A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators noted that heading into the week the equity markets had been strong and might need a short term pause or pullback before resuming higher. Elsewhere Gold seemed it might ready to bounce in its downtrend while Crude Oil also looked like it may reverse higher. The US Dollar Index was continuing to consolidate with an upward bias while US Treasuries (iShares 20+ Year Treasury Bond (NYSE:TLT)) were biased lower in the short run in their uptrend.

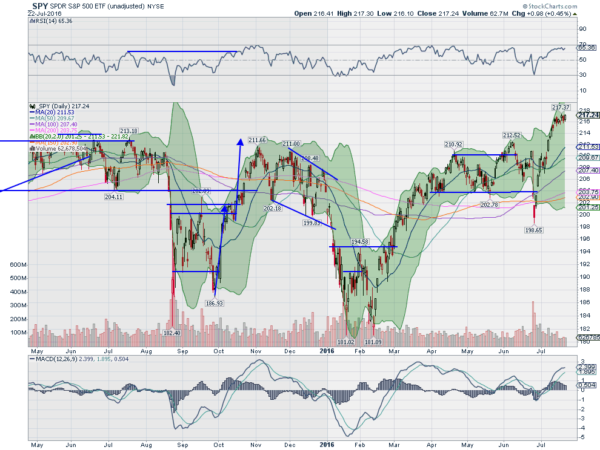

The Shanghai Composite looked to continue its slow reversal higher as Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) rose to test the long term resistance zone just above. Volatility looked to remain below normal levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM)and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts also were biased to the upside in the intermediate timeframe while they consolidated in the shorter timeframe. The SPY (NYSE:SPY) looked most vulnerable to a short term pullback followed by the QQQ.

The week played out with Gold probing lower for a day mid week but then returning to its recent range while Crude Oil drifted lower. The US Dollar started to move higher out of consolidation while Treasuries found support at the gap and held. The Shanghai Composite pulled back from the recent drift higher while Emerging Markets moved sideways over their recent break out level, consolidating.

Volatility made a new 11 month low before rebounding slightly, but remaining below normal levels. The Equity Index ETF’s started the week in consolidation mode, moving sideways, and the SPY and the IWM continued the full week, while the QQQ started moving higher into the end of the week, possibly dragging the IWM with it at the end of Friday. What does this mean for the coming week? Lets look at some charts.

The SPY started the week in consolidation. It printed a couple of small body, inside candles, Monday and Tuesday, often a precursor to a reversal. A third small body candle Wednesday, but with a gap higher, made a new all-time high close. Thursday filled that small gap and then Friday moved back higher to another all-time high close.

The daily chart shows the RSI firmly in the bullish zone and moving sideways, avoiding any overbought pressure. The MACD is rising and the Bollinger Bands® are open above. There looks to be room to move higher. It is getting extended from its SMA’s though, which can correct through time. All of the SMA’s are now rising. This has not been the case since May 2015.

The weekly chart shows a second week outside of the upper Bollinger Bands. But also a 4th week of movement to the upside. Volume has drifted lower during the move higher and the candle bodies are getting smaller. These suggest possible exhaustion. Exhaustion does not mean reversal. The RSI is strong and moving higher and the MACD is rising and bullish. Exhaustion could easily lead to consolidation in this framework.

There is no resistance above. There is a Measured Move to 218.90 off of the June 24 low to the July 1st high. And there is a price objective to 222.70 on an Inverse Head and Shoulders that triggered through the neckline July 8th. Support lower comes at 215.70 and 215 followed by 214 and 213.50 before 211.50. Possible Consolidation in the Uptrend.

Heading into the last week of July the weather is hot and so are the Equity markets. Elsewhere look for Gold continue to consolidate the pullback in its uptrend while Crude Oil moves lower in its uptrend. The US Dollar Index looks to continue to move higher in its broad 18 month consolidation while US Treasuries consolidate in their uptrend. The Shanghai Composite looks to drift sideways with an upward bias and Emerging Markets may need to consolidate further before assaulting long term resistance.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The QQQ looks the strongest and ready for more upside on both timeframes. The SPY and IWM look a bit extended on the longer timeframe with the IWM consolidating on the short timeframe and the SPY looking to move higher. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.