Last week’s review of the macro market indicators noted that heading into the holiday shortened last week of the year equity markets looked strong longer term and consolidative in the short term. Elsewhere looked for gold to continue lower while crude oil consolidated with an upward bias. The US dollar index was strong and looked to move higher while US Treasuries (NASDAQ:TLT) continued to be biased lower.

The Shanghai Composite and Emerging Markets (NYSE:EEM) were biased to the downside with the Chinese market looking more like a digestive move rather than the breakdown in Emerging Markets. Volatility (NYSE:VXX) looked to remain subdued and at very low levels keeping the bias higher for the equity index SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). Their charts all suggested further short term consolidation or even minor pullbacks may occur but within longer term strength.

The week played out with gold finding support and following the positive divergence in momentum higher while crude oil started the week with a push higher but then consolidated the rest of the week. The US dollar broke consolidation with small move lower Friday while Treasuries continue to build support as they bottom.

The Shanghai Composite consolidated sideways around 3100 while Emerging Markets found a bid and bounced back higher. Volatility moved up off of its low but still remains a young teenager. The Equity Index ETF’s continued their short term weakness, with the IWM breaking support and the SPY (NYSE:SPY) leaking lower while the QQQ clings to short term support. What does this mean for the coming week? Lets look at some charts.

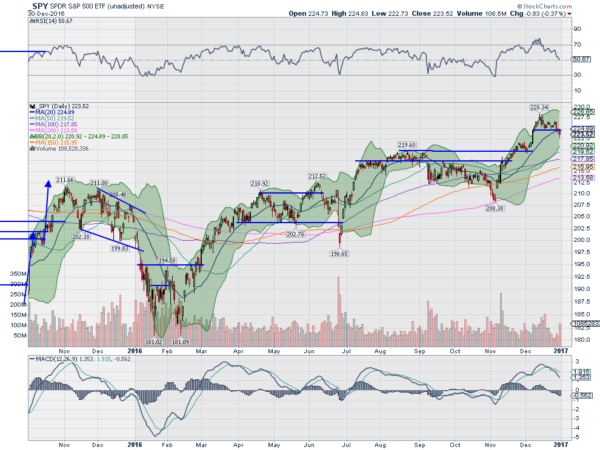

SPY Daily

The SPY opened Tuesday with a slight move higher off of support, but still within the consolidation range. Wednesday saw a push lower though to support and then a small body candle Thursday was followed by a drop Friday. The daily chart shows the RSI falling but at the mid line, still in the bullish zone. The MACD is also falling but positive. With a move through the 20 day SMA the downward retrenchment may not be over yet.

On the weekly chart the two inside weeks were followed by a break to the downside. The RSI is in the bullish zone but pulling back while the MACD is flattening. There is resistance at 224 and 225 followed by 226.50 and 228.34. There is support at 221.75 and 220. Pullback in the Uptrend.

SPY Weekly

With the calendar turning from 2016 to 2017 the equity markets are retrenching in their uptrends. Elsewhere, look for gold to continue its bounce in its downtrend while crude oil continues higher. The US dollar index looks to continue consolidation of the break out move while US Treasuries may have bottomed in their downtrend. The Shanghai Composite looks to continue to consolidate in the uptrend and Emerging Markets are consolidating the bounce in the downtrend.

Volatility looks to remain low but out of abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show short term pullbacks likely to continue within the long term uptrends. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.