Last week’s review of the macro market indicators noted that with the calendar turning from 2016 to 2017 the equity markets were retrenching in their uptrends. Elsewhere looked for gold (NYSE:GLD) to continue its bounce in its downtrend while crude oil continued higher. The US dollar index looked to continue consolidation of the break out move while US Treasuries (NASDAQ:TLT) might have bottomed in their downtrend.

The Shanghai Composite looked to continue to consolidate in the uptrend and Emerging Markets (NYSE:EEM) were consolidating the bounce in the downtrend. Volatility (NYSE:VXX) looked to remain low, but out of abnormally low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts showed short term pullbacks likely to continue within the long term uptrends.

The week played out with gold continuing higher while crude oil started higher Tuesday, but was slammed midday before a slow rebound the rest of the week. The US dollar pulled back, but held over the break out level while Treasuries started to inch higher. The Shanghai Composite started a push back higher while Emerging Markets resumed their move higher.

Volatility marched right back down to 16 month lows, erasing last weeks small bump. The Equity Index ETF’s all gapped higher to start the New Year. From there the QQQ continued up all week to new all-time highs, the SPY joined it, moving higher after a mid week pause, and the IWM held in place after the gap. What does this mean for the coming week? Lets look at some charts.

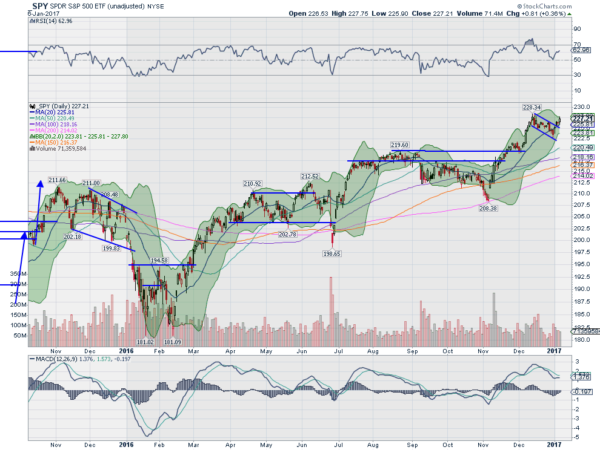

SPY Daily

The SPY ended 2016 with a pullback under its 20 day SMA and a 3 week drift lower. As 2017 began, the SPY moved higher to the 20 day SMA Tuesday and then over it Wednesday. An inside day Thursday held over the 20 day SMA and then it continued higher Friday closing only 50 cents from its all-time high. This also confirmed that 3 week pullback as a bull flag and as it broke it, it established a target to 231.50.

The daily chart shows the RSI bounce off of the mid line and firmly in the bullish zone with the MACD level after resetting lower. The Bollinger Bands® are starting to open after a squeeze as well. On the weekly chart, you see a new all-time high weekly close as price follows the Bollinger Bands higher. The RSI on this timeframe is bullish and the MACD bullish and rising as well.

There is resistance higher only at 228.34, the intraday all-time high. Everything above that is targets and extensions, also known as guesses. There is support lower at 226.50 and 225 followed by 224 and 221.75 then 220. Continued Uptrend.

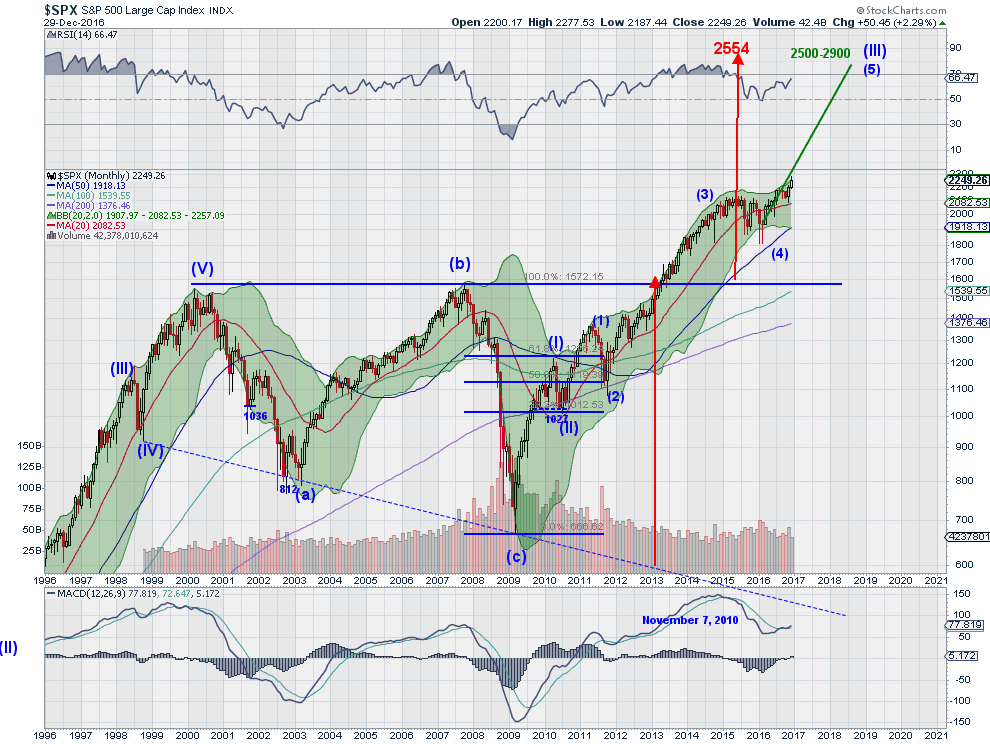

SPY Weekly

Heading into the first full week of 2017 the equity index ETF’s look strong, as if they had a restful holiday break. Elsewhere, look for gold to continue the bounce in its downtrend while crude oil continues higher. The US dollar index may continue to digest its break out while US Treasuries continue their bounce in the downtrend. The Shanghai Composite is resuming its uptrend and Emerging Markets are biased to continue higher short term as well.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all look great for more upside on the longer timeframe. On the shorter time frame, the QQQ looks to be the leader moving higher while the SPY is not far behind and the IWM consolidates.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.