Last week’s review of the macro market indicators saw that the last week of Fed Speak and Options Expiration took a toll on equity markets as they suffered a down week. Elsewhere looked for Gold ($GLD) to pause in its uptrend while Crude Oil ($USO) drove lower. The US Dollar Index ($DXY) remained stuck in a sideways consolidation while US Treasuries ($TLT) were pausing in their uptrend. The Shanghai Composite ($ASHR) and Emerging Markets ($EEM) looked to be consolidating sideways, the Shanghai Composite after a pullback and Emerging Markets in an uptrend.

Volatility ($VXXB) looked to continue low but drifting up keeping the bias slightly lower for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts all showed consolidative pullbacks in the shorter time frame, with the SPY (NYSE:SPY) and QQQ showing no real damage, while the IWM continued to tread water. The SPY and QQQ looked strong on the longer timeframe with the IWM continuing sideways on this timeframe also.

The week played out with Gold stalling and falling back to support while Crude Oil found support and consolidated. The US Dollar found support and moved slightly higher in the broad range while Treasuries tread water, moving sideways. The Shanghai Composite and Emerging Markets continued to consolidate in place.

Volatility ended the bounce and fell back to the April lows, keeping the bias higher for equities. The Equity Index ETF’s reacted by moving higher, with the SPY and QQQ rising to new all-time highs. The IWM also moved higher, however it remains stuck in a range. What does this mean for the coming week? Let’s look at some charts.

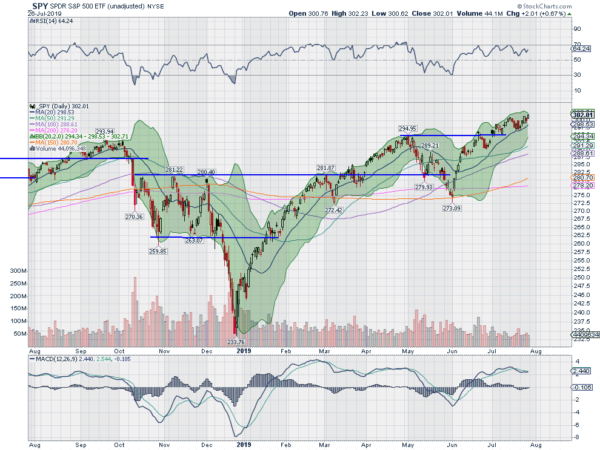

SPY Daily, $SPY

The SPY came into the week pulling back from an all-time high and with a long bearish candle. It was over the 20 day SMA though. It held there with a small body candle on Monday and then moved higher Tuesday. By the Wednesday close it had made another new all-time high. After giving back some ground Thursday it rallied to close the week at another all-time high.

A strong week ahead of the FOMC meeting next week. The daily chart shows the RSI holding strong in the bullish zone with the MACD flat and positive, not near an extreme. The Bollinger Bands® are starting to tighten, suggesting it may slow down soon.

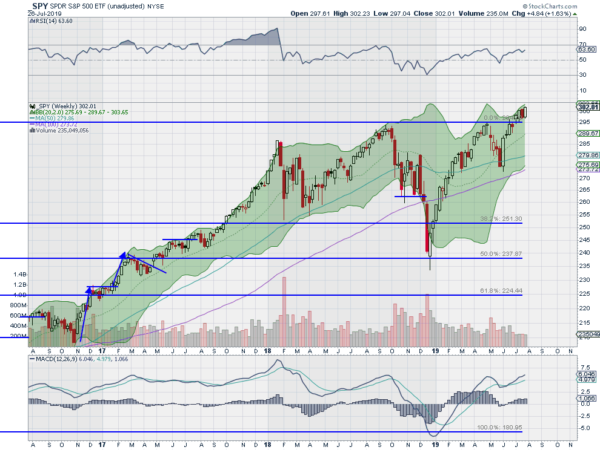

The weekly chart shows a slow plod higher. The 335 target remains intact with the Bollinger Bands shifted to the upside. The RSI is holding strong in the bullish zone with the MACD rising and positive. There is no resistance over 302.01. Support lower comes at 301 and 300 followed by 298.80 and 296.75 then 295 and 294. Uptrend.

SPY Weekly, $SPY

Heading into the FOMC meeting and on the edge of closing out July equity markets remain strong. Elsewhere look for Gold to continue to mark time in its uptrend while Crude Oil pauses in the move lower. The US Dollar Index seems looks to move higher in consolidation while US Treasuries pause and consolidate their move up. The Shanghai Composite and Emerging Markets are both in consolidation mode with no indication that will change.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all agree with this on the shorter timeframe and are moving higher. But with the SPY and QQQ making all-time highs and driving to the upside on the longer timeframe, the IWM continues to lag and remains in a range. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.