Last week’s review of the macro market indicators noted with February Options Expiration behind, the equity markets had recovered substantially from their first correction in 2 years. Elsewhere looked for gold (SPDR Gold Shares (NYSE:GLD)) to continue higher in its new uptrend while Crude Oil (United States Oil (NYSE:USO)) also resumed the path higher. The US Dollar Index looked better to the downside and US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) were biased lower. Both were entering major trend change territory.

The Shanghai Composite (ASHR) and Emerging Markets (EEM) reversed their moves lower with the Chinese market still a bit weak. Volatility (VXX) continued to drift lower easing the pressure on the equity markets. The equity index ETF’s SPY, IWM and QQQ, all had strong moves higher on the week, retracing at least 61.8% of the moves lower. All three ended the weak with possible reversal candles on the shorter time frame though, but with strong charts on the longer time frame. Perhaps some short term weakness remained.

The week played out with gold finding resistance again and falling back while crude oil stumbled early and resumed the path higher late in the week. The US dollar bounced but stopped short of a higher high while Treasuries moved lower but then caught a bid at the end of the week. The Shanghai Composite continued higher after the Lunar New Year break while Emerging Markets held steady.

Volatility held in a tight range with a slight drift lower, but still notably higher than in January, easing the tightness on equities. The Equity Index ETF’s held in tight ranges on the week, with the SPY and iShares Russell 2000 (NYSE:IWM) stalling at 61.8% retracements and their 50 day SMA’s. The QQQ has faired better, holding over its 20 day SMA and at a 78.6% retracement. What does this mean for the coming week? Lets look at some charts.

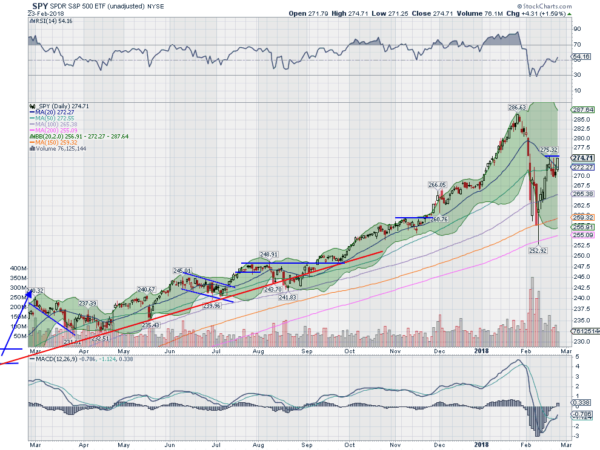

SPY Daily:

The SPY came into the holiday shortened week under the 20 day SMA, sitting on its 50 day SMA and at a 61.8% retracement of the move lower from late January. It needed a move up to convince anyone that the fall was over. It started Tuesday with a small pullback and followed that up again Wednesday and Thursday. These built a bull flag, but also took the price back under the 50 day SMA. And with the upper shadows on the candles suggested that might be the extent of the upward move.

But Friday changed that with a strong move higher ending at the high of the day. This brought price back over the 50 day SMA and over the 20 day SMA for the first time since February 1st. Retracing the flag leaves it still very near that 61.8% retracement level though, but with a target on a Measured Move to 285. The RSI on the daily chart is rising in the bullish zone, over the mid line. The MACD crossed up Friday, but is negative. Both are supportive of more upside but not full on bullish yet.

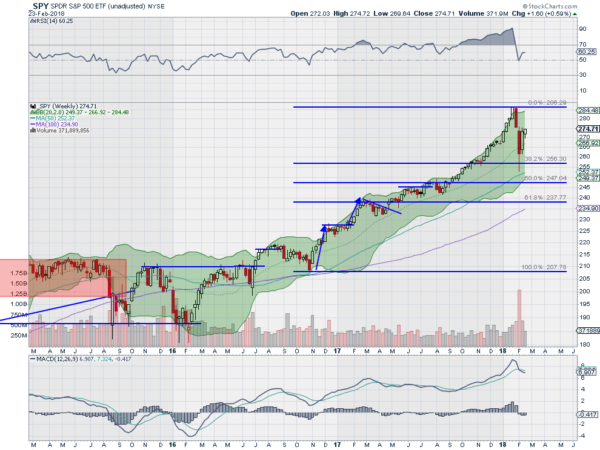

The weekly chart shows a second positive week, but a finish that remains with in the bottoming candle range still. The RSI is rising and poking back into the bullish zone while the MACD is slowing its descent. A close over 275 next week would give more confidence in the bottom being in. There is resistance at 275 and 279 then 280 and 283.30 before 286.60. Support lower comes at 272.50 and 269 then 267 and 265.50. Short Term Uptrend.

SPY Weekly:

Heading into the last days of February the equity markets have recovered much of the downturn and are looking stronger. Elsewhere look for gold to bounce around in a wide range while crude cil resumes on the path higher. The US dollar is pausing in its downtrend while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets both look to continue higher.

Volatility looks to continue to drift lower toward the range that held it for the last couple of years, but remaining above it. This is easing the pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts show the QQQ with the strongest recovery and looking to resume the long uptrend. The SPY and IWM are still holding under critical levels and are showing less positive conviction at this point. Another positive week could end that. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.