Last week’s review of the macro market indicators suggested as the books closed on 2015 and we prepped for 2016 that the equity markets were showing a lack of strength at best and some weakness short term. Elsewhere looked for consolidation to rule the short term. In gold (N:GLD) it looked for consolidation in the downtrend with crude oil (N:USO) also consolidating its move lower. The US dollar index (N:UUP) looked to consolidate in the uptrend while US Treasuries (N:TLT) just continued broad consolidation sideways marking time.

The Shanghai Composite (N:ASHR) looked to continue its sideways motion while Emerging Markets (N:EEM) were biased to the downside in consolidation. Volatility (N:VXX) looked to remain subdued keeping the bias higher for the equity index ETFs N:SPY, N:IWM and O:QQQ. Their charts looked to move into the new year showing further consolidation in the long run but with some weakness in the short run, especially in the SPY.

The week played out with gold immediately pushing higher while crude oil melted down lower. So much for consolidation. The US dollar started the week moving higher but gave it all back while Treasuries pushed higher but both remained in consolidation. The Shanghai Composite took center stage but not until late in the week with a dumping while Emerging Markets continued lower, printing new 6 year lows.

Volatility pushed higher back to the pre-Christmas highs. The Equity Index ETFs halted started the week in consolidation but quickly headed lower, with the SPY falling below 200 and giving up nearly 6%, while the IWM and the QQQ fared even worse. All this made for the worst opening week for a year in the markets ever. What does this mean for the coming week? Lets look at some charts.

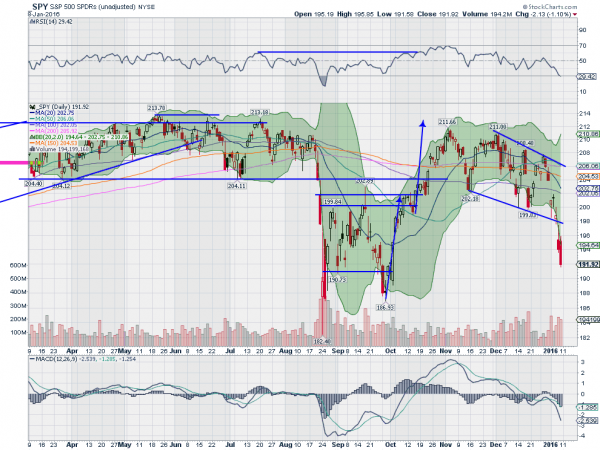

SPY Daily

The SPY gapped down to start the week, finding both the lower Bollinger Band® and the bottom of a falling channel and then bounced. It printed a Hammer Monday which gave hope for a reversal higher and even confirmed the reversal Tuesday but with a Hanging Man. That was followed by a fall back to the lower channel bound Wednesday, again printing a potential reversal candle, this time a Spinning Top.

Thursday ended all thoughts of a reversal though with a gap down open, out of the Bollinger Bands again and well below the channel. Friday started with a bounce higher but then selling took over and it finished day and week just above the low print. It is well outside of the lower Bollinger Band so a bounce to start the week is possible, but the RSI on the daily chart is firmly in the bearish zone and falling, while the MACD is falling hard. These support more downside.

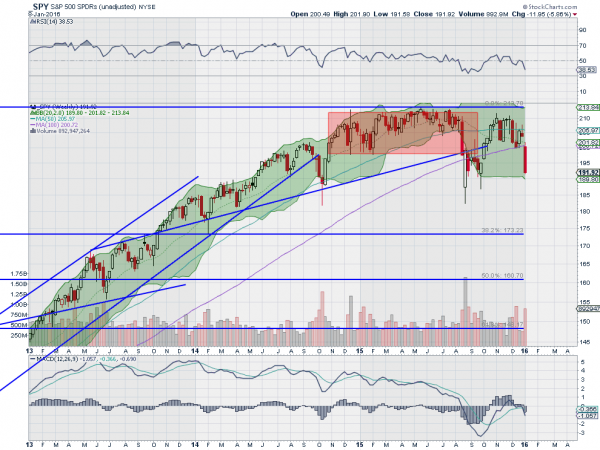

On the weekly chart the strong, long red candle starting at the 100 week SMA reeks of more ugliness. The RSI on this timeframe is falling and in the bearish zone while the MACD heads lower. Even the Bollinger Bands started to open lower. Support lower comes at 191.50 and 189.50 followed by 188 and 187.30 before 184.50 and 181.75. Resistance higher comes at 194.50 and 196 followed by 198.50 and 200. Continued Downtrend.

SPY Weekly

This was the worst first week of the New Year ever. Now heading into January options expiration there really does not look to be any relief in sight for the equity markets. Elsewhere look for gold to continue the bounce higher in its downtrend while crude oil burns lower. The US dollar index looks to continue consolidation at its highs while US Treasuries are biased higher in consolidation. The Shanghai Composite and Emerging Markets are biased to the downside and looking really ugly.

Volatility looks to remain elevated keeping the bias lower for the equity index ETFs SPY, IWM and QQQ. Their charts also point lower with perhaps a pause or oversold bounce in the short run, but with their intermediate term charts moving decidedly more bearish. The one possible exception is the QQQ which remains somewhat above the August lows. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.