Last week’s review of the macro market indicators noted that with only 2 full weeks left in the trading year, equities could not shake out of the pullback and some sectors looked as if they might be worsening. Elsewhere looked for Gold to continue to move higher while Crude Oil was poised to bounce in its downtrend. The U.S. Dollar Index continued to consolidate while U.S. Treasuries moved up in a short term trend.

The Shanghai Composite continued to show signs of a possible consolidation in its pullback while Emerging Markets (NYSE:EEM) continued their long term downtrend. Volatility (NYSE:VXX) looked to remain above recent ranges and possibly poised to move higher, adding pressure to equity prices. The equity index ETF’s SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ), responded by reversing their recent mini recoveries and turned lower. The IWM looked the worst as it was resuming a downtrend while the QQQ was next in a short term downward channel, with the SPY holding in a consolidation range.

The week played out with Gold finding resistance and falling back late in the week while Crude Oil consolidated in a narrow range. The U.S. Dollar continued to mark time moving sideways while Treasuries moved slightly higher before finding resistance and stalling. The Shanghai Composite found its footing and reversed higher to resistance while Emerging Markets held in a tight range at recent lows.

Volatility settled slightly all week with a small bounce Friday, easing some pressure on equities. The Equity Index ETF’s reacted positively early in the week, rising out of an early hole Monday, but lost their strength by mid-week and fell back. The QQQ managing to gain a small bit of ground while the SPY and IWM finished the week lower. What does this mean for the coming week?

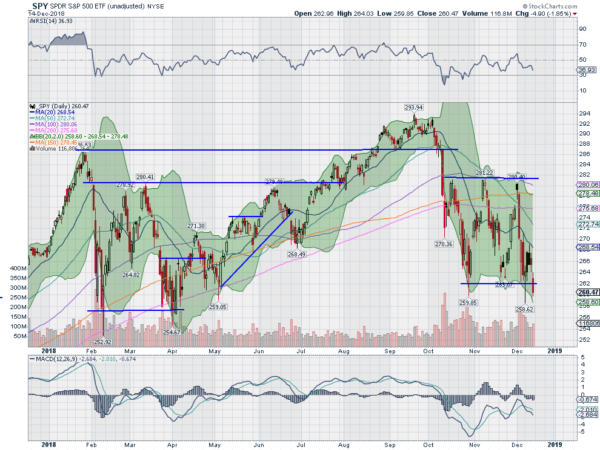

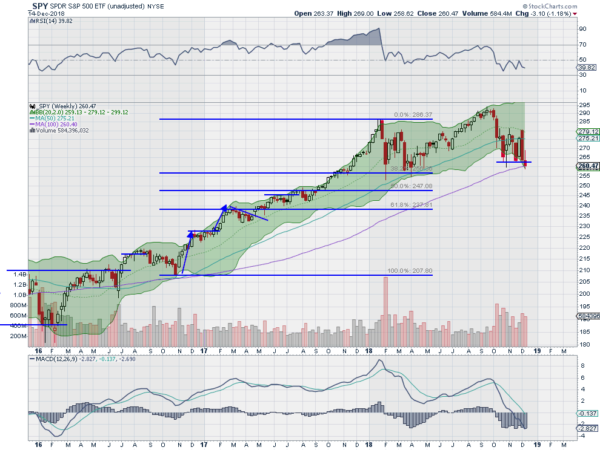

The SPY came into the week at a channel low for the third time. It dipped down Monday but recovered to form a Hammer reversal candle. That was confirmed Tuesday, barely, and then followed up Wednesday. But both days shed a lot of gains on the way. Thursday it gave back a bit and Friday drove lower in the afternoon for the lowest close since April.

The daily chart shows a push below the 2-month range with the Bollinger Bands® opening lower. The SPY is also now nearly as far below the 200-day SMA as it was above it at the end of September. The RSI is falling in the bearish zone with the MACD pushing lower. It looks like a retest of the February and April lows is in order.

On the weekly chart the break of support is clear. The SPY is now at the 200-week SMA. It has a RSI bearish and falling with the MACD negative and moving lower. There is support lower at 257.50 and 255 then 254 and 250.50 followed by 249 and 248 then 246 and 243.50. Resistance above is found at 261 and 263 then 265 and 269 before 271.40. Downtrend Resumes.

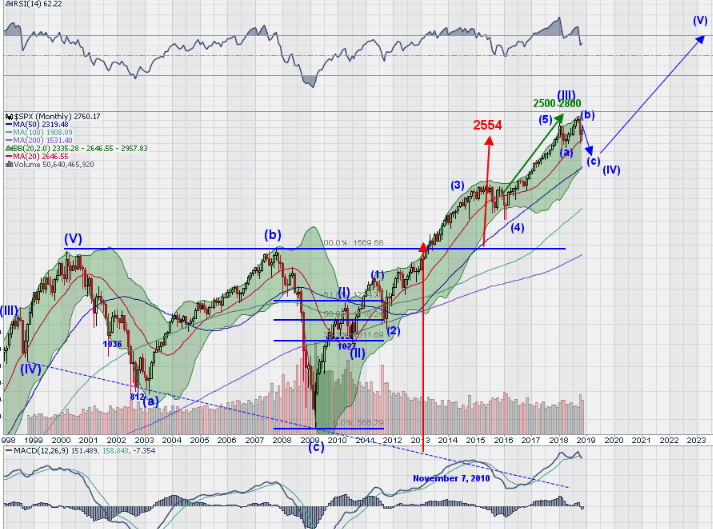

Heading into December Options Expiration and the last full trading week of the year equity markets continue to look weak, and getting weaker. Elsewhere, look for Gold to pause in its uptrend while Crude Oil consolidates in its downtrend. The U.S. Dollar Index looks to pause in its uptrend while U.S. Treasuries consolidate in their short term rise. The Shanghai Composite continues in broad consolidation in its downtrend and Emerging Markets are pausing in their move lower.

Volatility looks to remain elevated, keeping in the new higher range. This continues to keep the bias lower for the equity index ETF’s SPY, IWM and QQQ. Their charts show the pressure with the IWM leading markets lower, the SPY breaking a range to join it and the QQQ dropping to the bottom of recent trading, hanging on by a fingernail. Use this information as you prepare for the coming week and trade them well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.