Last week’s review of the macro market indicators noted heading into August Options Expiration week, the equity markets continued to look strong on the longer timeframe, but might need a rest in the short run. Elsewhere looked for Gold (GLD (NYSE:GLD)) to possibly pause in its downtrend while Crude Oil (USO (NYSE:USO)) bounced at support after a pullback on the uptrend. The US Dollar Index (DXY) was breaking out to the upside and looked strong while US Treasuries (TLT) were bouncing in consolidation.

The Shanghai Composite (ASHR) might be ready to pause in its downtrend while Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) continued lower. Volatility (VXX) looked to remain low but creeping up into the teens removing the aid it had been giving to equities. The equity index ETF’s SPY, IWM and Invesco QQQ Trust Series 1 (NASDAQ:QQQ), all looked strong on the weekly timeframe. But on the shorter charts the SPY (NYSE:SPY) might continue the short term pullback along with the QQQ while the iShares Russell 2000 (NYSE:IWM) consolidates at the highs.

The week played out with Gold decidedly continuing lower under 1200 per ounce while Crude Oil could not hold its bounce and fell back. The US Dollar met resistance mid week and saw some profit taking while Treasuries pushed slightly higher in broad consolidation. The Shanghai Composite renewed its downtrend to finish at 30 month lows while Emerging Markets made new 52 week lows.

Volatility poked higher early in the week but then recoiled to end near unchanged, keeping the bias higher for equities. The Equity Index ETF’s reacted in mixed fashion again, with the SPY and IWM basically treading water all week until drifting up Friday while the QQQ moved slightly lower. What does this mean for the coming week? Lets look at some charts.

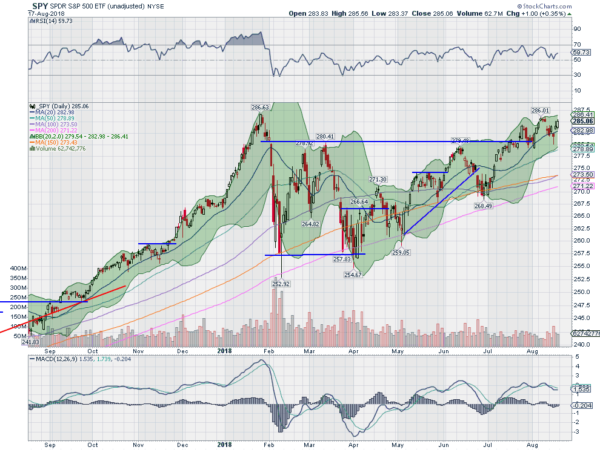

SPY Daily, SPY

The SPY had gapped down to end the prior week, giving back a short term break out and finding support at the 20 day SMA. It dipped and closed under the 20 day SMA Monday and recovered Tuesday before a dip lower Wednesday that ended under the 20 day SMA. These two closes under the 20 day SMA were the first since the beginning of July. It jumped back over the 20 day SMA Thursday and then finally closed that gap down Friday with a strong move higher.

This left it higher on the week but with a small open gap below. The daily chart shows the price moving back toward a retest at the highs with the RSI rising off of the mid line and bullish. There is also a small RSI Positive Reversal with a target to 287. The MACD is turning back toward a cross up and is positive. The Bollinger Bands® are also turned higher for a move up.

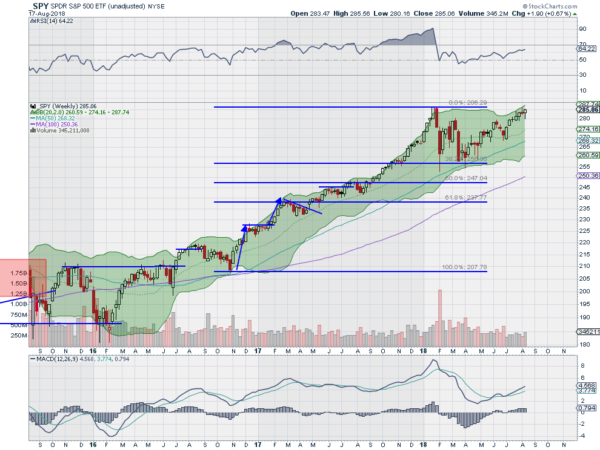

The weekly chart is much cleaner and shows a solid trend to the upside with 6 of the last 7 weeks closing higher, as it moves toward the target of 289. The Bollinger Bands on this timeframe have now shifted to the upside with the price riding the top higher. The RSI is rising and bullish with the MACD moving up and positive. There is resistance at 286. Support lower comes at 284 and 283 then 280 and 279 before 277.50. Uptrend.

SPY Weekly, SPY

With August options expiration over and back to school on its way the equity markets continue to look strong on the longer timeframes. Elsewhere look for Gold to continue lower while Crude Oil joins it heading to the downside. The US Dollar Index may pause in its uptrend while US Treasuries drift higher in broad consolidation. The Shanghai Composite and Emerging Markets are looking really weak as they print multi-year lows and continue lower.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are a bit mixed in the shorter timeframe with the QQQ pulling back, the IWM flat and the SPY running higher. But all three remain in solid uptrends on the longer basis. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.