Last week’s review of the macro market indicators entered a week following the Cavaliers winning the NBA title, and the Summer solstice and then the Brexit vote reversing all that as the equity markets, and all other markets dumped Friday. With a one day turn around equities look weak into the week.

Elsewhere looked for gold (NYSE:GLD) to continue higher while crude oil (NYSE:USO) consolidated with a pullback in the uptrend. The US Dollar Index (NYSE:UUP) remained stuck in a sideways consolidation while US Treasuries (NYSE:TLT) were moving back higher. The Shanghai Composite (NYSE:ASHR) and Emerging Markets (NYSE:EEM) were stuck in consolidation ranges with the Chinese market biased to break the range to the upside while Emerging Markets were biased to break theirs lower.

Volatility (VXX) looked to remain elevated to start the coming week keeping the bias lower for the equity index ETFs SPY, NYSE:IWM and NASDAQ:QQQ. Their charts all looked better to the downside in the short term, with the QQQ at intermediate support and the SPY (NYSE:SPY) breaking its intermediate support. All 3 printed possible reversal candles though so stay nimble.

The week played out with gold holding the gains from last week in a tight range, drifting higher, while crude oil started lower but found support and bounced later in the week. The US dollar extended the bull flag in the consolidation range while Treasuries gapped up to new all-time highs. The Shanghai Composite drifted higher testing the top of the range while Emerging Markets Hammered out a bottom and jumped.

Volatility briefly made a new 4 month high before falling back to the normal range. The Equity Index ETFs all started the week making lower lows but then reversed sharply, erasing almost all of the Brexit losses in the process. What does this mean for the coming week? Lets look at some charts.

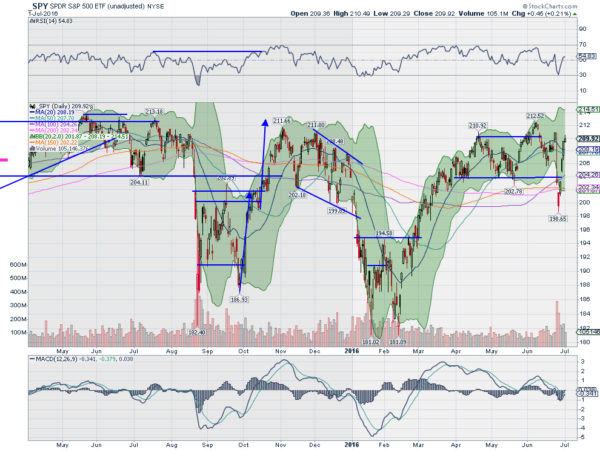

SPY Daily Chart

The SPY started the week running lower, out of its Bollinger Bands®, and below its 100 and 200 day SMA’s. Tuesday saw a bullish kicker candle move price back over those SMA’s and back to the prior support area. A gap higher Wednesday continued higher Thursday and Friday to the top of the recent range. The 210 level is looking real sticky now.

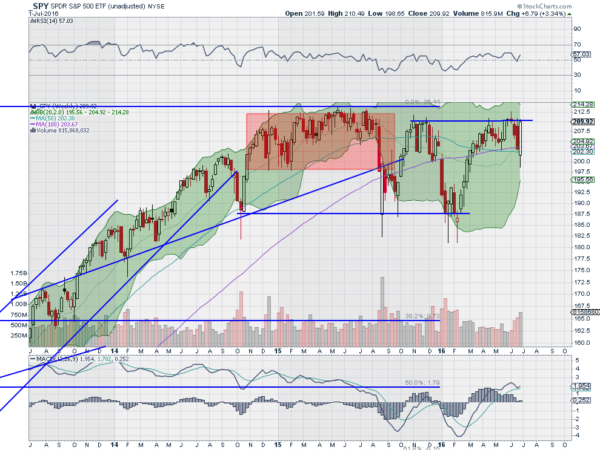

The RSI on the daily chart pushed up through the mid line and the MACD crossed up and is rising. These support more upside, but are yet to reach their bullish zones. The weekly chart shows a strong recovery in a near bullish engulfing candle. The Bollinger Bands are squeezing in, often a precursor to a big move, as it found support at the 100 week SMA and drove higher.

The RSI on this timeframe is turning higher off of a touch at the mid line while the MACD avoided a cross down and is turning up. There is resistance above at 210 and 210.75 followed by 211.5 and 213 before the all-time high. Support lower comes at 208.50 and 207.60 followed by 206 and 203.75. Trend Higher in Broad Consolidation.

SPY Weekly Chart

Heading into the holiday shortened week the equity markets showed some strength with a strong rebound. Elsewhere look for gold to continue higher while crude oil consolidates with a bias lower. The US Dollar Index is also consolidating but with a bias higher while US Treasuries are set to continue higher. The Shanghai Composite looks to continue its bottoming process and Emerging Markets look to continue higher in consolidation.

Volatility has fallen back and looks to remain in the normal zone keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts all agree with this on the shorter timeframe, and the IWM on the longer timeframe, while the SPY and QQQ remain in consolidation longer term. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.