A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators suggested, heading into the week saw the equity markets remaining positive in the longer run but mixed with a bit of trepidation in the short term.

Elsewhere looked for Gold (ARCA:GLD) to continue to hold around 1200 while Crude Oil (NYSE:USO) continued its short term bounce. The US Dollar Index (NYSE:UUP) looked to continue to consolidate sideways while US Treasuries (ARCA:TLT) were biased higher if they were to break their consolidation range. The Shanghai Composite (NYSE:ASHR) was on fire and frothy but who knew when it will stop while Emerging Markets (ARCA:EEM) consolidated their recent move higher.

Volatility (ARCA:VXX) looked to remain subdued keeping the bias higher for the equity index ETF’s ARCA:SPY, ARCA:IWM and NASDAQ:QQQ. Their charts suggested that the longer term view remained stronger while in the short term the IWM continued to be the strongest but with some short term trepidation in the SPY and QQQ with a decent possibility to start the week lower.

The week played out with gold holding near 1200 early but then probing lower while Crude Oil consolidated its recent bounce. The US dollar moved slightly lower in its consolidation while Treasuries broke consolidation to the downside. The Shanghai Composite continued its climb, giving a bit back Friday, while Emerging Markets made another assault on the recent high.

Volatility made a new low for 2015 and at levels not seen since December 5, 2014. The Equity Index ETF’s all moved higher on the week, with the SPY breaking a 2 month range near the all-time high, the IWM approaching its all-time high from 2 weeks ago and the QQQ’s making a new 15 year high moving towards the all-time high at 117.56. What does this mean for the coming week? Lets look at some charts.

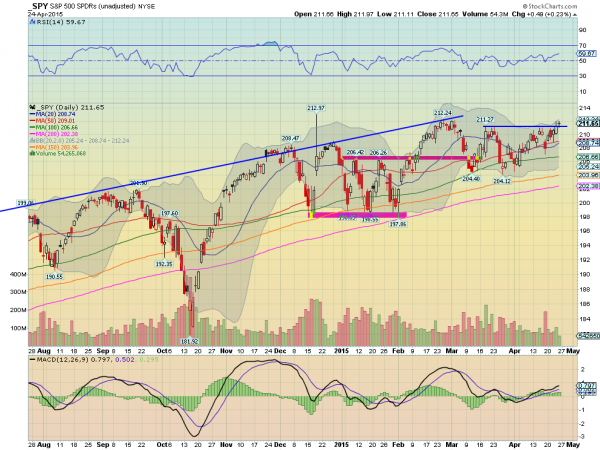

SPY Daily, SPY

The SPY started the week higher, confirming the hammer from Friday as a reversal. After filling the gap down it stalled though at prior resistance. Thursday it poked over that resistance but could not hold. Then Friday it moved back over the resistance and held, establishing a new 7 week closing high. That is the good news. The other side of the coin is that the Friday candle was a doji star, a possible reversal signal. The momentum indicators are positive though. The RSI on the daily chart is rising and bullish while the MACD is also rising and bullish.

Moving out to the weekly chart shows the price pressing against the top of the consolidation box since October. The RSI on this timeframe is holding in the bullish zone as it consolidates while the MACD has pulled back and is set up for a bullish cross. The Bollinger Bands® are opening to the upside, which is a good sign to facilitate a move higher. There is support at 211 and 210.25 followed by 209 and 208 before 206.40 and 204.40. Resistance higher stands at 212.24 and 212.97, with the 161.8% Fibonacci retracement of the move lower in the Financial Crisis at about 213. Consolidation in the Uptrend with an Upward Bias.

SPY Weekly, SPY

Heading into the last week of April, the equity indexes are looking strong on the weekly timeframes and a bit mixed on the short term view. Elsewhere look for Gold to continue lower while Crude Oil rises towards a major character change area. The US Dollar Index looks to continue to consolidate the large move higher while US Treasuries are biased lower in the short term in their uptrend. The Shanghai Composite and Emerging Markets are biased to the upside with risk of the Chinese market becoming overheated at any point.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts all look higher ion the weekly timeframe but on the daily timeframe the QQQ may be a bit stretched while the IWM and SPY test resistance but with some strength. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.