Last week’s review of the macro market indicators noted that with the FOMC and December Options Expiration in the rear view mirror, Equity Markets remained strong at all-time highs with some minor digestion. Elsewhere looked for gold shares (NYSE:GLD) to continue lower while US crude oil (NYSE:USO) was set to push higher out of consolidation. The US Dollar Index was poised for more upside while US treasuries (NASDAQ:TLT) continued to be biased lower.

The Shanghai Composite and Emerging Markets (NYSE:EEM) were pulling back to the downside but it looked to be a digestive move for the Chinese market. Volatility (NYSE:VXX) looked to remain subdued keeping the bias higher for the equity index SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ). All were in short term pullbacks, that looked digestive for the SPY and IWM, and perhaps the QQQ as well which had at this point failed in its break out attempt.

The week played out with gold limping lower but in a tight range while crude oil started higher but fell back to near even late in the week. The US dollar held its gains, moving sideways, while Treasuries also consolidated sideways at their lows. The Shanghai Composite traded in a tight range, little changed, while Emerging Markets continued their move lower.

Volatility fell to levels not seen in 16 months before a minor rebound, remaining very low. The Equity Index ETF’s all spent the week in very narrow ranges near their highs. The QQQ made a new all-time high, and then all drifted lower at the end of the week. What does this mean for the coming week? Lets look at some charts.

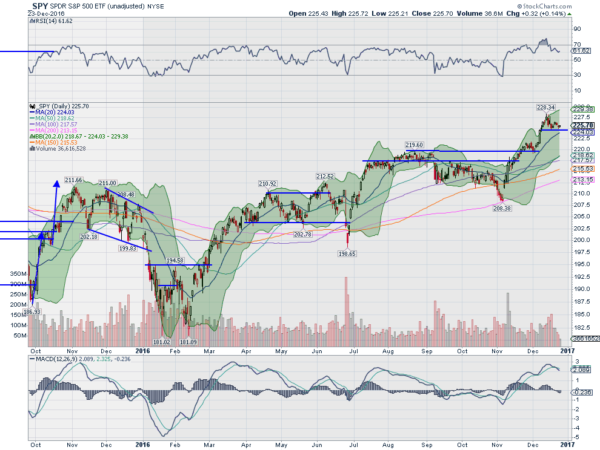

The SPY started the week with an inside, Harami candle, Monday. It moved higher Tuesday but could not hold up and fell back a bit Wednesday. Thursday retested the support level and Friday moved back up a bit. Sounds exciting huh? Actually the entire week stayed within a 2 point range, less than 1%. Very boring. The daily chart shows 225 holding as support the entire week though and a finish within 0.5% of the all-time high.

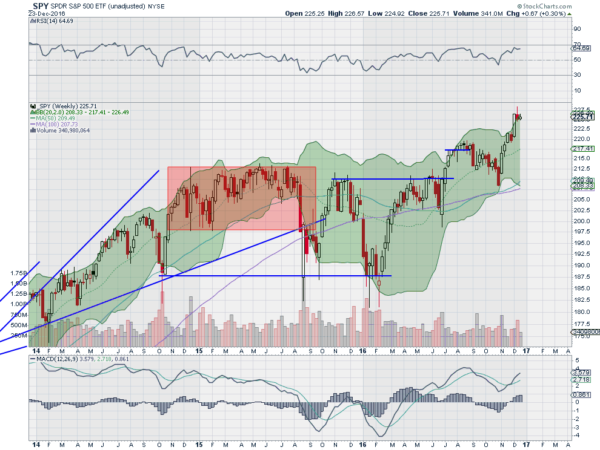

It also remains over the 20 day SMA, a positive. The RSI on the daily chart is pulling back in the bullish range but still very strong, while the MACD has crossed down. These suggest the consolidation could turn into a digestive pullback but do not give rise to any topping concerns at this point. The weekly chart shows a second small body candle inside the prior small candle, and now back within the Bollinger Bands®.

The RSI on this timeframe is also strong and in the bullish zone, moving sideways, while the MACD is rising. Things look a bit stronger on this timeframe. There is resistance at 226.50 and then the all-time intraday high at 228.34. Above that, a measured move gives a potential target to 234. Support lower comes at 225 and then 224 and 221.75 before 220. Consolidation in uptrend.

SPY Weekly

Heading into the holiday shortened last week of the year equity markets look strong longer term and consolidative in the short term. Elsewhere look for gold to continue lower while crude oil consolidates with an upward bias. The US dollar Index is strong and looks to move higher while US Treasuries continue to be biased lower. The Shanghai Composite and Emerging Markets are biased to the downside with the Chinese market looking more like a digestive move rather than the breakdown in Emerging Markets.

Volatility looks to remain subdued and at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all suggest further short term consolidation or even minor pullbacks may occur but within longer term strength. Use this information as you prepare for the coming week and trade 'em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.