Last week’s review of the macro market indicators noted heading into the first full week of 2019 that equity markets had shown some short term strength but still had a long way to go to claim a reversal. Elsewhere looked for Gold (NYSE:GLD) to continue in its uptrend while Crude Oil (NYSE:USO) joined it moving higher. The US Dollar Index continued to move sideways while US Treasuries (NASDAQ:TLT) paused in their uptrend.

The Shanghai Composite continued to move lower while Emerging Markets (NYSE:EEM) paused in their downtrend. Volatility looked to continue to fall from elevated levels easing the pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts looked ready for more upside after a strong week with the IWM leading the charge and the QQQ and SPY not far behind.

The week played out with Gold bouncing off of $1300 in a tightening consolidation while Crude Oil WTI Futures drove higher, back well over $50. The US Dollar Index Futures pulled back towards its long term moving average while Treasuries dropped all week until a bounce Friday. The Shanghai Composite stalled at resistance and turned back while Emerging Markets made a small move higher.

Volatility drifted lower all week, making it back into the teens, and easing the pressure on equities. The Equity Index ETF’s rose early in the week and then stalled at the end. This left the SPY, IWM and QQQ all still below their 200 day moving averages and prior breakdown areas. What does this mean for the coming week? Let’s look at some charts.

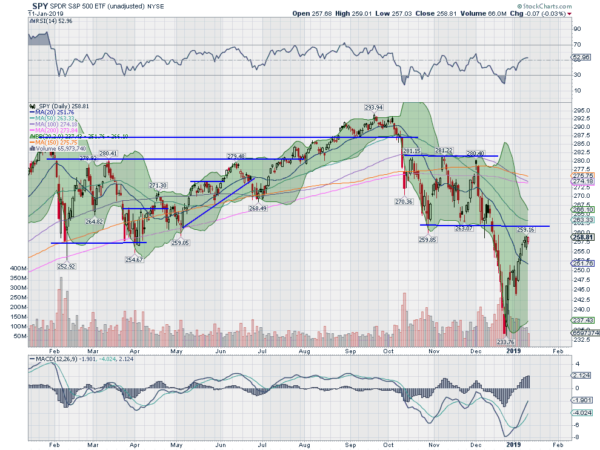

SPY Daily, $SPY

The SPY had started a secondary move up out of short term consolidation and was coming into the week at the 20 day SMA. It moved over it Monday and continued higher through Thursday. It paused then, just under prior support for the rest of the week.

The daily chart shows the RSI starting to level short of a return to the bullish zone with the MACD rising, but still negative. More positive progress but it is still short of being able to confirm a reversal and not just a bounce in a downtrend.

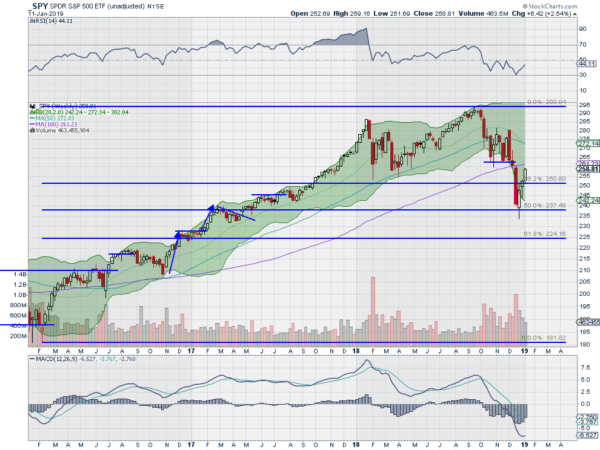

The weekly chart shows a strong candle higher, but on falling volume, also raising caution. The RSI is moving up but short of the mid line with the MACD leveling at extreme lows. There is resistance at 261 and 263 then 265 and 269. It would take a move back over 263 to start to breathe easier. Support below sits at 257.50 and 255 then 254 and 250.50. Bounce Continues in Downtrend.

SPY Weekly, $SPY

As the first full week of 2019 concludes equities posted a positive follow up to last week with some digestion at the end of the week. Good news but still shy of a confirmed reversal higher. Elsewhere look for Gold to possibly pause in its uptrend while Crude Oil moves higher with some digestion short term. The US Dollar Index looks to drift lower in broad consolidation while US Treasuries pull back in their uptrend.

The Shanghai Composite looks to continue the downtrend with Emerging Markets possibly putting in a bottom and reversal. Volatility looks to settling back to normal levels clearing the way for equities to show if they have strength. Their charts show the equity index ETF’s SPY, IWM and QQQ, continuing the bounce higher and consolidating the move at the end of the week. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.