Last week’s review of the macro market indicators saw as August options expiration came to a close, the equity index ETF’s had a wild week finishing slightly lower in consolidation. Elsewhere looked for Gold ($GLD) to continue in its uptrend while Crude Oil ($USO) consolidated in its downtrend. The US Dollar Index ($DXY) seemed content to continue the slow drift higher while US Treasuries ($TLT) were possibly starting to pullback.

The Shanghai Composite ($ASHR) and Emerging Markets ($EEM) looked to continue to the downside. Volatility ($VXXB) looked to remain elevated keeping the bias lower for the equity index ETF’s $SPY, $IWM and $QQQ. They were all showing consolidation in the short run charts, happening at higher lows for the SPY (NYSE:SPY) and QQQ. The IWM remained in a broad consolidation. On the longer charts the back to back indecision candles got many anxious.

It was a pretty calm summer week until Friday morning when all hell broke loose. And it was not the Fed Chairman’ speech in Jackson Hole that caused it, but rather ramped up talk about tariffs. Gold jumped Friday after a flat week while Crude Oil quickened what was already a move building lower. The US Dollar was holding at highs but dropped sharply while Treasuries had given up some gains all week but recovered them in less than 90 minutes.

The Shanghai Composite moved up out of a short consolidation while Emerging Markets gave up the progress it had made over the prior 6 days. Volatility which had drifted lower all week shot up to 20 again, putting pressure on equities. The Equity Index ETF’s all had gapped up Monday and were moving in narrow ranges through Thursday. The saber rattling resulted in all pulling bad fast, closing the gap and more. What does this mean for the coming week? Let’s look at some charts.

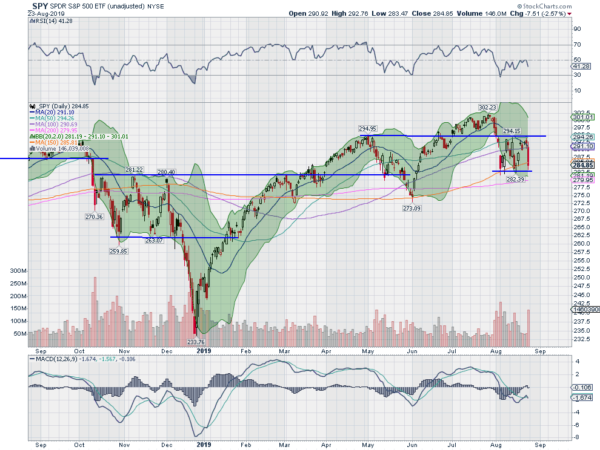

SPY (NYSE:SPY) Daily, $SPY

The SPY (NYSE:SPY) had just confirmed a Hammer reversal as the week started. It gapped up Monday, but could not get beyond the August bounce highs. It held there through Thursday, moving in a small range. Friday It opened toward the bottom of that range and then started higher as Fed Chairman Powell spoke.

But strong comments on trade from the President triggered a sell off that continued all day until the close. It ended the week back at the consolidation lows. This is also the top of the range of consolidation from last fall acting as support. The daily chart shows the RSI back to 40 in the bearish zone with the MACD crossing down and negative.

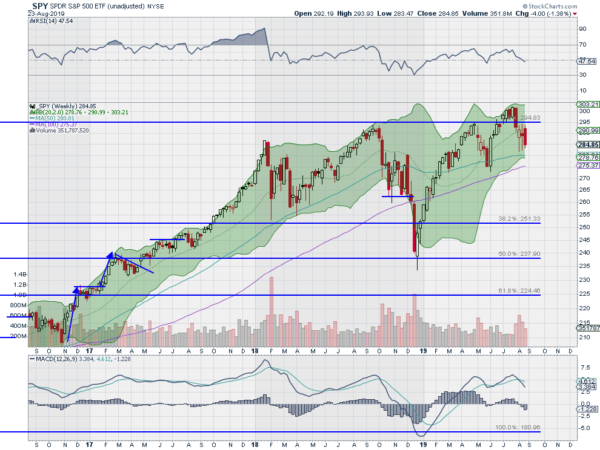

The weekly chart shows a bearish engulfing candle, but inside the prior candle range and at a higher low. The RSI on this timeframe is back at the May low with the MACD crossed down and falling but positive. There is support lower at 284 then 282 and 279 then 276 and 273. Resistance above sits at 285 then 287 and 290 followed by 292. Consolidation in Pullback.

SPY (NYSE:SPY) Weekly, $SPY

Heading into the last week of August the equity markets have taken another body blow and are back at support. Elsewhere look for Gold to continue in its uptrend while Crude Oil continues to move lower. The US Dollar Index looks to continue to drift higher while US Treasuries are pausing in their uptrend. The Shanghai Composite is giving a short term reversal higher while Emerging Markets continue to the downside.

Volatility continues to creep up keeping the bias lower for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts also show the SPY and QQQ continuing to move in tandem with the IWM weaker and lower. This has persisted since the December low. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.