Last week’s review of the macro market indicators noted with January Options Expiration behind and a long weekend ahead equity markets continued to recover and were looking strong. Elsewhere looked for Gold to pause in its uptrend while Crude Oil resumed the move higher. The U.S. Dollar Index was showing short term strength, while U.S. Treasuries were biased to continue lower. The Shanghai Composite was also exhibiting short term strength and might be reversing higher while Emerging Markets continued to move up.

Volatility (VOX) was back down to the lows since when equities started to drop in October making the path higher the easier one for equities. The equity index ETF’s SPY, IWM and QQQ, were all responding well in both the short and intermediate term charts. But they all remained short of confirming reversals with a higher high and below their 200-day SMA’s. More work needed to be done.

The week played out with Gold marking time sideways until a spike on Friday while Crude Oil paused in its move higher. The U.S. dollar met resistance and pulled back Friday while Treasuries found support and bounced. The Shanghai Composite consolidated its move over trend resistance while Emerging Markets made a small move higher off of a retest of trend support.

Volatility moved higher Tuesday but returned back by the end of the week, keeping the bias higher for equities. The Equity Index ETF’s reacted with a drop Tuesday and then consolidation before strong moves higher on Friday. This led to the SPY, IWM and QQQ being little changed on the week. What does this mean for the coming week? Let’s look at some charts.

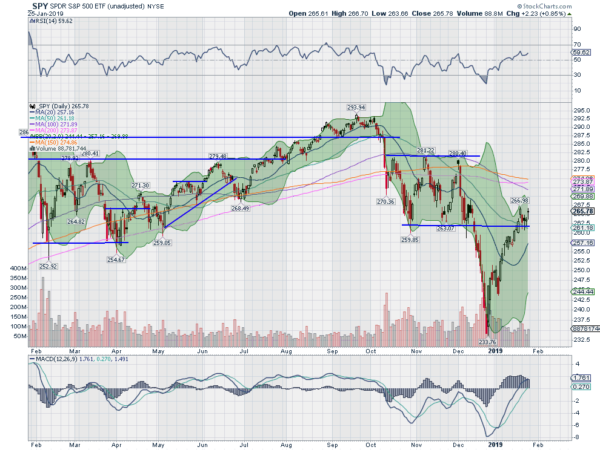

SPY Daily

The SPY came into the week moving higher and over what was prior support that started the December breakdown. It was also over the 50-day SMA and it held there Tuesday. Wednesday and Thursday were back to back inside real bodies on the candles and then Friday it gapped higher and closed slightly up on the day.

The daily chart shows it right back where it ended the prior week and at the 50% retracement of the downward move. It has a RSI sitting right at the edge of the bullish zone with the MACD rising and positive. A positive end to the week after consolidation.

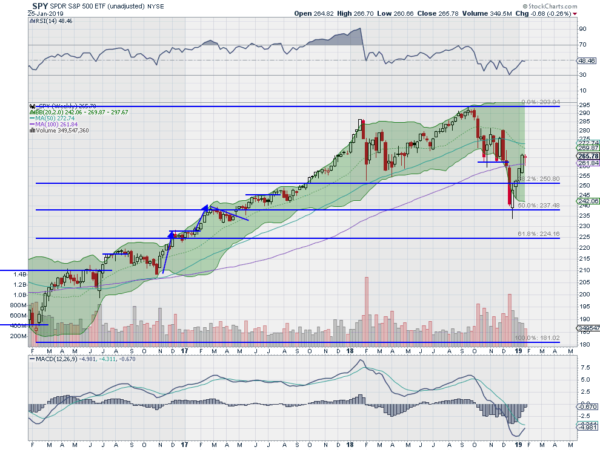

The weekly chart shows price holding over the 100 week SMA with a small drop on the week. The RSI is stalling at the midline and the MACD is rising and about to cross. A solid digestive week but still short of declaring an all-clear signal. There is resistance at 269 and 271.40 then 272.50 and 274.50 before 277.50 and 279 then 280 and 281.50. Over that and the bull case is much stronger. Support comes at 265 and 263 then 261 and 257.50 before 255. Uptrend.

SPY Weekly

Heading into the last week of January equities have taken a pause but remain in their uptrends. But they also remain short declaring that the correction is over. Elsewhere look for Gold to pause in its uptrend while Crude Oil pauses in its move higher. The U.S. Dollar Index is back in broad consolidation while U.S. Treasuries pause in their uptrend. The Shanghai Composite is building the case for a possible reversal higher while the Emerging Markets building a reversal itself.

Volatility looks to remain muted keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts remain strong in the short timeframe and just short of full bullish on the longer timeframe. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.