Last week’s review of the macro market indicators suggested heading into the last full week of August, the Equity markets looked horrible, ready for more downside. Elsewhere looked for gold (NYSE:GLD) to continue in its uptrend, while crude oil (NYSE:USO) continued lower. The US dollar index (NYSE:UUP) was consolidating sideways with a downward bias, while US Treasuries (NYSE:TLT) were biased higher. The Shanghai Composite (NYSE:ASHR) and Emerging Markets (NYSE:EEM) were biased to the downside with risk of the Chinese market running sideways in consolidation.

Volatility (NYSE:VXX) looked to remain elevated above the prior stable period, but I noted it usually does not hold these levels long. This would keep the bias lower for the equity index ETF’s NYSE:SPY, NYSE:IWM and NASDAQ:QQQ, in the short run. Their charts suggested the downside move was not over either, but all were very oversold and could see short term bounces early in the week.

The week played out with gold starting higher before meeting resistance and falling back, while crude oil started lower but rebounded sharply late in the week. The US dollar moved lower early and reversed, while Treasuries found trouble after a gap up open Monday and fell the rest of the week. The Shanghai Composite started to the downside and bounced to end the week, while Emerging Markets finally met some support and started back higher.

Volatility spiked over 50 before settling back but still in an elevated state. The Equity Index ETFs started the week with a huge gap down in response, before bouncing Tuesday and the retracing the move the rest of the week to close flat to higher on the week. What does this mean for the coming week? Lets look at some charts.

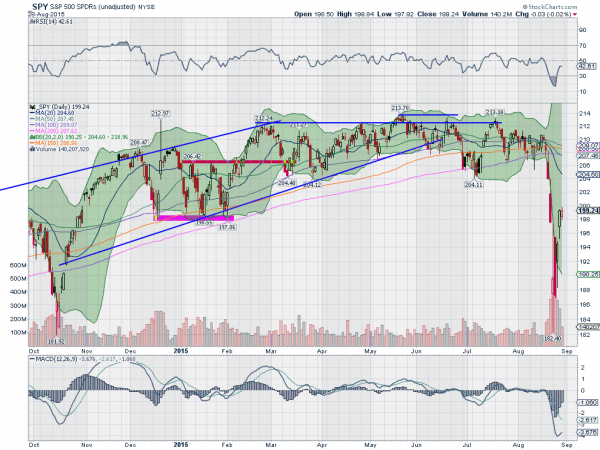

SPY Daily

The SPY started the week gapping lower and then selling off hard. The dip was quickly bought though and moved to the upside, nearly filling the gap before a reversal to close near the open. An 8% range and better than 4% lower close from Friday. And that was just one day! Tuesday saw a strong bounce at the open fade completely to a lower close, with Wednesday opening higher again but holding up this time.

The 3 days were each inside the range of the prior day, Harami, and reversal signals if confirmed higher. And it did confirm higher Thursday, with Friday holding at the top of the range, making for a positive week. It sure did not feel positive for most though. The daily chart shows the RSI dipping into the teens, very oversold, before bouncing, and the MACD sell off hard but reverse to end the week on an upswing. Both remain bearish but improving to close the week.

The weekly picture shows a large gap down followed by bullish intra-week price action in a long white candle to close the gap on very big volume. It ended below the rising trend line that had been support though. Will it become resistance? The RSI is trending lower on this timeframe, and the MACD is falling hard, which would support more downside. But should the strength follow through, there is potential for a Positive RSI Reversal measured against the October 2014 low. This would target a move to new highs at 214.26. Follow through would also reconfirm the uptrend is intact with a higher low.

There is resistance above at 199.5 and 200 followed by 201.60 and 202.40 before 204.40 and 206.4. Support lower may come at 198 and 197 followed by 195 and 194 before 191.70 and 188. Short Term Bounce Continues Watching for Reversal if no Follow Through.

SPY Weekly

Heading into the unofficial last week of summer, the equity markets have dodged a bullet, but still need to prove they have the strength to continue and not get pulled lower. Elsewhere look for gold to continue to bounce in its downtrend, while crude oil continues higher. The US dollar index is biased to the upside in consolidation, while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets both look to continue their bounce in the downtrends, and may turn into reversals.

Volatility looks to remain elevated, keeping the bias lower for the equity index ETFs SPY, IWM and QQQ, despite their rebounds higher. Their charts all show signs of both promise to the upside but further risk or another turn lower. Best to keep all long trades on a tight leash. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.