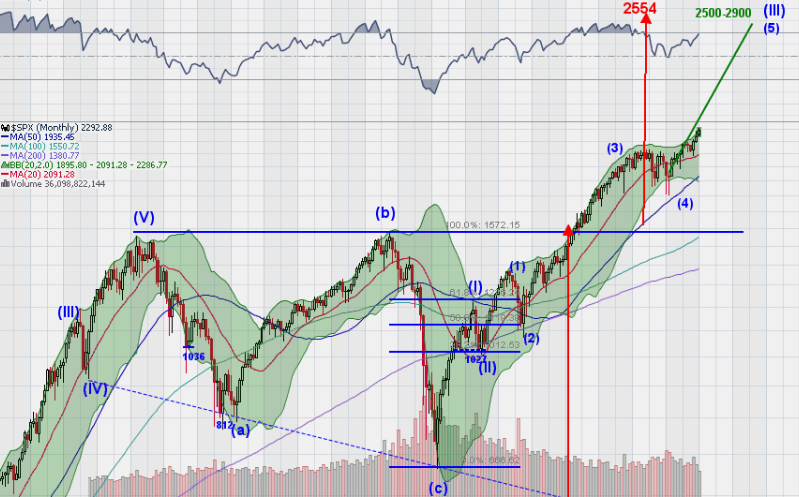

Last week’s review of the macro market indicators saw as markets headed into the holiday shortened week equity markets continued to look strong on the longer timeframe and were getting overheated on the shorter timeframe. Elsewhere looked for gold (NYSE:GLD) to continue to see an easier path higher while crude oil (NYSE:USO) churned in a tight range. The US dollar Index looked ready to reverse back up while US Treasuries (NASDAQ:TLT) were biased lower, should either break consolidation ranges.

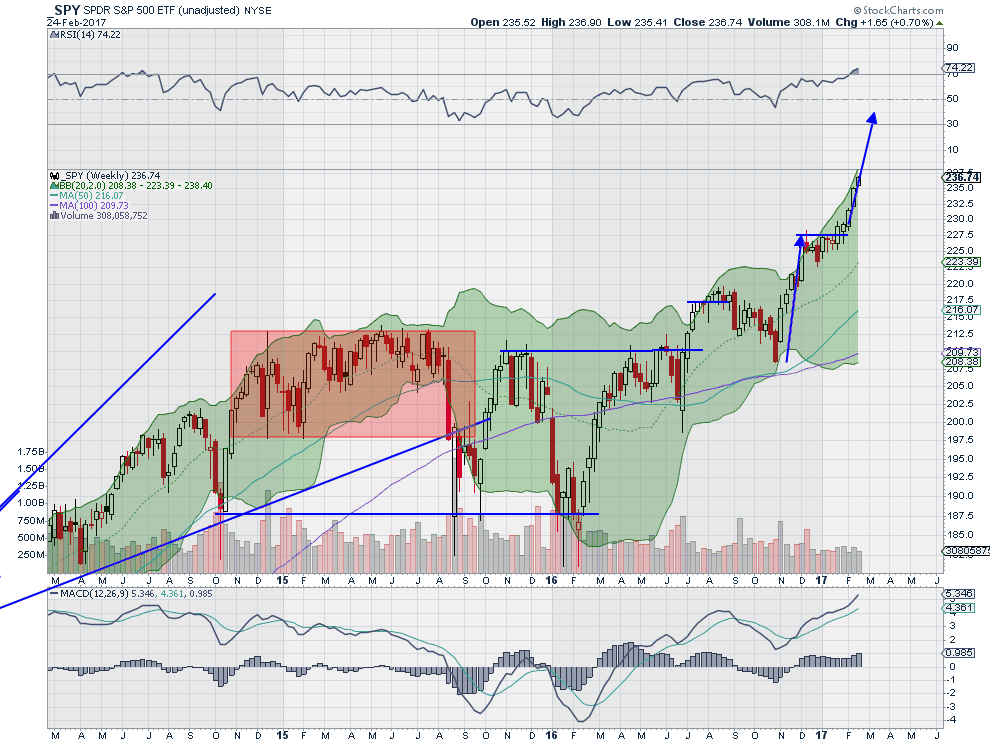

The Shanghai Composite continued to see a drift higher and Emerging Markets (NYSE:EEM) were pausing but also looked good for more upside. Volatility (NYSE:VXX) looked to remain at extremely low levels keeping a breeze at the backs of the equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). All 3 looked strong on the weekly timeframe, despite the moves higher. On the shorter timeframe the SPY and QQQ were moving deeper into overbought territory and might need a pause or pullback, while the IWM was consolidating.

