Last week’s review of the macro market indicators noted heading into the end of the second Quarter of the year, the equity markets remained strong on both timeframes and poised for more upside. Elsewhere looked for gold (GLD (NYSE:GLD)) to participate to the upside while Crude Oil (USO (NYSE:USO)) continued the trend lower. The US Dollar Index (DXY) marked time in consolidation while US Treasuries (TLT) continued higher.

The Shanghai Composite (ASHR) and Emerging Markets (EEM) both looked to continue uptrends, although Emerging Markets might need some further consolidation first. Volatility (VXX) looked to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts looked stronger on the weekly timeframe than the shorter one. And on that shorter timeframe the IWM and QQQ looked set to outperform the SPY for the week.

The week played out with gold holding in a range moving sideways while Crude Oil moved higher all week. The US dollar broke consolidation to the downside while Treasuries peaked Monday and pulled back the rest of the week. The Shanghai Composite pushed higher while Emerging Markets held in consolidation.

Volatility was sedate early before a spike Thursday that settled back to end the week. The Equity Index ETF’s broadly held in consolidation ranges, with the QQQ dipping to a 5% correction Thursday. What does this mean for the coming week? Lets look at some charts.

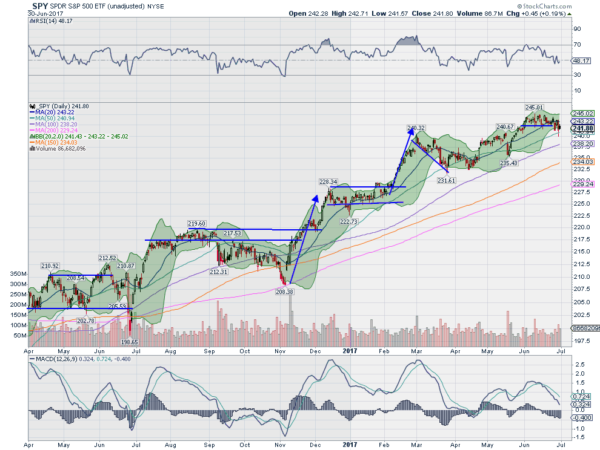

SPY Daily, SPY

The SPY was in consolidation when it entered the week, sitting just under the 20 day SMA. Monday started higher but trailed off and then Tuesday saw a strong move to the downside, finishing at the low. This was under the lower Bollinger Band®, where bounces often occur, and it did so Wednesday. Thursday dropped again, touching the 50 day SMA, and then rebounding but also finishing out of the Bollinger Bands.

Friday got the requisite bounce and it finished the week inside the Bollinger Bands and slightly lower. The SPY has been in such a tight range for so long the two down days got many worried of a major move, but the full range for the week was less than 5 points or less than 2%. The daily chart shows the RSI trending lower, but in the bullish zone near the mid line while the MACD is falling but positive.

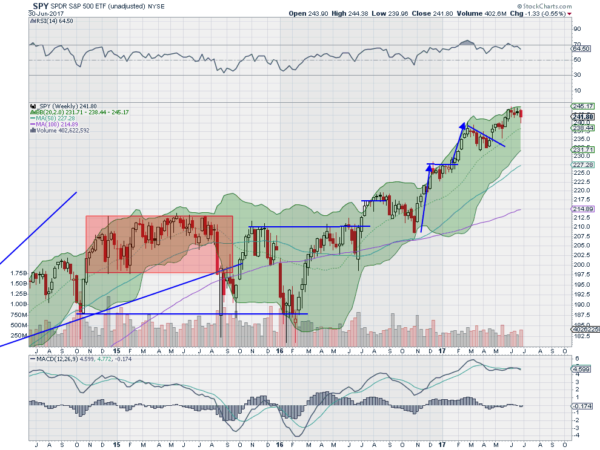

The longer weekly timeframe shows the consolidation more clearly. Five weeks in a row holding up over the break out level. The RSI on this timeframe is strong in the bullish zone, currently retracing, while the MACD is flat. There is resistance at 242 and 245 then free air above. Support lower sits at 240 and 238. Continued Consolidation in the Uptrend.

SPY Weekly, SPY

After tying up the second quarter and heading into the Fourth of July Holiday Weekend, equities have held up well, with a first crack in the armor for the QQQ. Elsewhere look for Gold to consolidate sideways while Crude Oil continues higher short term. The US dollar Index is weak and looks to continue lower while US Treasuries are also biased lower after a reversal. The Shanghai Composite and Emerging Markets are biased to the upside with risk that Emerging Markets may continue to consolidate in the short run.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are more mixed than they have been with the QQQ showing some signs of weakness on both timeframes while the SPY and IWM are still strong. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.