Last week’s review of the macro market indicators saw heading into February Options Expiration week the equity markets looked strong if not moving towards getting overheated. Elsewhere looked for gold (NYSE:GLD) to continue in its uptrend while crude oil (NYSE:USO) churned marking time. The US dollar index was looking stronger while US Treasuries (NASDAQ:TLT) consolidated in their downtrend.

The Shanghai Composite and Emerging Markets (NYSE:EEM) both looked strong and ready for more upside. Volatility (NYSE:VXX) looked to remain at extremely low levels keeping the wind at the back of the equity index SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts all looked great and ready for more upside in the longer timeframe but the SPY and QQQ were getting a bit hot in the short term and may need a rest.

The week played out with gold pushing higher but unable to clear the recent range while crude oil bounced off of resistance and held its consolidation pattern. The US dollar met resistance and pulled back but in a tight range while Treasuries found support and bounced. The Shanghai Composite continued to drift higher while Emerging Markets met short term resistance and consolidated.

Volatility spent another week at unusually low levels, giving a boost to equities. The Equity Index ETF’s all pushed higher early in the week, all making new all-time highs by Wednesday. They all pulled back from there but ended the week up, and the QQQ right at the all-time high. What does this mean for the coming week? Lets look at some charts.

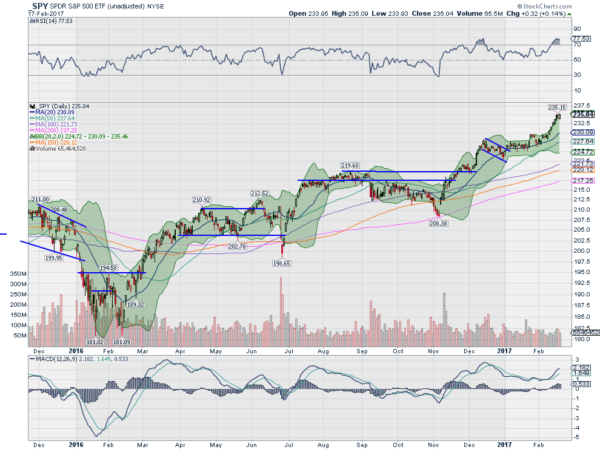

SPY Daily

The SPY moved higher Monday extending the strength at the end of the prior week. That continued through Wednesday as it printed a 4th straight close outside of its Bollinger Bands® and a 5th consecutive all-time high. It made a Hanging Man candle Thursday, often a reversal signal, but then failed to confirm it as it moved higher Friday. It ended the week back inside the Bollinger Bands.

Over the week the RSI worked into an overbought condition on the daily chart and turned sideways, while the MACD continues higher. The strength would suggest the overbought would work off over time not through a pullback, but of course either is possible, along with becoming more overbought. The weekly picture looks very strong.

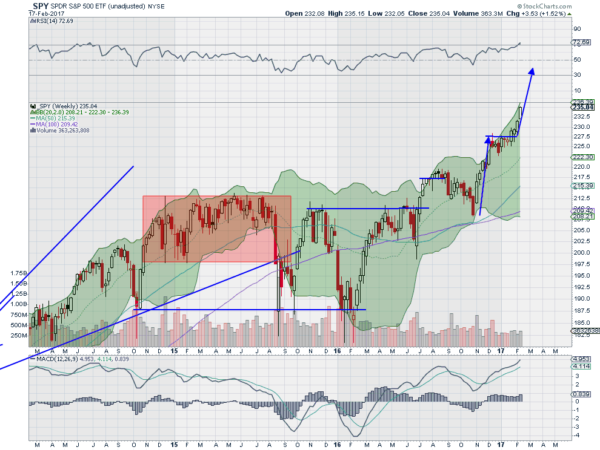

A second long candle to the upside pulling out of consolidation has room to the Bollinger Bands. The RSI is pushing above 70 though not as big a deal as on the daily chart. The MACD is rising as well. There is no resistance above as it makes new all-time highs, but there is a Measured Move above at 244. Support lower comes at 233.70 and 232 followed by 229.50 and 228.25 then 227 and 225.50. Continued Uptrend.

SPY Weekly

As markets head into the holiday shortened week equity markets continue to look strong on the longer timeframe and are getting overheated on the shorter timeframe. Elsewhere look for gold to continue to see an easier path higher while crude oil churns in a tight range. The US dollar Index looks ready to reverse back up while US Treasuries are biased lower, should either break consolidation ranges. The Shanghai Composite continues to see a drift higher and Emerging Markets are pausing but also look good for more upside.

Volatility looks to remain at extremely low levels keeping a breeze at the backs of the equity index ETF’s SPY, IWM and QQQ. All 3 look strong on the weekly timeframe, despite the moves higher. On the shorter timeframe the SPY and QQQ are moving deeper into overbought territory and may need a pause or pullback, while the IWM is consolidating. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.