A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

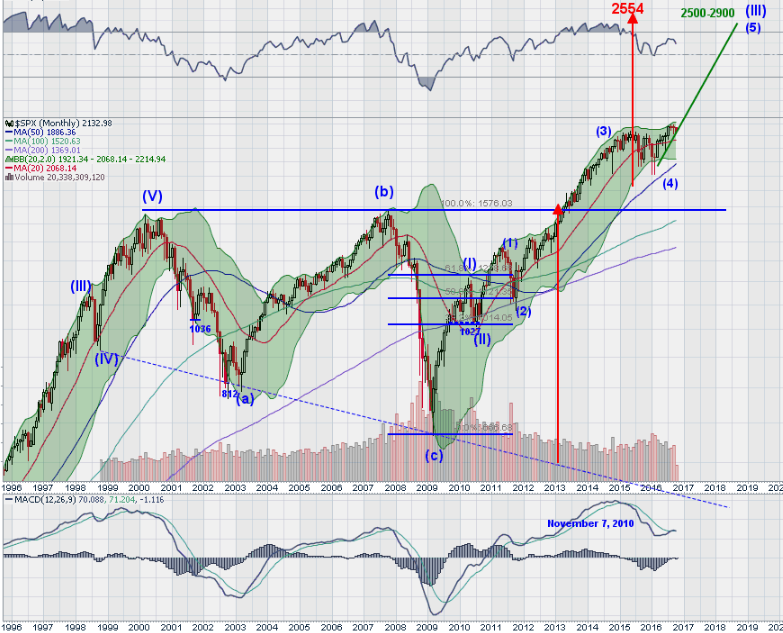

Last week’s review of the macro market indicators noted that stuffed with Turkey and shopped out from Black Friday, traders and investors saw the equity markets looked strong heading into December. Elsewhere looked for gold to continue lower while Crude Oil consolidated with a short term bias higher. The US Dollar Index continued to look strong while US Treasuries ($TLT) were biased lower but possibly finding support.

The Shanghai Composite continued to look strong and Emerging Markets continued to consolidate in their downtrend. Volatility (iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) looked to remain very low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). The SPY (NYSE:SPY) looked strong and ready for more while the IWM was getting overheated and garnered close attention for a possible short term pullback. The QQQ was sitting just under highs and could be the beneficiary of any short term rotation.

The week played out with Gold pushing to the downside while Crude Oil started lower in consolidation but jumped higher late in the week. The US Dollar consolidated over the break out level while Treasuries continued to hold at the beginning of the week but then dropped to new lows. The Shanghai Composite continued its drift higher while Emerging Markets marked time in a tight range.

Volatility crept up off of abnormally low levels to normal levels. The Equity Index ETF’s started the week strong but one by one they rolled over. The IWM went first and continued all week, with the SPY and QQQ joining the move lower by Wednesday. What does this mean for the coming week? Lets look at some charts.

