Last week’s review of the macro market indicators noted that, heading into the last days of January, equity markets continued to drive higher and were running hot. Elsewhere saw gold to continue in its uptrend while Crude Oil drove higher as well. The US Dollar Index continued to look weak and better to the downside while US Treasurys) were biased lower in consolidation.

The Shanghai Composite and Emerging Markets were poised to continue to make new highs. (NYSE:Volatility) (VXX) looked to remain low, keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts continued to show the SPY to be the most overheated with the QQQ only moderately so, and the IWM possibly ready to take the reigns and lead the markets.

The week played out with gold gapping lower and end down, while crude oil pulled back as well before rebounding. The US dollar moved lower before a Friday bounce while Treasurys moved lower through long-term support. The Shanghai Composite gapped down as well while Emerging Markets also dropped but to support.

Volatility started higher, paused and then jumped Friday, putting some downward pressure on equities. The equity index ETFs held firm to start the week, then gapped down and accelerated lower to end the week at the lows. What does this mean for the coming week? Lets look at some charts.

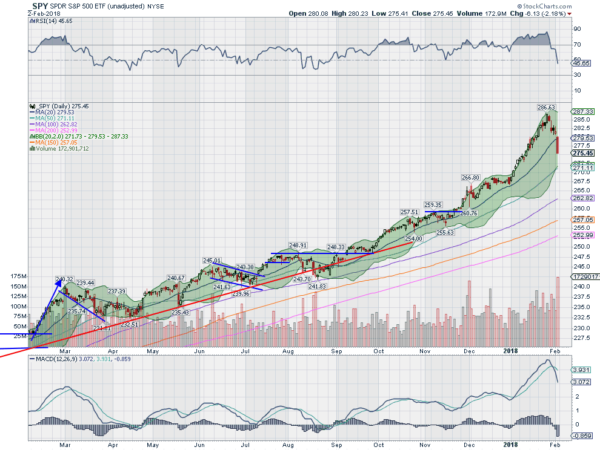

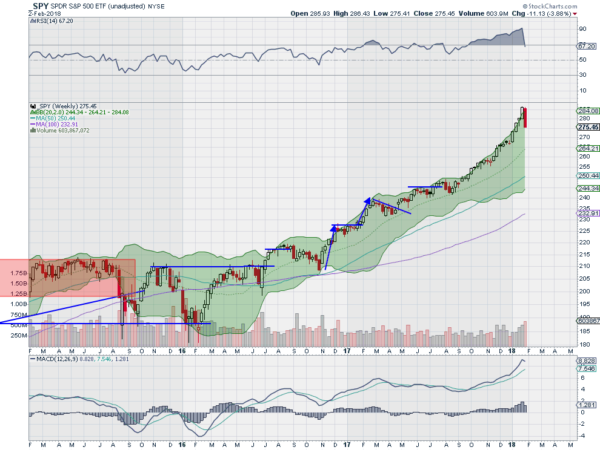

The SPY entered the week at an all-time high and held there Monday. Tuesday saw a drop lower though and a continued small move down through Thursday. Friday opened above the 20 day SMA and then started lower, accelerating as the day went on and closing at the low of the week. This ended the steak without a 3% pullback.

The daily chart printed a bearish Marubozu candlestick Friday boding for more downside. The RSI is now nearing the lower edge of the bullish zone and falling fast. Note that a reversal now would invoke a Positive RSI Reversal targeting a new high should it reverse before 267. The MACD us crossed own and falling.

On the weekly timeframe it was also a bearish Marubozu. This has reset the RSI out of overbought territory, still high in the bullish zone. The MACD is turning lower. There is support lower at 275 and 272 followed by 269 and 267.50. Resistance above is at 278 and 280 then 282 and 284.70 then 287. Pullback in Uptrend.

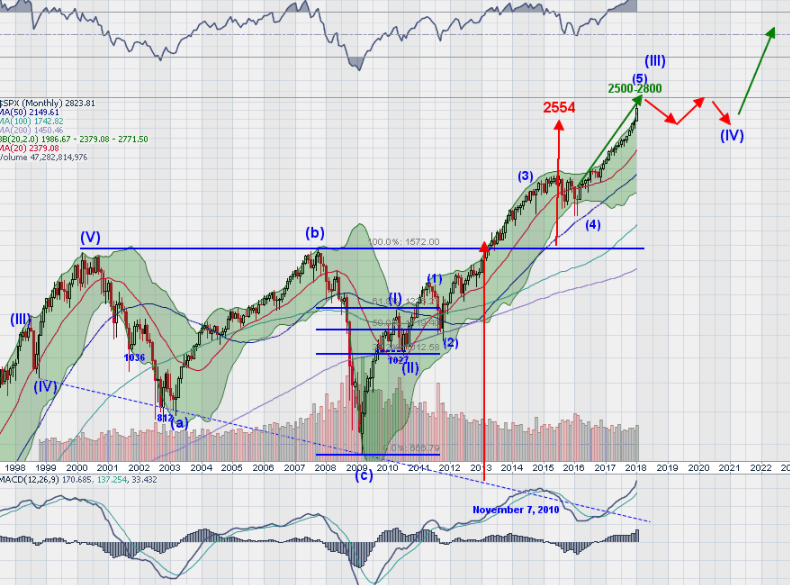

As February starts equities have experienced their first pullback of more than 3% since what feels like forever, with technicals suggesting the pain may not be over yet. Elsewhere look for gold to consolidate in its uptrend while crude oil pauses in its uptrend as well. The US Dollar Index downtrend has hit new lows but may be ready for a bounce while US Treasurys are accelerating lower.

The Shanghai Composite and Emerging Markets are are pulling back in their uptrends. Volatility looks to continue higher keeping the pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts show pauses in the uptrend in the longer timeframe with pullbacks in the shorter one ready to continue next week. Use this information as you prepare for the coming week and trade ’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.