Last week’s review of the macro market indicators noted that with the Inauguration and January Options Expiration in the rearview mirror, the equity markets held up very well and remained strong on the longer timeframe. Elsewhere looked for gold (NYSE:GLD) to consolidate its uptrend or pullback while Crude Oil (NYSE:USO) moved sideways in a range. The US dollar index looked better to the downside in the short run while US Treasuries (NASDAQ:TLT) were resuming their move lower.

The Shanghai Composite was stuck at 3100 and did not look to change that soon while Emerging Markets (NYSE:EEM) looked tired in their move higher and ready for a pullback. Volatility (NYSE:VXX) would remain at abnormally low levels keeping the bias higher for the equity index SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts showed the QQQ remaining the short term leader as it crept to new all-time highs, while the SPY and IWM consolidated moving sideways in the short run. In the longer timeframe all 3 looked strong.

The week played out with gold choosing the path lower while crude oil started lower but then recovered, finishing almost unchanged. The US dollar found support at 100 and clung there while Treasuries tried to move higher Monday and then gave that move back and more later in the week. The Shanghai Composite bounced ending the week at the high while Emerging Markets started the week moving higher but then met some resistance and consolidated.

Volatility dropped to levels not seem in over 2 and a half years and held there. The Equity Index ETF’s pushed higher early in the week, with the SPY and QQQ making new all-time highs. By the end of the week they ran out of gas then stalled, with the IWM drifting lower. What does this mean for the coming week? Lets look at some charts.

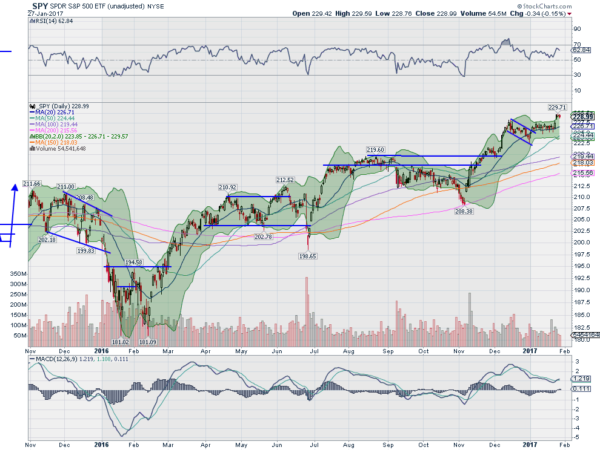

SPY Daily

The SPY came into the week after 12 trading days of small body candles holding over the 20 day SMA. Monday was not any different, another small body candle. But Tuesday saw strength and a move to the upside to the top of the longer consolidation range. Wednesday gapped higher to a new all-time high, but out of the Bollinger Bands®.

An inside doji Thursday was confirmed lower Friday but also remained inside the Wednesday candle, with the SPY moving back inside the Bollinger Bands. They are opening to the upside, a positive, but not much going on. The RSI on the daily chart is in the bullish range but retracing the jump Wednesday, while the MACD has crossed up. Bullish but without much conviction on this timeframe.

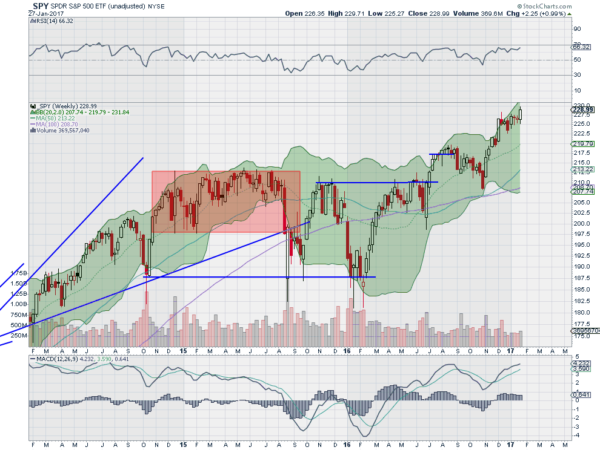

Moving to the weekly chart looks much more positive. A break of the consolidation to the upside, establishing a target on a Measured Move to 242, with the Bollinger Bands expanding. The RSI on this timeframe is bullish and rising while the MACD is moving higher. There is resistance at 229.70 and then free air above. Support lower comes at 228 and 226.50 followed by 225 and 224 then 221.75. Uptrend Resumes.

SPY Weekly

Heading into February the Equity markets continue to look strong, especially on the intermediate charts. Elsewhere look for gold to continue lower while crude oil churns over support. The US dollar index continues lower but may be bottoming while US Treasuries are biased lower. The Shanghai Composite is resuming its drift higher, but will be closed until Friday while Emerging Markets work higher.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show real strength continuing in the intermediate term. Shorter term the QQQ has been the leader but is getting a bit overheated, while the SPY and IWM may be ready to start higher out of consolidation. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.