Last week’s review of the macro market indicators noted as the first full week of 2019 concluded equities posted a positive follow up to the prior week with some digestion at the end of the week. Good news but still shy of a confirmed reversal higher. Elsewhere looked for Gold to possibly pause in its uptrend while Crude Oil moved higher with some digestion short term. The U.S. Dollar Index looked to drift lower in broad consolidation while U.S. Treasuries pulled back in their uptrend.

The Shanghai Composite looked to continue the downtrend with Emerging Markets (NYSE:EEM) possibly putting in a bottom and reversal. Volatility looked to settle back to normal levels clearing the way for equities to show if they have continued strength. Their charts show the equity index ETF’s SPY, IWM and QQQ, continued the bounce higher and consolidating the move at the end of the week.

The week played out with Gold pausing before falling back slightly to end the week while Crude Oil consolidated before a push higher Friday. The U.S. dollar found support and rebounded slightly higher while Treasuries continued their pullback. The Shanghai Composite managed a short term move to the upside while Emerging Markets continued their move higher.

Volatility held in the teens all week, keeping the bias higher for equities. The Equity Index ETF’s took advantage, continuing their moves to the upside, with the IWM and SPY back over key break down areas. They plus the QQQ are also back over their 50-day moving averages. What does this mean for the coming week? Let’s look at some charts.

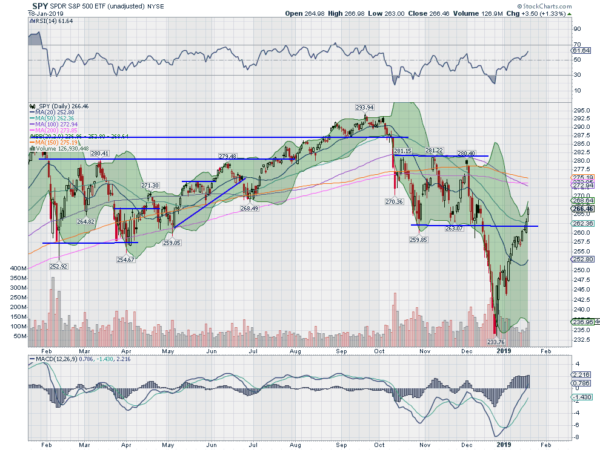

SPY Daily

The SPY was driving higher and had just reached a 38.2% retracement of the drop from September when the week started. It held there Monday but then started to move higher again Tuesday. By Thursday it had reached the breakdown area at previous support and stopped. Then Friday it continued higher over that level and over a 50% retracement.

The daily chart shows the 200 day SMA still above and a 61.8% retracement that it can reach before that. The RSI is rising and bullish with lots of room before it gets to overbought levels. The MACD is rising and has just turned positive. And the Bollinger Bands® are opening higher. It looks like a strong trend.

The weekly chart now has 3 Advancing White Soldiers, a bullish pattern, after reversing higher. The RSI on this timeframe is just at the midline and the MACD curling up but negative still and yet to cross. More work to be done here. There is resistance at 269 and 271.40 then 272.50 and 274.50 followed by 277.50. It will take a move over the channel at 281.50 to sound the all safe signal. Support lower comes at 265 then 263 followed by 261 and 257.50 then 255. Uptrend Continues.

SPY Weekly

With January Options Expiration behind and a long weekend, ahead equity markets continue to recover and are looking strong. Elsewhere look for Gold to pause in its uptrend while Crude Oil resumes the move higher. The U.S. Dollar Index is showing short term strength while US Treasuries are biased to continue lower. The Shanghai Composite is also exhibiting short term strength and may be reversing higher while Emerging Markets continue to move up.

Volatility is back down to the lows since equities started to drop in October making the path higher the easier one for equities. The equity index ETF’s SPY, IWM and QQQ, are all responding well in both the short and intermediate term charts. But they all remain short of confirming reversals with a higher high and below their 200 day SMA’s. More work to be done. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.