Last week’s review of the macro market indicators suggested, heading into the last week of July, that the equity markets were a bit weaker, but mixed with the tech names, the strongest.

Elsewhere looked for gold (ARCA:GLD) to continue lower along with crude oil (NYSE:USO). The US dollar index (NYSE:UUP) might move sideways or continue higher, while US Treasuries (ARCA:TLT) were biased to the upside. The Shanghai Composite (NYSE:ASHR) was looking stronger and had almost dispelled all possibility of a Dead Cat Bounce, while Emerging Markets (ARCA:EEM) were confirming the resumption of the move lower.

Volatility (ARCA:VXX) looked to remain subdued, keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts were a bit mixed, with all better on the longer timeframe. The QQQ was the leader on the weekly timeframe, with the IWM next and then the SPY. On the shorter timeframe, the QQQ’s were also looking the strongest, with the SPY and IWM worse, but all biased lower short term.

The week played out with gold holding in a tight range under 1100, while crude oil tried to bounce but could not hold it and fell back late in the week. The US dollar started lower but recovered by week’s end, while Treasuries moved higher ending at the resistance since May. The Shanghai Composite took another stab lower, but held above the 200 day SMA, while Emerging Markets consolidated at the lows.

Volatility spiked on Monday, but fell back and ended at the lows of last week. The Equity Index ETF’s all found a bottom on the volatility spike Monday and rose through the week. All gave back a bit on Friday, but the IWM starting higher first and the SPY and QQQ from flat. What does this mean for the coming week? Lets look at some charts.

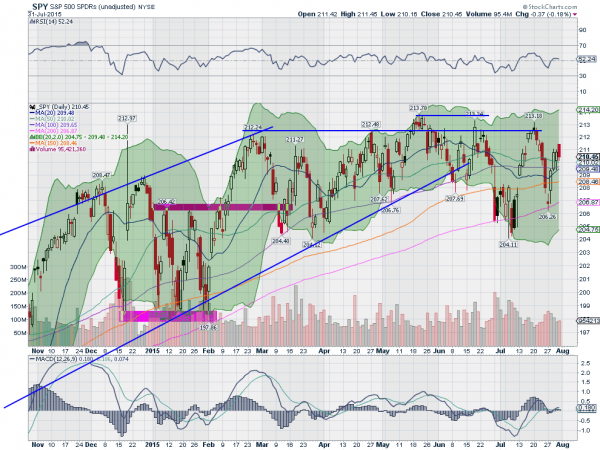

SPY Daily

The SPY continued lower to the 200 day SMA on the spike in volatility Monday. But it printed a Spinning Top Doji there, a signal of indecision, that was confirmed higher Tuesday. From there, it continued higher back over the SMA’s. Thursday showed a Tweezers Top and despite the higher open Friday, the lower close confirms it as a reversal.

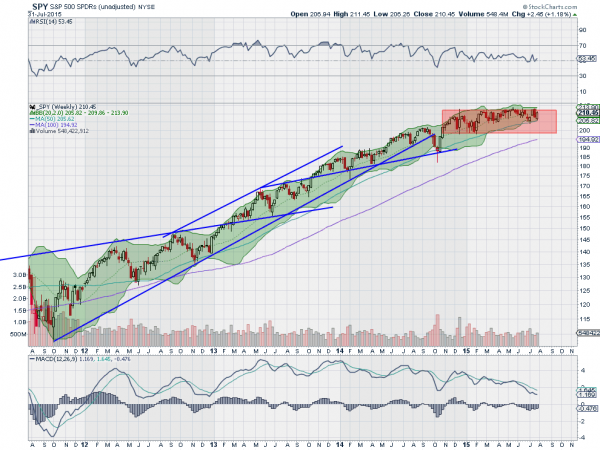

The trouble with Japanese Candlesticks, though, is they do not tell you how far it could fall, and even Friday’s move could be the end. The RSI held over the mid line Friday though and the MACD held the cross up. So far, on a small scale, there is a higher low and reversal up. The weekly chart shows this was really all just consolidation in the top of the 9 month box.

The price touched the lower Bollinger Band® and bounced higher. The RSI on this timeframe remains in the bullish zone and over the mid line while the MACD is falling. A divergence. The SPY has traded in a 10 point range for 2 trading days short of 6 months! There is resistance higher at 211 and 212.50 followed by 213.40. Support lower comes at 209 and 208 followed by 206.40 and 204.40. Continued Consolidation in the Long Term Uptrend.

SPY Weekly

Heading into the dog days of August, the Equity markets have weathered another storm, but are not showing strength to push higher yet. Elsewhere, look for gold to consolidate or continue lower, while crude oil moves to the downside. The US dollar index looks to move sideways with an upward bias, while US Treasuries are biased to continue higher. The Shanghai Composite and Emerging Markets both are biased to the downside, but trying to consolidate.

Volatility looks to remain subdued, keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts suggest that there is potential for some weakness in the current move short term though. On the longer timeframe, the QQQ looks strong and may be ready for new all time highs, while the SPY is on consolidation and the IWM a retrenching consolidation. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.