lower while US Treasuries (TLT) were biased higher.

The Shanghai Composite (ASHR) remained in consolidation and Emerging Markets (EEM) were biased to continue higher. Volatility (VXX) looked to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts showed strength in the SPY (NYSE:SPY) and QQQ (NASDAQ:QQQ) on both timeframes, with the QQQ starting to get extended on a momentum basis. The IWM looked strong on the longer timeframe as is slowly rose, but at the top of resistance short term.

The week played out with gold starting higher before rolling over mid week and ending the week lower while crude oil continued lower. The US dollar found support and moved slightly higher while Treasuries pulled back from 7 month highs. The Shanghai Composite pushed higher from its 20 day SMA to the 200 day SMA while Emerging Markets moved up to fresh 2 year highs.

Volatility moved lower, touching 23 year lows increasing the breeze at the back of equities, until a snap back Friday. The Equity Index ETF’s all started the week in consolidation, but then diverged mid week with the SPY and the IWM moving up to new all-time highs. The QQQ managed 1 new all-time high but generally held in consolidation all week. Friday profit taking saw gains for the week in SPY erased and the QQQ give back 2 weeks of effort. What does this mean for the coming week? Lets look at some charts.

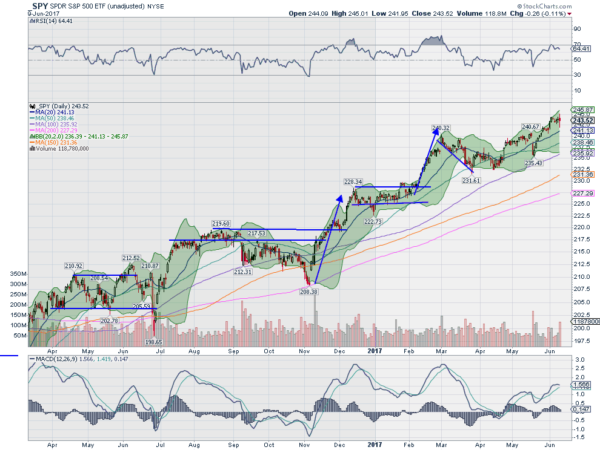

SPY Daily, SPY

The SPY entered the week following a strong two day performance ending the Holiday shortened week. Monday saw an inside day, a Harami, and it was followed by a 3 small body candles that left the SPY little changed by Thursday. It looked like a week of digestion. Then it opened and ran higher Friday morning, into new intraday high levels before a mid-day sell off dropped it back to the lows of the week. It recovered later in the day, finishing down Friday, but in the consolidation range again.

Volume was heavy Friday, but less than on the last big down day May 17th (that one was followed by a 6 day move higher and then continuation to last week’s high). The bearish engulfing candle Friday will have many talking bearish but the main range, as measured by the open to close was very tight for the week and consolidative. The daily chart shows the RSI pulled back but is still strong in the bullish range while the MACD is flat after a rise.

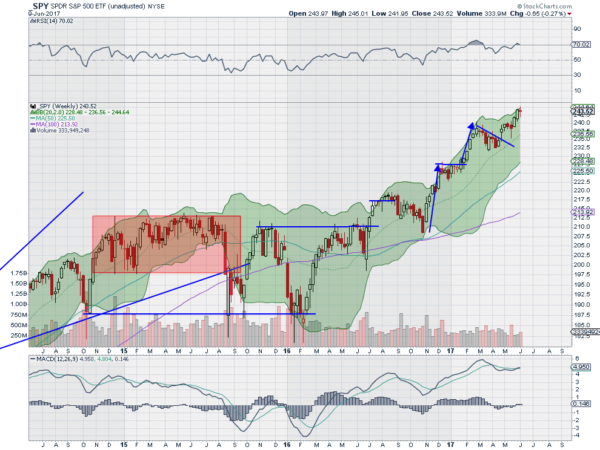

On the longer weekly timeframe the SPY shows an inside week after two strong weeks higher. The RSI is strong in the bullish zone near overbought levels while the MACD is crossing up. There are two targets to 248 on this timeframe. There is resistance at 244.25 and support lower comes at 242 and 240 followed by 238. Uptrend Continues.

SPY Weekly, SPY

Equities are mixed heading into the June Options Expiration Week, with the IWM and SPY looking strong but the QQQ weak as there is rotation out of the QQQ and into IWM. Elsewhere look for Gold to continue lower while Crude Oil also looks better to the downside. The US Dollar Index continues to be biased lower while US Treasuries pullback in the uptrend. The Shanghai Composite is back to its upward drift and Emerging Markets are biased to continue higher.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show strength in the IWM and consolidation in the SPY short term with the QQQ looking diseased. Longer term all trends remain higher with real strength returning to the IWM. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.