A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators which heading into April Options Expiration week saw the equity markets had stalled in some respects and might start to turn back lower. Elsewhere looked for gold (NYSE:GLD) to continue its reversal higher as crude oil (NYSE:USO) rose. The US Dollar Index (NYSE:UUP) looked weak and headed lower while US Treasuries (NYSE:TLT) were strong and rising.

The Shanghai Composite (NYSE:ASHR) looked to continue its drift higher as Emerging Markets (NYSE:EEM) were starting to turn lower. Volatility (NYSE:VXX) looked to remain subdued keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts showed some weakness, especially in the SPY (NYSE:SPY), with the NYSE:IWM and NASDAQ:QQQ a bit stronger and consolidating, but no longer rising short term.

The week played out with gold finding resistance early and turning back lower while crude oil also started higher but rolled over late in the week. The US dollar found support and bounced while Treasuries drifted lower until a rebound Friday. The Shanghai Composite continued the drift higher while Emerging Markets moved to another higher high.

Volatility started the week low and stable and then dropped further. The Equity Index ETFs continued the consolidation to start the week but then all moved higher mid week and held the gains. The SPY started the move up with the QQQ and the IWM quickly followed. What does this mean for the coming week? Lets look at some charts.

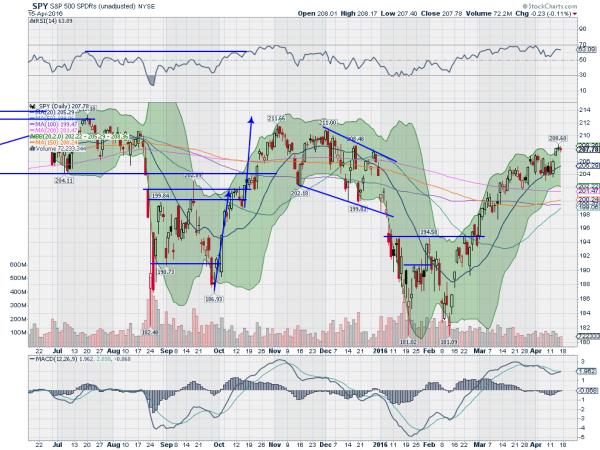

SPY Daily

The SPY started the week pushing down through the 20 day SMA. It rebounded with a strong candle Tuesday and was followed by a gap up move Wednesday to a higher high. Thursday saw a possible Shooting Star and it confirmed lower Friday, but barely, and held the gap up. The daily chart shows the RSI holding the bullish zone with the MACD about to cross up. This is bullish support. Note as well that the 50 day SMA is moving higher fast towards a Golden Cross probably within 2 weeks.

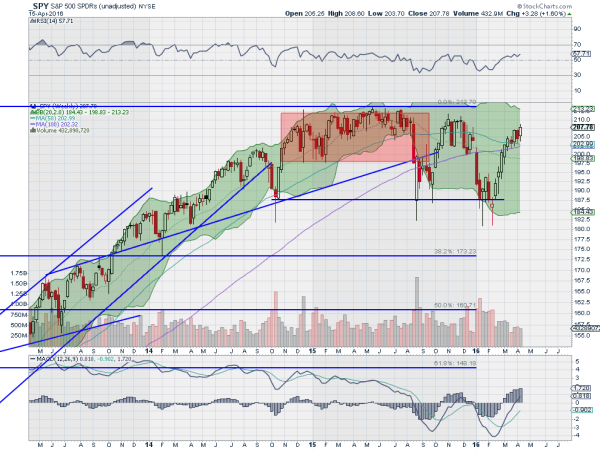

The weekly picture sees a move higher, continuing the upward leg. The RSI is at the edge of what has been resistance since December 2014 and the MACD is rising and now positive. There is resistance at 208.50 and 210.75 followed by 211.50 and 213. Support lower comes at 207.60 and 206 followed by 203.75 and 201.50. Continued Uptrend.

SPY Weekly

With April Expiry behind the Equity markets held strong and look to have started back higher. Elsewhere look for gold to consolidate while crude oil consolidates but with a bias to the upside. The US dollar Index is testing the bottom of the consolidation range while US Treasuries look to move higher.

The Shanghai Composite and Emerging Markets look strong and ready to go higher the with risk of Emerging Markets running in place a bit longer. Volatility looks to remain subdued keeping the bias higher for the equity index ETFs SPY, IWM and QQQ. Their charts also look better to the upside now with the weekly charts looking strong. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.