Last week’s review of the macro market indicators noted that heading into the last week of July, the weather was hot and so were the equity markets. Elsewhere looked for SPDR Gold Shares (NYSE:GLD) to continue to consolidate the pullback in its uptrend while United States Oil (NYSE:USO) moved lower in its uptrend. The US Dollar Index looked to continue to move higher in its broad 18-month consolidation while iShares 20+ Year Treasury Bond (NYSE:TLT) consolidated in its uptrend.

The Shanghai Composite looked to drift sideways with an upward bias and iShares MSCI Emerging Markets (NYSE:EEM) needed to consolidate further before assaulting long-term resistance.

iPath S&P 500 VIX Short-Term Futures (NYSE:VXX) looked to remain at abnormally low levels, keeping the bias higher for the equity index ETFs SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ).

The QQQ looked the strongest and ready for more upside on both timeframes. The SPY and IWM looked a bit extended on the longer timeframe, with the IWM consolidating on the short timeframe and the SPY looking to move higher.

The week played out with gold working through consolidation and moving higher at the end the week while crude oil continued lower. The US dollar reversed lower while Treasuries broke their consolidation to the upside.

The Shanghai Composite lost support and fell under 3000 while Emerging Markets continued the consolidation. Volatility continued to remain at abnormally low levels. The QQQ proved to be the strongest equity index ETF, driving higher all week, while the SPY and the IWM consolidated before joining late in the week.

What does this mean for the coming week? Lets look at some charts.

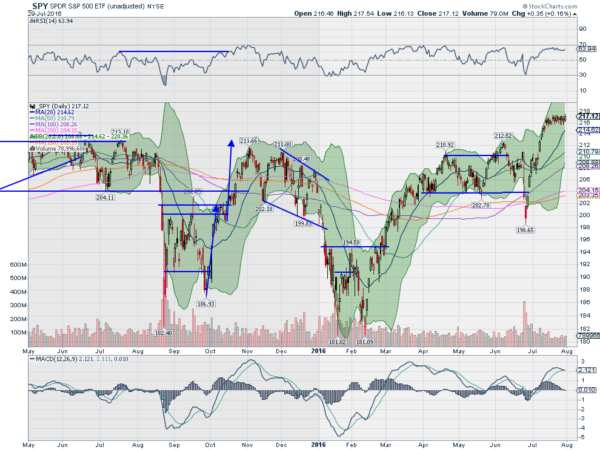

SPY Daily

The SPY moved in a tight range all week around its all-time high. Less than a 2 point range the entire week. Wow. As it passes time the 20 day SMA is moving up towards it on the daily chart and the RSI is holding in the bullish zone also moving sideways.

The MACD is easing into the signal line and looks like it may just kiss it and move on. The Bollinger Bands® are shifted higher and tightening. Nothing significant to note in the daily chart.

On the weekly front the doji ends the string of upward weekly closes in a row at 4. But it continues the string of progressively smaller candles. This can be a sign of exhaustion. The RSI on this timeframe is in the bullish zone and the MACD rising, both supporting the upside. There is no resistance higher but a measured move to 218.90 and an inverse head and shoulders pattern price objective to 222.70.

Support lower comes at 215.70 and 215 followed by 214 and 213.50 before 212.50. Consolidation in the uptrend.

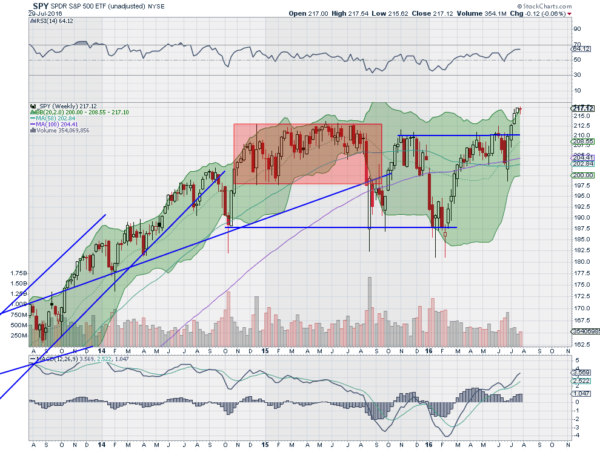

SPY Weekly

Heading into August the equity markets still look strong, but the smaller cap and technology laden indexes look stronger than the large caps. Elsewhere look for gold to continue its uptrend while crude oil continues lower.

The US Dollar Index looks better to the downside short-term while US Treasuries are biased higher. The Shanghai Composite looks like it will continue to drift lower while Emerging Markets move higher.

Volatility looks to remain at abnormally low levels, keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts show real strength in the QQQ, with the IWM ready to join it moving higher, while the SPY takes a pause. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.