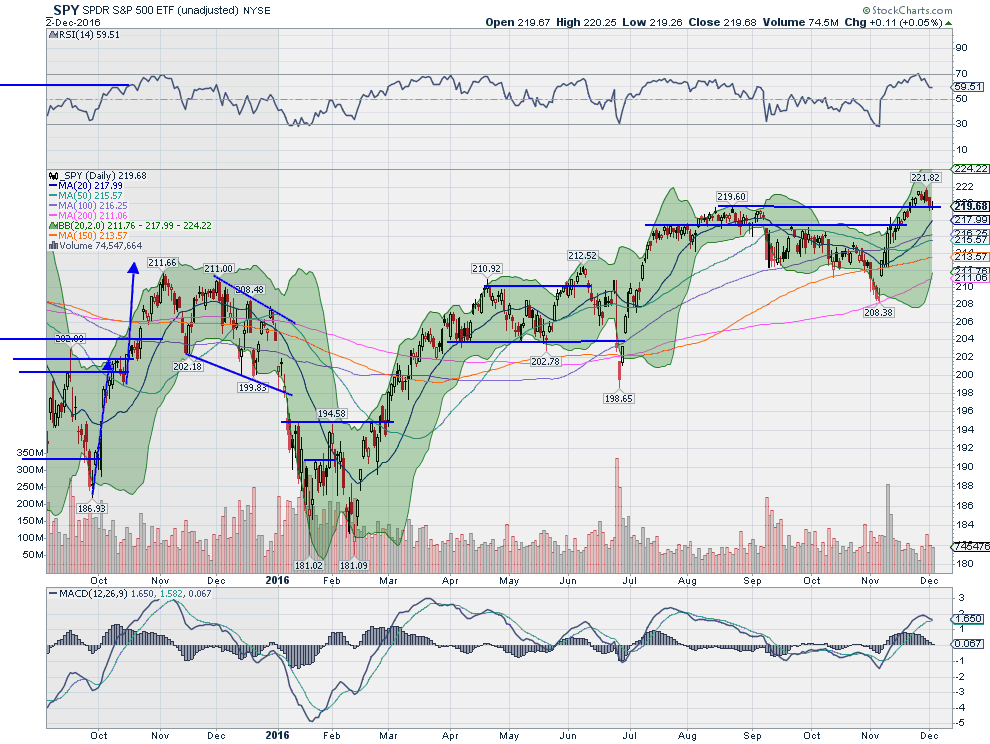

SPY Daily

The SPY came into the week at all-time highs after a gap up to end the week. Monday saw a drop to close the gap and a hold there Tuesday. Wednesday made a new intraday high near the start of the session before ending back at that same support, but the intraday falling price action had set the tone. Thursday continued lower and Friday found support at the tops from August. It ended the week with a doji slightly to the upside, in what was really a shallow pullback of less than 1%.

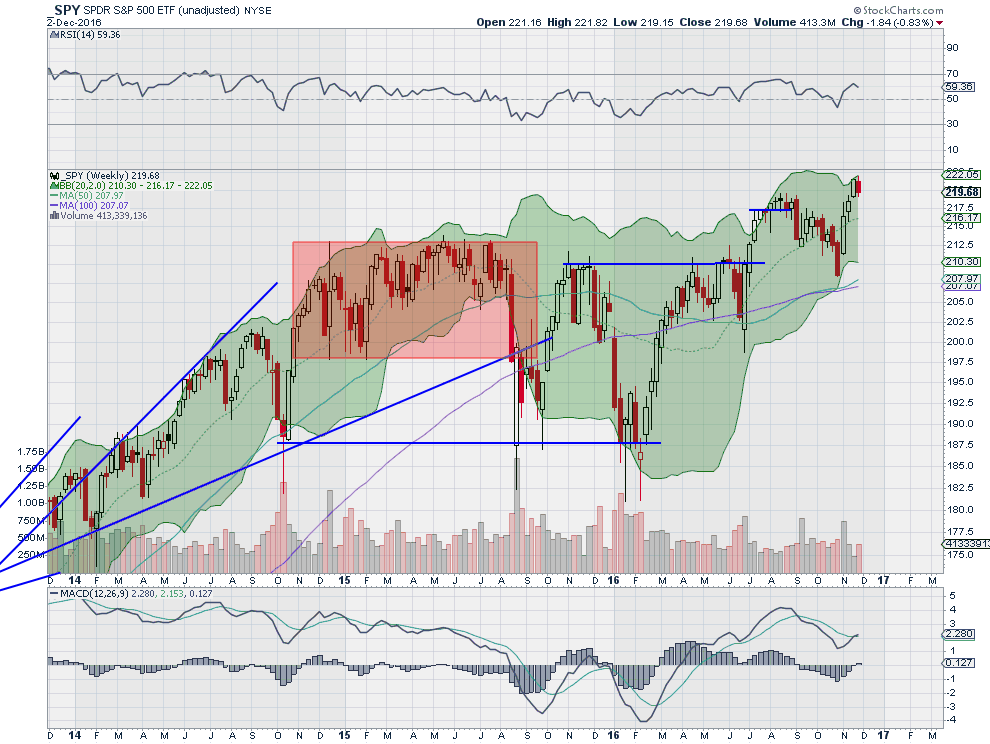

The daily chart shows that the RSI pulled back as a well, resetting from the touch at overbought levels, and started a reversal when it hit 60 Friday. The price and RSI are two bright spots. The MACD is pulling back though and about to cross down, a black mark on the short term record. On the longer weekly chart the SPY printed an inside week, suggesting maybe a reversal, but the Bollinger Bands® are opening higher and the MACD is crossed up and rising.

The RSI is the black mark on this chart as it is turning back lower as it touched 60. There is resistance above at 220.75 and 221.75, with a break over that seeing a Measured Move to 229 higher. Support lower comes at 219.50 and 218 followed by 217 and 215.70 before 213. Consolidation in the Uptrend.

SPY Weekly

Heading into the last month of the year the equity markets are retrenching from their post-election moves, with shallow pullbacks at this point. Elsewhere look for Gold to continue in its downtrend while Crude Oil moves higher. The US Dollar Index continues to mark time, moving sideways, while US Treasuries are biased to continue lower. The Shanghai Composite is on a trend higher that looks to continue while Emerging Markets consolidate at resistance with a bias to the downside.

Volatility looks to remain low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are mixed again, with the longer timeframe better for all 3, but the shorter timeframe showing weakness. All 3 ended the week with indecision candles though so the retrenchment may end soon. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.