Last week’s review of the macro market indicators noted with 1 month left in the year equities had given up most or all of their gains for the year, but were looking to start December moving higher. Perhaps a Santa Claus rally could repair some of the damage. Elsewhere looked for Gold (GLD (NYSE:GLD)) to consolidate in the short term while Crude Oil (USO (NYSE:USO)) paused in its downtrend. The US Dollar Index (DXY) was resuming the path higher while US Treasuries (TLT) bounced in their downtrend.

The Shanghai Composite (ASHR) was resuming its path lower while Emerging Markets (EEM) paused in their downtrend. Volatility (VXX) looked to remain elevated but stable, putting light pressure on equities. The equity index ETF’s SPY, IWM and QQQ, all showed great strength on the week and looked to continue that into December. On the longer scale the QQQ had the most work to do to reverse the downtrend, while the IWM and SPY (NYSE:SPY) had stopped the bleeding for now.

The week played out with Gold climbing to nearly 6 month highs while Crude Oil chopped around in a 4 range near the recent lows. The US Dollar held in a tight range drifting slightly lower while Treasuries continued their bounce higher. The Shanghai Composite popped early and then faded the rest of the week while Emerging Markets made a higher high before pulling back.

Volatility fell back Monday but rose all week, ending at a 5 week closing high, and adding downward pressure to the equity markets. The Equity Index ETF’s started the week moving higher but by Tuesday lost there momentum and dropped continuing to lows Thursday before bouncing. they could not hold though and closed at or below those Thursday lows to end the week. What does this mean for the coming week? Lets look at some charts.

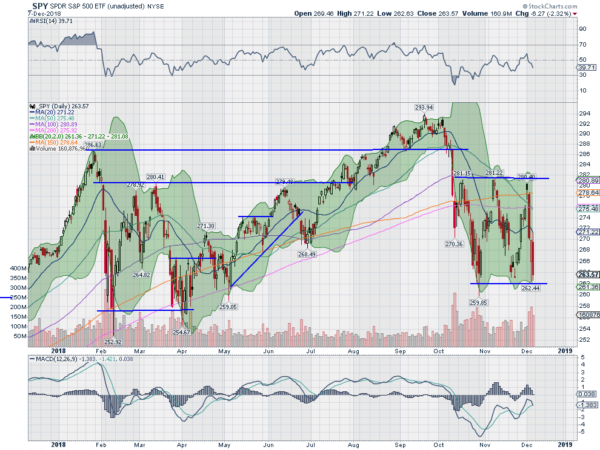

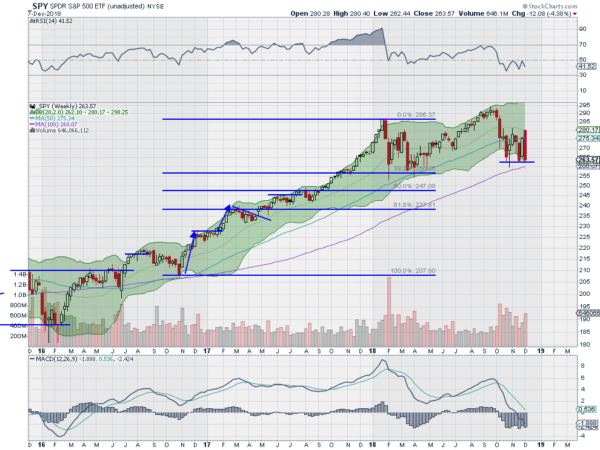

The SPY was rising off of a retest of the October lows when the week started. It gapped higher Monday to near the 100 day SMA, where it has stalled twice since the October drop. And it stalled there again. Tuesday it closed the gap and then kept moving lower through the 20 day SMA. A gap down Thursday was closed although it gave back that entire move Friday for a third touch at the October low and closed there.

It was an incredibly ugly week after so much promise the prior week. The daily chart shows the RSI pulling back from a touch at 60, failing again to move into bullish territory. While the MACD made a higher high, but stayed negative, and closed the week trying to cross down.

On the weekly timeframe there is now 2 month support with the near bearish Marubozu candle touching it, and the 200 week SMA approaching. The RSI on this timeframe failed and reversed at the mid line with the MACD continuing lower. There is support lower at 263 and 261 followed by 257.50. Resistance above comes at 265 and 269 then 271.40 and 272.50. Broad Consolidation Following Pullback.

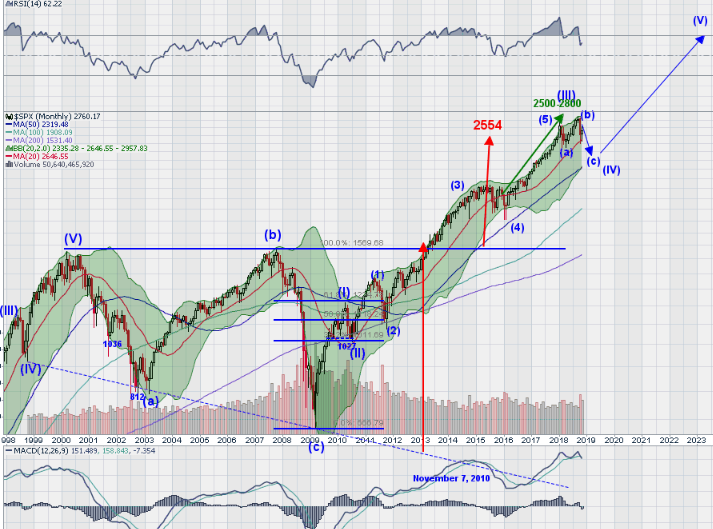

With only 2 full weeks left in the trading year equities cannot shake out of this pullback and some sectors look as they may be worsening. Elsewhere look for Gold to continue to move higher while Crude Oil is poised to bounce in its downtrend. The US Dollar Index continues to consolidate while US Treasuries move up in a short term trend. The Shanghai Composite continues to show signs of a possible consolidation inits pullback with Emerging Markets continuing their long term downtrend.

Volatility looks to remain above recent ranges and possibly poised to move higher, adding pressure to equity prices. The equity index ETF’s SPY, IWM and QQQ, responded by reversing their recent mini recoveries and turning lower. The IWM looks the worst as it is now resuming a downtrend while the QQQ is next in a short term downward channel, with the SPY holding in a consolidation range. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.