Last week’s review of the macro market indicators noted with Thanksgiving behind, the holiday shopping season is in full swing but the price action in the equity markets was casting a dark shadow over the festivities. Elsewhere looked for Gold ($GLD) to continue in its uptrend while Crude Oil ($USO) continued to move lower. The US Dollar Index ($DXY) was resuming its move higher while US Treasuries ($TLT) were reversing to the upside.

The Shanghai Composite ($ASHR) might also be reversing higher while Emerging Markets ($EEM) continued to pause in their downtrend. Volatility ($VXX) remained elevated and had an upward bias which was keeping the bias lower for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts all looked weak on the shorter timeframe, with the QQQ the worst under the October lows and nearing the February lows. The IWM was nearing 12 month support while the SPY (NYSE:SPY) sat at the October low.

The week played out with Gold dipping mid week and recovering, but then drifting lower while Crude Oil is making a base after its long drop. The US Dollar held in a tight range while Treasuries gave up some ground Monday but then held the rest of the week. The Shanghai Composite built an expanding base, for a possible reversal while Emerging Markets held in the top of the consolidation range.

Volatility pulled back slightly but remained in the high teens, keeping light pressure on equities. The Equity Index ETF’s saw measured improvement on the week but remain below important levels. All are below their 200 day SMA’s and short of making higher highs. The SPY is in the best shape, kissing the 200 day SMA in sideways consolidation while the IWM is well below but also in a range. The QQQ is still running in a downtrend. What does this mean for the coming week? Lets look at some charts.

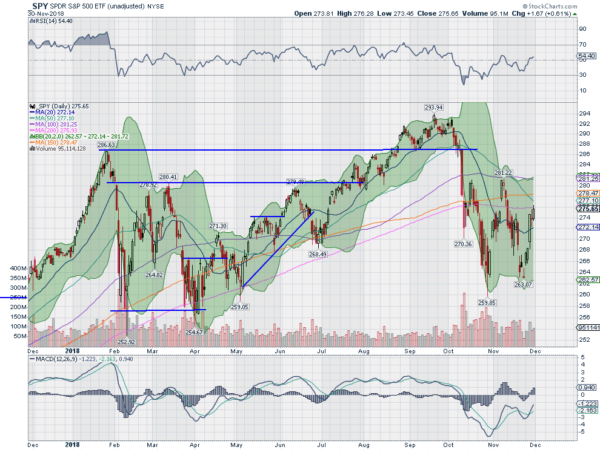

The SPY was retesting the October lows and looking weak as the week began. Monday saw the Inverted Hammer from Friday confirmed as a reversal though as it gapped higher. It followed through Tuesday and closed the last gap down. Then rocketed higher Wednesday following the Powell speech. Thursday it took a breather and started to look like the prior November high when it printed a doji. But Friday continued higher.

It closed the week with a touch at the 200 day SMA but just under it. The daily chart shows the RSI peeking over the mid line with the MACD moving higher toward positive. Both support more upside but neither is in the bull range yet. A very productive week on this scale, but it needs to move over the 100 day SMA and October and November bounce highs to sound the all clear signal.

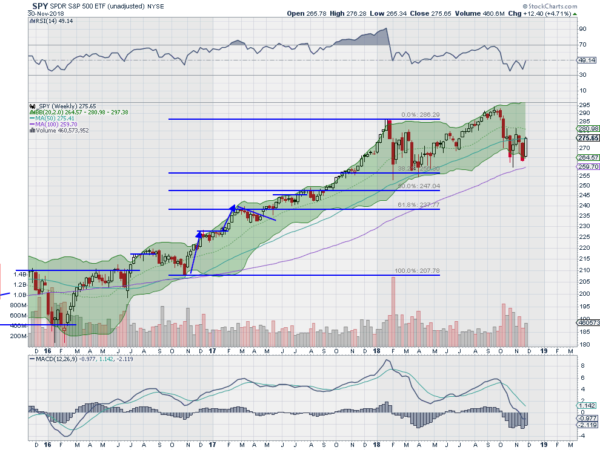

The weekly chart looks a lot more like a consolidation range after the pullback. Volume tailing off is a good sign of potential exhaustion of the down move. The RSI is pushing at the mid line with the MACD starting to level. There is resistance at 277.50 and 279 then 280 and 281 before 284 and 286. Support lower comes at 274.50 and 272.50 then 271.40 and 269 before 265. Broad Consolidation after Downtrend.

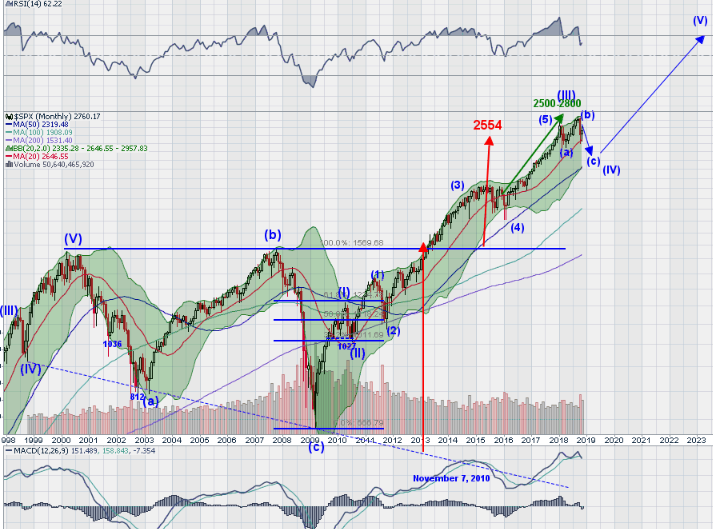

With 1 month left in the year equities have given up most or all of their gains for the year, but are looking to start December moving higher. Perhaps a Santa Claus rally can repair some of the damage. Elsewhere look for Gold to consolidate in the short term while Crude Oil pauses in its downtrend. The US Dollar Index is resuming the path higher while US Treasuries bounce in their downtrend. The Shanghai Composite is resuming its path lower while Emerging Markets pause in their downtrend.

Volatility looks to remain elevated but stable, putting light pressure on equities. The equity index ETF’s SPY, IWM and QQQ, all showed great strength on the week and look to continue that into December. On the longer scale the QQQ has the most work to do to reverse the downtrend, while the IWM and SPY have stopped the bleeding for now. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.