Last week’s review of the macro market indicators suggested heading into the shortened Christmas week that the equity markets looked weak in the short term with the N:SPY weak in the intermediate term as well. Elsewhere watching gold (N:GLD) for a bounce in its downtrend while crude oil (N:USO) continued lower. The US dollar index (N:UUP) looked strong and ready for more upside while US Treasuries (N:TLT) were mired in broad consolidation.

The Shanghai Composite (N:ASHR) was biased higher in consolidation and Emerging Markets (N:EEM) were biased to the downside. Volatility (N:VXX) looked to remain elevated keeping the bias lower for the equity index ETFs SPY, N:IWM and O:QQQ. Their charts concurred on the daily feed after back-to-back strong down days, while the IWM and QQQ were nearing support in prior consolidation channels on the intermediate view. The SPY looked to be weaker, rolling lower on the longer view.

The week played out with gold pressing up to resistance while crude oil started lower but quickly found support and bounced. The US dollar moved slightly lower while Treasuries found overhead resistance and pulled back. The Shanghai Composite continued higher while Emerging Markets made a higher low, rising through the week. Volatility fell back to a more normal range, easing the headwinds to the market. The Equity Index ETFs all started the week with firming action then ran higher into the Christmas Eve close. What does this mean for the coming week? Lets look at some charts.

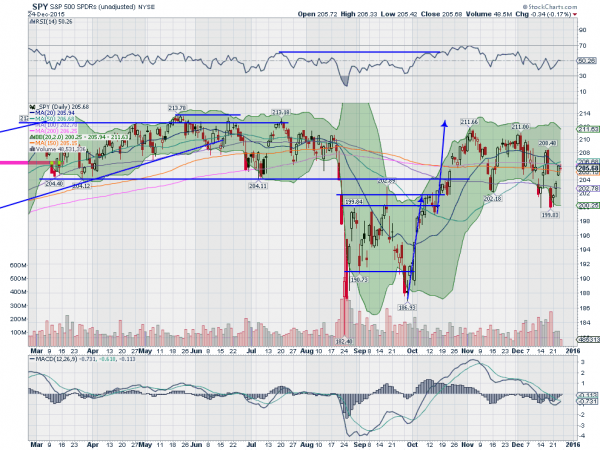

SPY Daily

The SPY came into the week looking horrible in the short term. A bearish Marubozu followed with a gap down and another near Marubozu left it outside of the Bollinger Bands®. That seemed the only hope for an oversold bounce. An inside day, or Harami, Monday in the form of a Hammer brought it back into the Bollinger Bands though and gave a possible reversal signal. That was confirmed higher Tuesday. The gap up Wednesday then continued closing at the high and followed by consolidation Thursday.

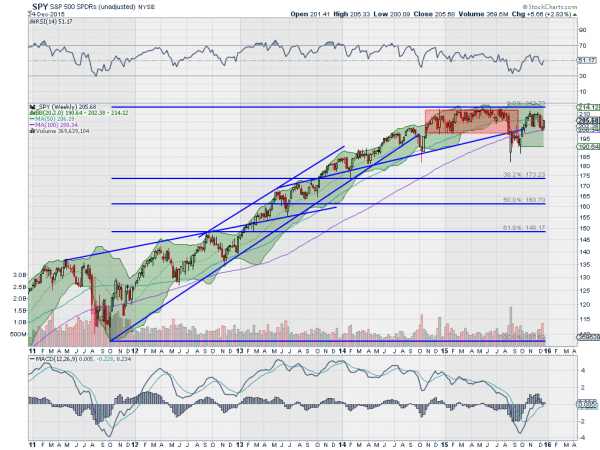

All this is happening among the 20, 50 and 200 day SMA’s. At this point it is still a series of lower highs and lower lows until a move over 208.48. The daily chart shows the RSI moving over the mid line, still low in the bullish zone, but with the MACD turning up and looking like a cross up is imminent. The weekly chart shows the increased volatility of the past few weeks in the loner candles and the 100 week SMA creeping into the picture for a touch.

The RSI is oscillating around the mid line while the MACD is leveling pulling back toward the signal line in its rise. There is resistance higher at 206.40 and 208.40 followed by 209 and 210.25 then 211. Support lower comes at 204.40 and 203 followed by 201.75 and 200. Short Term Upward Bias in the Intermediate Downward Move.

SPY Weekly

Into another holiday shortened week, and one that should prove to be very light on everything the equity markets have rebounded but are still looking vulnerable, especially the SPY. Elsewhere look for gold to consolidate in its downtrend while crude oil continues a bounce in its downtrend. The US dollar index looks to be weaker short term in consolidation while US Treasuries consolidate.

The Shanghai Composite looks to continue consolidation with an upward bias while Emerging Markets bounce in their consolidation of the downward move. Volatility looks to remain Subdued keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts agree with that in the short term with the IWM looking the strongest. In the intermediate term the SPY looks weakest, while the IWM and QQQ continue the sideways churn. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.