Heading into August options expiration the equity markets took a blow to the head but shook it off to recover by the end of the week. Elsewhere look for Gold to continue in its uptrend while Crude Oil may be ready to pause in its pullback. The US Dollar Index continues the slow grind higher in a wide channel while US Treasuries may be ready to pause in their uptrend. The Shanghai Composite and Emerging Markets have resumed their path lower.

Volatility has picked up slightly making the path higher a bit tougher for the equity index ETF’s SPY, IWM and QQQ. Their charts show good recoveries from a shock in the short run, with continued strength in the SPY and QQQ in the long term chart, while the IWM consolidates in a range. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Last week’s review of the macro market indicators saw heading into the dog days of August equity markets had been dinged despite an accommodative FOMC. Elsewhere looked for Gold ($GLD) to move higher while Crude Oil ($USO) continued to head lower. The US Dollar Index ($DXY) also looked to strengthen while US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) were biased to continue higher.

The Shanghai Composite ($ASHR) looked to continue lower in the short term while Emerging Markets ($EEM) resumed a downtrend. Volatility ($VXXB) looked to move higher putting a bias lower for the equity index ETF’s $SPY, $IWM and $QQQ. Their charts also pointed to some short term weakness, especially in the SPY (NYSE:SPY) and Invesco QQQ Trust (NASDAQ:QQQ). Long term the SPY and QQQ still remained strong with the IWM stuck in a range.

The week played out with Gold breaking over 1500 before settling while Crude Oil bottomed mid-week and bounced. The US Dollar fell hard early in the week and then held while Treasuries pushed higher. The Shanghai Composite took another leg lower while Emerging Markets gapped lower and a late week bounce could not close the gap.

Volatility moved sharply higher Monday, increasing the downside bias for equities, but then retreated back to the teens. The Equity Index ETF’s reacted with gap down moves Monday and then retraced to close the gaps by Thursday, before giving up some ground Friday. Not much changes with the SPY and QQQ remaining near all-time highs and the IWM stuck in a range. What does this mean for the coming week? Let’s look at some charts.

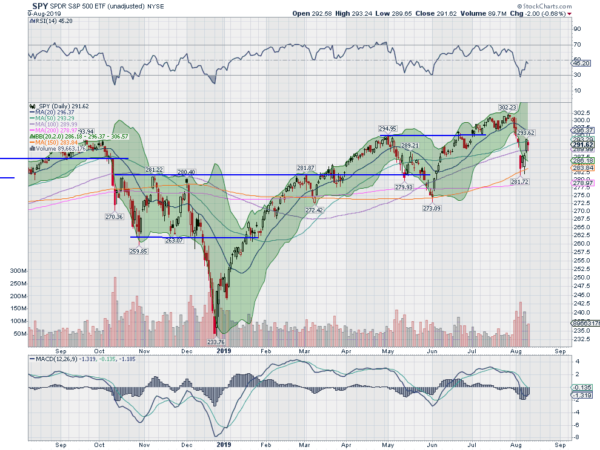

SPY Daily, $SPY

The SPY came into the week at support on the 50 day SMA after a pullback from a new all-time high. Monday saw it gap down though and run lower throughout the day. It held there Tuesday and Wednesday and then started back higher on Thursday. It closed the gap but stalled at the 50 day SMA and held there Friday.

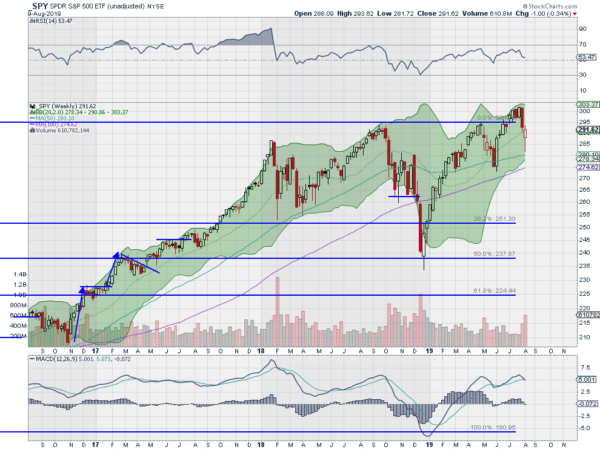

In all it was little changed on the week. The daily chart shows the RSI hit oversold when it reversed and it ended the week just shy of the mid line. The MACD went negative and then quickly flattened. A recovery building and more next week would be welcomed. The weekly chart shows a long Hammer candle, a possible reversal if confirmed next week.

If so this would be at a higher low and give a target to 314. The RSI is leveling above the mid line in the bullish zone with the MACD trying to avoid a cross down and positive. There is resistance above at 292 then 294 and 295 then 296.75 and 298.80 before 300 and 301 then 302. Support lower comes at 290 then 287 and 285 before 284 and 282. Possible Resumption of Uptrend.

SPY Weekly, $SPY