Last week’s review of the macro market indicators noted April options expiration was in the rearview mirror as the markets headed into the last full week of April trading. Here in Northeast Ohio the weather was mixed with sunshine but very cold temperatures and some snow, hardly spring time, and stocks looked the same way, confused, sometimes strong and then weak again.

Elsewhere looked for Gold ($GLD) to consolidate in a broad range while Crude Oil ($USO) continued to be the strongest market rising higher. The US Dollar Index ($DXY) churned along sideways while US Treasuries ($TLT) were now in a downtrend. The Shanghai Composite ($ASHR) had also turned downward while Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM) ) continued to mark time at the highs. Volatility (iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) was stuck in a more normal range and did not look to be changing that anytime soon. This left the equity index ETF’s SPY, iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) to blaze their own path. Their charts continued to frustrate in the short term, falling back from lower highs, but longer term continue to consolidate in broad ranges at the top.

The week played out with Gold running lower to the bottom of the range while Crude Oil bounced around early but ended the week little changed. The US Dollar broke out of its extended channel to the upside while Treasuries retested the February lows before a late week bounce. The Shanghai Composite found support at the prior low but remained under falling short term moving averages while Emerging Markets pulled back to a lower low and under their 200 day SMA for the first time since the end of 2016.

Volatility pushed higher early in the week, but held in the teens and fell back to end it lower. The Equity Index ETF’s all started the week in place after a narrow range, indecisive day, but then all fell hard Tuesday before spending the next two days recovering. Friday looked to be a great day for the QQQ with a big gap higher but that sold off bringing it back in line with the SPY (NYSE:SPY) and IWM, and they all closed the week little changed. What does this mean for the coming week? Lets look at some charts.

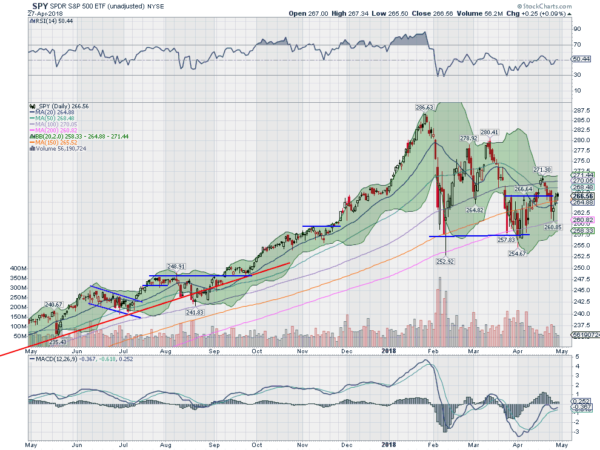

SPY Daily, $SPY

The SPY entered the week after a mixed week. It had made a higher high but then pulled back to close it nearly unchanged. Monday held at the Friday close and then Tuesday it dropped in a strong down day, ending below the 20 day SMA. Wednesday saw a push down nearly touch the 200 day SMA again and then print a Hammer candle, a possible reversal, and at a higher low.

It did confirm to the upside Thursday and held there after failing to move higher Friday. In the end it was a second week of going in circles to finish near where it started. The daily chart shows the RSI oscillating around the mid line with the MACD turning up and about to go positive. With all of the SMA’s and the Bollinger Bands® running flat there seems to be no real strength to move it either way.

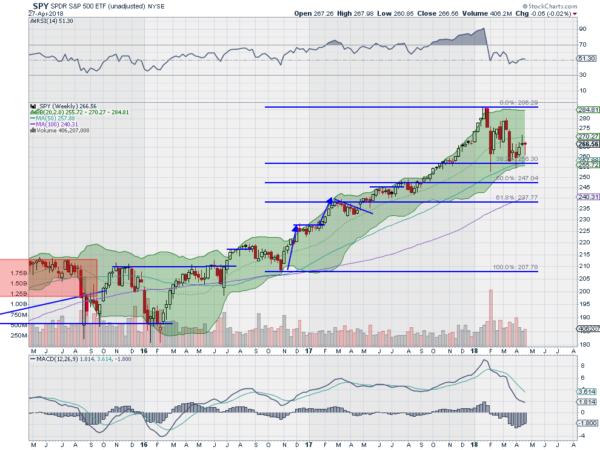

The weekly chart is also a bit mixed with technically a confirmation of a Shooting Star, reversing to the downside, but with strong end of week price action to close it near unchanged. The RSI is holding bullish at the mid line on this timeframe and the MACD is slowing its descent while it remains above zero. There is support lower at 265 and 262.50 then 260 and 257.80 before 255. Resistance above comes at 267.50 and 269 then 271.40, 272.50 and 275 before 279 and 280. Tightening Consolidation.

SPY Weekly, $SPY

As the calendar looks to turn from April to May the equity markets are floundering. They could sure use some May flowers after all the spring rain. Elsewhere look for Gold to continue its broad consolidation while Crude Oil remains in an uptrend. The US Dollar Index is showing signs of life and attempting to reverse higher while US Treasuries are bouncing in their downtrend.

The Shanghai Composite looks weak and possibly on the verge of a big move lower while Emerging Markets continue to churn at the highs. Volatility looks to drip lower and out of the nearly 3 month range, which would be a positive for equities. The equity index ETF’s SPY, IWM and QQQ, all seem stuck in tightening consolidation and holding over important support on the longer timeframe. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.