Last week’s review of the macro market indicators saw with Easter behind and April options Expiration ahead, equity markets looked a bit weaker short term as they gave up some ground. Elsewhere looked for gold (NYSE:GLD) to continue in its uptrend while crude oil (NYSE:USO) also moved higher. The US Dollar Index moved into broad consolidation while US Treasuries (NASDAQ:TLT) were biased higher short term and might be reversing. The Shanghai Composite looked to continue to drift higher as Emerging Markets (NYSE:EEM) consolidated their recent move up.

Volatility (NYSE:VXX) looked to remain low, but higher than it had been and with a short term bias to continue up. This alone should not be enough to put a damper on equities but could contribute. The equity index SPY (NYSE:SPY), IWM (NYSE:IWM) and QQQ (NASDAQ:QQQ), all looked ready to continue to give ground in the short run. In the intermediate view they were all stronger with the QQQ strongest and IWM next and the SPY the least positive.

The week played out with gold pushing higher to the round number before a small pullback into the end of the week while crude oil fell back from resistance and then accelerated lower. The US dollar started lower in consolidation before an end of week bounce while Treasuries pushed up out of consolidation and held. The Shanghai Composite got knocked back toward long term support while Emerging Markets consolidated in a drift lower.

Volatility made a bee line back lower and held at more normal levels. The Equity Index ETF’s all started the week moving back higher, and continued through Friday with the the QQQ making another all-time high, and the SPY and IWM at the top of ranges and looking toward a break higher. What does this mean for the coming week? Lets look at some charts.

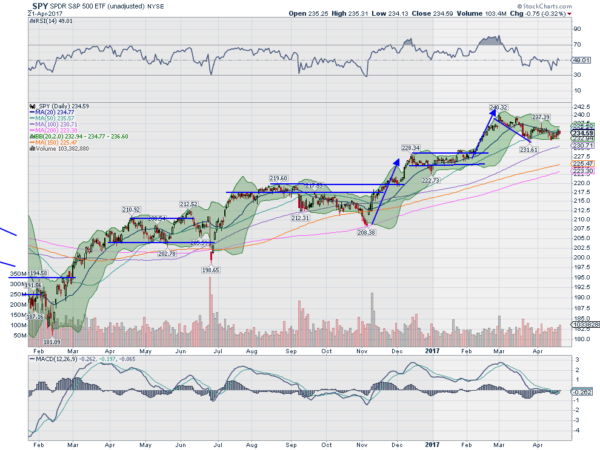

SPY Daily

The SPY came into the week after a modest 3 day pullback. The longer candle at the end of the week suggested maybe more to come. But it was also out of its Bollinger Bands®, a place the SPY does not like to be. Monday saw a strong move higher all day taking it back to the 20 day SMA and inside the Bollinger Bands. The bounce could only hold though as Tuesday saw an inside day and then a bearish engulfing candle Wednesday. Thursday it rose again and briefly pushed over the 50 day SMA, but it could not close there. The week ended with another move down and an inside candle.

All told the SPY held in a 3 point band though, not much excitement and perhaps a bit too much analysis for such a small move. The daily chart shows a shallow pullback morphing into a sideways consolidation. The RSI is moving back to the mid line and the MACD is about to cross up. These support more upside. The narrow Bollinger Bands also suggest a move could happen very soon. On the weekly chart the picture is much clearer.

After the reaching the Measured Move higher the SPY has pulled back along falling trend resistance. This week just added to that bull flag, with an inside week. It stays above the 20 week (100 day) SMA in the top half of the Bollinger Bands. This is still strong. The RSI is pulling back but still well into the bullish zone while the MACD is crossed down, reset lower. There is support at 233.70 and 231.80 followed by 229.4 and 227.50. Resistance above sits at 236 and 237.10 then 239.80. Continued Retrenchment in Uptrend.

SPY Weekly

With April Options Expiration behind, the equity markets are a bit stronger than last week in the short term and still in consolidation longer term. Elsewhere look for gold to pause in its uptrend while crude oil continues to pull back lower. The US dollar Index remains moving sideways in broad consolidation while US Treasuries continue to look better to the upside in the short term. The Shanghai Composite has morphed into a consolidation with a downward bias short term and Emerging Markets are pulling back in their uptrend.

Volatility has moved up slightly from abnormally low levels to a more normal range but still low which continues to keep an upward push on the equity index ETF’s SPY, IWM and QQQ. Their charts look stronger in the short term, with the QQQ and IWM stronger than the SPY, but with all three consolidating near their highs and strong in the intermediate term. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.