The week played out with gold holding steady before rising to a new range to end the week up while crude oil bounced in a tight range finishing little changed. The US dollar also held in a tight range and slightly higher while Treasuries waited until Friday to slowly move higher. The Shanghai Composite continued its drift higher while Emerging Markets made new 18 month highs before pulling back Friday.

Volatility moved up slightly, but still could not become a teenager. The Equity Index ETF’s all started the week moving higher but had given up the gain by Friday. Each made a new all-time high early in the week and the pullbacks were minimal, with each of the SPY and QQQ remaining in a range of less than 2 points while the IWM range was all of 3 points. What does this mean for the coming week? Lets look at some charts.

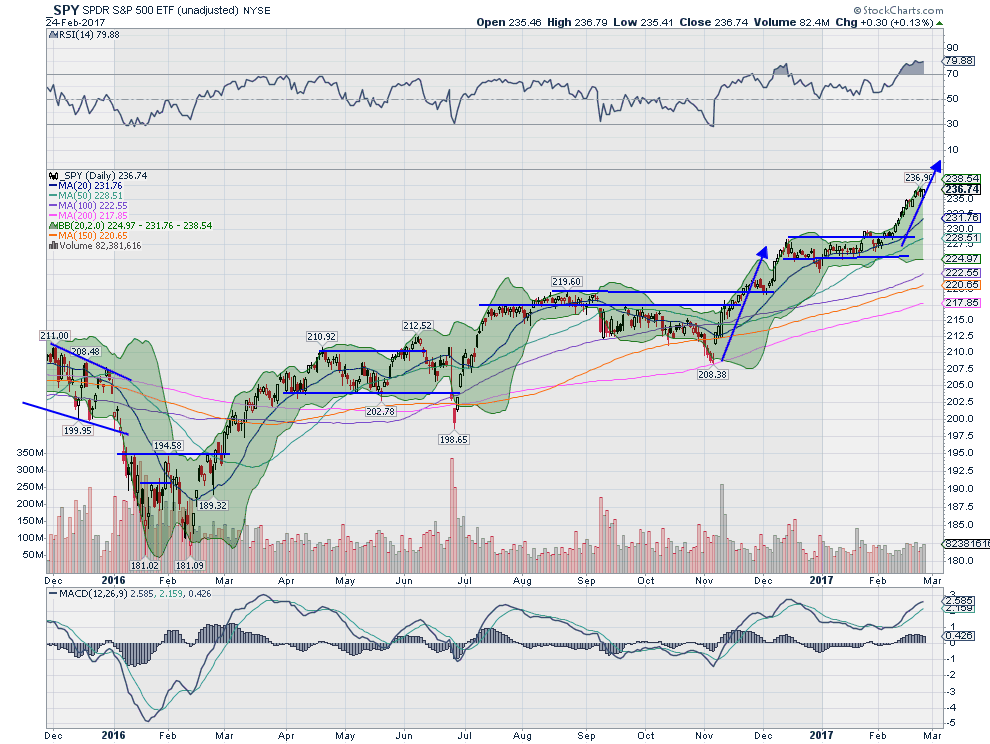

SPY Daily

The SPY started the Holiday shortened week with a gap higher, over 235 and running to another new all-time high close Tuesday. It printed an inside day Wednesday, or Harami, followed by another small body candle Thursday that hit an intraday all-time high before falling back to close just a nickel under its record close. Friday opened lower and chugged higher all day, finishing at at the high and making a new all-time daily closing high and all-time weekly closing high.

Next week, barring a significant pullback early, it will print a monthly all-time closing high again. This is a strong trend. The daily chart shows the RSI overbought but moving sideways now around 80. The MACD is slowing its angle of ascent as well. There is a Measured Move on this chart giving a target to 248 above. The weekly chart shows that strong trend, but from the 2016 low early in the year. The SPY is up over 30% since then.

The RSI on the longer timeframe is just starting to get into overbought territory. This is a sign of strength on this timeframe and nothing to worry about until it is well into the 80’s. The MACD also rising and bullish. There is resistance at 236.60 and then none further above. Support lower stands at 233.75 and 232.20 followed by 229.40 and 227.50. Continued Uptrend.

SPY Weekly

Heading into March the Equity markets still look strong on the longer time frame but are showing more signs of short term weakness taking hold. Elsewhere look for gold to continue higher in its uptrend while crude oil churns with a bias for a break to the upside. The US dollar Index still looks better to the upside while US Treasuries consolidate further. The Shanghai Composite continues to drift higher while Emerging Markets are showing some weakness in their uptrend.

Volatility looks to remain at abnormally low levels keeping the wind at the back of the equity index ETF’s SPY, IWM and QQQ. Their long term charts all continue to look strong while the short term charts hit a set back and may continue a drift lower short term. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.