Last week’s review of the macro market indicators suggested, heading into the holiday shortened week that the equity markets looked better on the longer timeframe with some vulnerability on the short timeframe.

Elsewhere looked for gold (ARCA:GLD) to continue consolidation with a downward bias while crude oil (NYSE:USO) consolidated with an upward bias. The US Dollar Index (NYSE:UUP) continued to move sideways in broad consolidation after the uptrend while US Treasuries (ARCA:TLT) were biased lower. The Shanghai Composite (NYSE:ASHR) was finally be in the long awaited correction while Emerging Markets (ARCA:EEM) were biased to the downside.

Volatility (ARCA:VXX) looked to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts continued to show the SPY and QQQ moving similarly on the shorter timeframe while the IWM was stronger until late in the week. The rotation seemed to be starting out of the small caps again.

The week played out with gold probing higher before falling back to the June lows while crude oil started lower in its consolidation late in the week. The US dollar continued the drift higher while Treasuries consolidated at the lows. The Shanghai Composite continued lower into bear market territory while Emerging Markets started lower but found support and bounced.

Volatility popped and held the week over the gap. The Equity Index ETF’s all gapped lower to started the week but then rebounded before giving back some of the gains Thursday. The IWM performed the worst while the SPY and QQQ held some of the mid week gains. Perhaps another round of rotation. What does this mean for the coming week? Lets look at some charts.

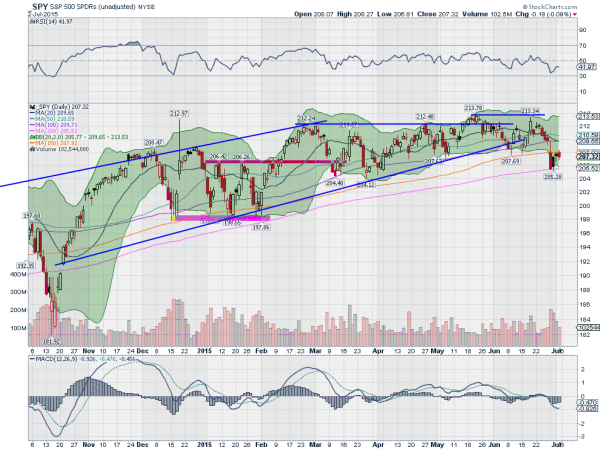

SPY Daily:

The SPY started the week out by gapping down. It closed the gap intraday but then resumed lower to the 200 day SMA. Tuesday saw consolidation and Wednesday a push higher to the 150 day SMA before a push lower Thursday. The daily chart shows the RSI now into the bearish zone but rebounded, while the MACD is falling.

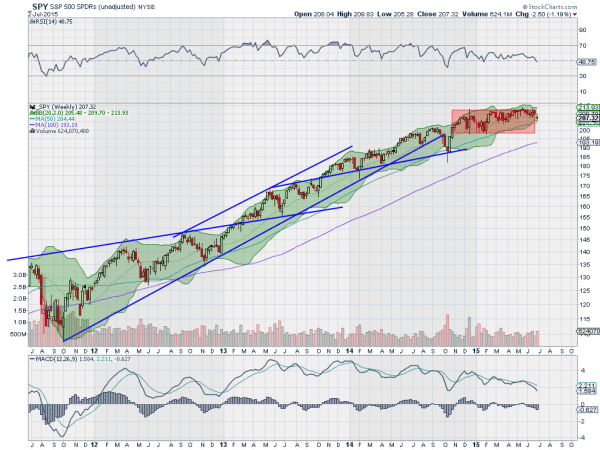

The weekly chart is much less grim. It closed the week at a 2 month low but remains in the top of the consolidation range. The RSI on this timeframe is turning down but at the mid line while the MACD is falling. The Bollinger Bands® are getting very tight on this timeframe. There is support lower at 206.40 and 205.40 followed by 204.40 and 202 before 198.50. Resistance higher may come at 208 and 209 followed by 210.25 and 211 before 212.50. Continued Broad Consolidation with a Short Term Downward Bias.

SPY Weekly:

Heading into the heat of Summer the Equity markets look vulnerable on the short time frame and just sideways on the longer timeframe. Elsewhere look for gold to continue the broad consolidation with a downward bias while crude oil looks to move lower. The US Dollar Index looks to continue to consolidate in a tightening range sideways while US Treasuries are consolidating but biased lower.

The Shanghai Composite is crashing and shows no sign of letting up yet while Emerging Markets may be bouncing in their downtrend.

Volatility looks to remain low but above recent levels and with a risk of more upside easing the tailwind it has given the equity indexes. The ETF’s SPY, IWM and QQQ, themselves all appear vulnerable on the daily timeframe with the QQQ the strongest looking flat. On the longer timeframe the QQQ is also looking the strongest but has pulled back to trend support with the IWM looking weaker. Perhaps some rotation out of small caps and into technology and larger caps to come. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.