Last week’s review of the macro market indicators noted that heading into July Options Expiration week, the equity indexes were strong and looking for new highs.

Elsewhere looked for gold (SPDR Gold Shares (NYSE:GLD)) to continue higher but perhaps see a short term pullback first, similar to the picture for crude oil (United States Oil (NYSE:USO)).

The US Dollar Index (PowerShares DB US Dollar Bullish (NYSE:UUP)) looked to continue higher toward the top of the broad consolidation while US treasuries (iShares 20+ Year Treasury Bond (NYSE:TLT)) were set to continue higher but with some caution, as they were getting extended short term.

The Shanghai Composite (Deutsche X-trackers Harvest CSI 300 China A-Shares (NYSE:ASHR)) and Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) both looked better to the upside in their consolidation ranges.

Volatility (iPath S&P 500 VIX Short-Term Futures (NYSE:VXX)) looked to remain subdued and possibly moving lower, keeping the bias higher for the equity index ETFs SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts agreed, with the SPY looking for new all-time highs quickly, the IWM chasing and the QQQ looking to break a range by making a new 2016 high.

The week played out with gold pulling back lower to its 20 day SMA while crude oil started lower but found support and bounced. The US dollar could not break its flag and continued sideways while treasuries found trouble and pulled back to their 20 day SMA. The Shanghai Composite jumped higher early in the week and then consolidated while Emerging Markets continued to the upside.

Volatility made a new eleven-month low, showing an all clear sign. The equity index ETFs all moved higher on the week, with the SPY and QQQ the strongest trends but the IWM’s strong early move outpacing them, before consolidating most of the week. What does this mean for the coming week? Lets look at some charts.

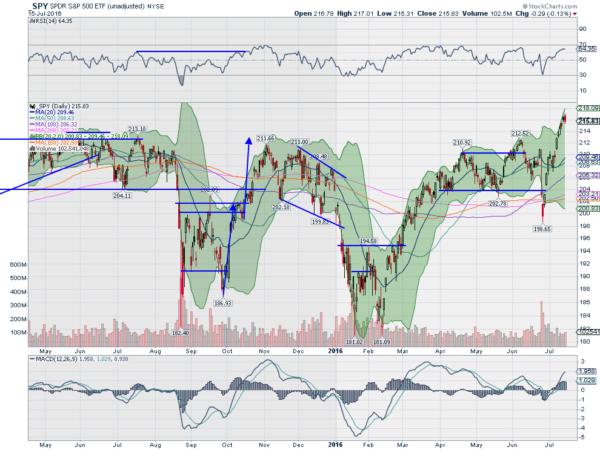

SPY Daily

The SPY started the week moving above the June high. As it did so, the RSI on the daily chart moved over 60 into a bullish zone, to complement the rising and bullish MACD. It continued higher Tuesday, making a new all-time high close. Wednesday pushed higher but eventually closed slightly lower and Thursday made another all-time high. Friday pushed to new intraday highs over 217 but then fell back in a bearish engulfing candle. If confirmed lower Monday, this would signal a reversal. For now the short-term trend remains higher.

On the weekly chart there was a third higher candle, this one with an upper shadow. The Bollinger Bands® are opening to the upside but the price has moved outside of them. Perhaps a small pullback or sideways consolidation is in order. The RSI on this timeframe is now into the bullish zone and making a new higher high as the MACD is rising.

There is resistance at 217 and a measured move to 218.90 off of the July 6th bottom, and a price objective on an inverse head and shoulders pattern to 222.70, with the head at the June low. Support lower may come at 215 and 214.30 followed by 214 and 213.50 then 211.50 and 210. Uptrend continues with a possible short-term pause or pullback.

SPY Weekly

Heading into the next week, the equity markets have been strong and may need a short-term pause or pullback before resuming higher. Elsewhere, gold may be ready to bounce in its downtrend while crude oil also looks like it may be ready to reverse higher. The US Dollar Index is continuing to consolidate with an upward bias while US treasuries are biased lower in the short run in their uptrend. The Shanghai Composite looks to continue its slow reversal higher as Emerging Markets rise to test the long-term resistance zone just above.

Volatility looks to remain below normal levels, keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts also are biased to the upside in the intermediate timeframe while they consolidate in the shorter timeframe. The SPY looks most vulnerable to a short-term pullback followed by the QQQ. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.