Last week’s review of the macro market indicators noted as the last full week of July ended and the markets looked to face the dog days of August, equity markets had been knocked back by an unexpected jab punch, shocked but not really damaged. Elsewhere looked for Gold to continue in its uptrend while crude oil also moved higher. The US Dollar Index continued to look weak and headed lower while US Treasuries consolidated with a short term bias higher.

The Shanghai Composite looks to continue to drift higher while Emerging Markets continue their uptrend. Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY), IWM and QQQ. Their charts suggested a pause or small pullback might be in order before they continued higher, with the SPY the strongest and the IWM and QQQ a bit weaker short term

The week played out with gold (NYSE:GLD) finding resistance and stalling while crude oil (USO) also met sellers and stalled. The US dollar (DXY) continued lower until bouncing late in the week while (TLT) moved higher but not not muster a higher high. The Shanghai Composite reached higher to the resistance area at 3300 while Emerging Markets (EEM) held firm over support.

Volatility held tight to the 10 level, keeping the bias higher for equities. The Equity Index ETF’s held in tight ranges on the week, with the SPY and QQQ consolidating over support and the IWM pulling back from the top of the broad rising range. What does this mean for the coming week? Lets look at some charts.

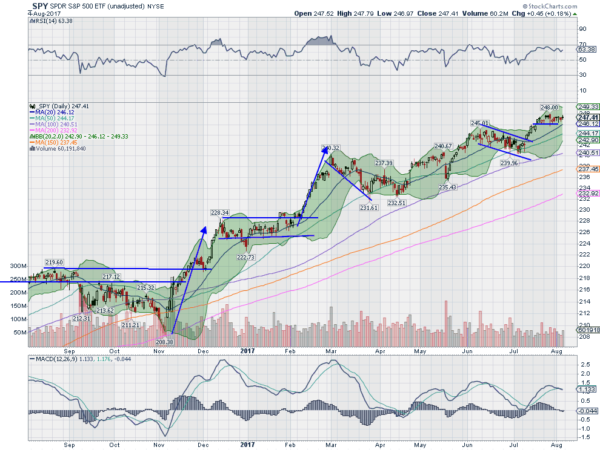

SPY Daily

The SPY had a most uneventful week. A great week for a vacation from the screens. It traded in a less than 60bp range the entire week at the highs, continuing the small range from the prior week. The daily chart shows the price holding over support and under 248. The RSI is holding strong in the bullish zone while the MACD is crossing down.

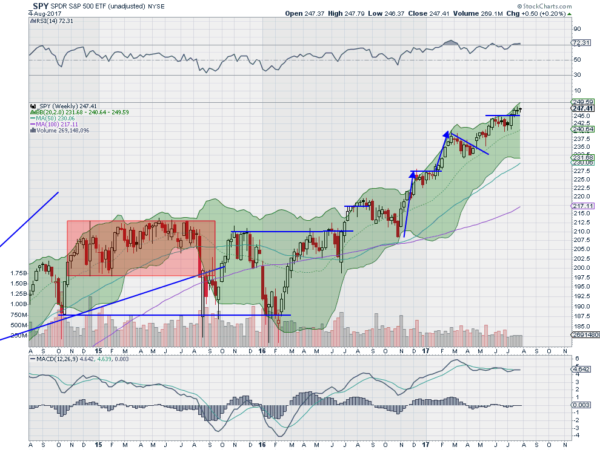

On the weekly chart the second doji candle after a break to new highs signals more consolidation. The RSI is strong and bullish while the MACD is flat and bullish. There is resistance at 248 and a Measured Move to 253 above. Support lower comes at 246 and 245 followed by 242 and 240 then 238. Consolidation in the Uptrend.

SPY Weekly

Heading into the first full week of August the equity markets are settling and marking time near their highs. Elsewhere gold looks to pause or pullback while crude oil pauses with a bias higher. The US Dollar Index is slowing in its descent while US Treasuries are broadly consolidating.

The Shanghai Composite looks to continue in its uptrend while Emerging Markets pause in their uptrend. Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show consolidation in the SPY and QQQ with a pullback in the the rising channel for the IWM. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.