Last week’s review of the macro market indicators noted with July Options Expiry and 1 full week of earnings behind them, the Index ETF’s were looking strong and ready to move higher. Elsewhere looked for gold GLD to continue in its uptrend while Crude Oil pulled back lower in the short run within the longer term drift higher. The US Dollar Index continued to weaken and move lower while US Treasuries TLT strengthened and moved higher.

The Shanghai Composite continued to drift up while Emerging Markets (NYSE:EEM) moved higher with strength. Volatility looked to remain at extremely low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. In the short run their charts looked to consolidate or pullback but all looked strong and ready to continue higher in the longer timeframe.

The week played out with gold pausing before a continuation higher while crude oil started lower but quickly found support and rebounded the rest of the week. The US dollar continued lower while Treasuries reversed and started lower. The Shanghai Composite continued to move slowly higher while Emerging Markets finally met some resistance and consolidated.

Volatility continued to remain at historically low levels until moving slightly higher Friday. The Equity Index ETF’s continued to make new highs and hold but ended the week with some profit taking. this left the SPY in consolidation over support with the IWM pulling back from the top of its channel and the QQQ testing support. What does this mean for the coming week? Let's look at some charts.

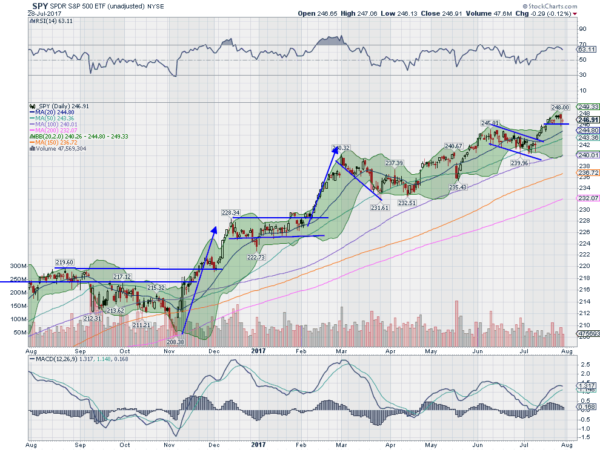

SPY Daily

The SPY came into the week just pennies off of new all-time high and settling back into its Bollinger Bands®. It continued Monday and then gapped higher Tuesday to a new all-time high. Price held there Wednesday and then started higher Thursday before slamming lower and closing the gap. Friday saw an inside day holding over the new support at 246.

The daily chart shows the RSI strong in the bullish zone but starting to roll over. The MACD is also rolling lower toward a bearish cross down. It is still far above the 20 day SMA so even a pullback to 244 would be immaterial. The weekly chart is printing a doji at the highs, a sign of indecision. This can resolve either direction. A break higher carries a target on a Measured Move now to 253.

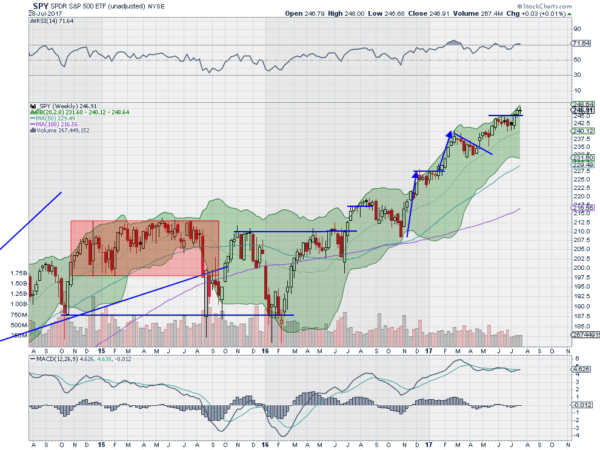

The RSI on this longer timeframe is strong and bullish on the edge of the overbought zone, while the MACD is drifting sideways and bullish. There is no resistance above the all-time high at 248, also the target of the Measured Move higher. There is support at 246 and 245 followed by 242 and 240. Pause in the Uptrend.

SPY Weekly

As the last full week of July ends and the markets look to face the dog days of August equity markets have been knocked back by an unexpected jab punch, shocked but not really damaged. Elsewhere look for Gold to continue in its uptrend while Crude Oil also moves higher. The US Dollar Index continues to look weak and headed lower while US Treasuries consolidate with a short term bias higher. The Shanghai Composite looks to continue to drift higher while Emerging Markets continue their uptrend.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts suggest a pause or small pullback may be in order before they continue higher, with the SPY the strongest and the IWM and QQQ a bit weaker short term. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.