Last week’s review of the macro market indicators noted that as we headed into the week, the equity markets continued to hold onto long term uptrends, consolidating in broader ranges as they printed nearly identical weeks, ending lower. Elsewhere looked for gold (GLD) to continue to consolidate in a broad range while Crude Oil (USO) consolidated with a bias lower. The US Dollar Index (DXY) looked to mark time sideways while US Treasuries (TLT) consolidated with a bias higher.

The Shanghai Composite (ASHR) returned after a short week stuck in a range at the February lows while Emerging Markets (EEM) continued to build a bull flag at the highs. Volatility (VXX) looked to remain elevated creating a headwind for the equity index ETFs SPY, IWM and QQQ. Their charts showed broad consolidation after the recent pullback with the QQQ at greatest risk of a move lower.

The week played out with gold spiking higher to resistance, stalling and then pulling back while crude oil broke the consolidation to the upside. The US dollar faded lower until bouncing late in the week, remaining in a tight range while Treasuries moved higher and consolidated. The Shanghai Composite tried to break consolidation higher but stalled at the 20 day SMA while Emerging Markets inched higher in their consolidation.

Volatility held in a tight range drifting lower, relieving more pressure from the equity indexes. The Equity Index ETF’s all moved higher on the week, pushing over the recent range, with the IWM leading the charge followed by the QQQ and then the SPY. All three finished weak though drawing back to the break out into the close Friday. What does this mean for the coming week? Lets look at some charts.

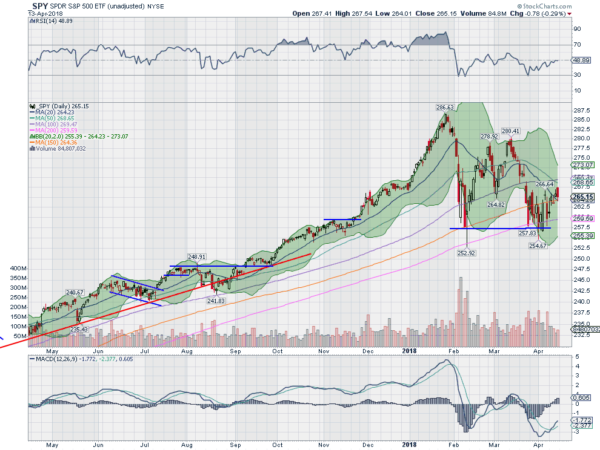

The SPY came into the week holding over the 200 day SMA in broad consolidation. It held there Monday printing an inside day and a doji, signaling more indecision. Tuesday saw a push to resistance and the 20 day SMA. It held under there Wednesday and then broke the moving average to the upside Thursday. It pushed above resistance Friday but could not hold and retreated to the 20 day SMA.

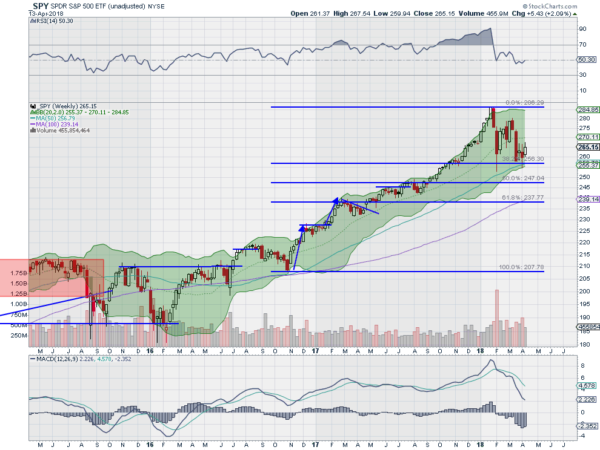

The daily chart shows the RSI stalling at the mid line with the MACD crossed and rising. The Bollinger Bands® are tightening, prepping for a move. The shorter chart is suspect as to whether it can continue higher. The weekly chart is much more promising with a confirmation of a Hammer reversal to the upside.

The RSI is pushing back up through the mid line with the MACD falling. There is support at 265 and 262.50 then 260 and 257.50. Higher resistance stands at 267.50 and 269 followed by 272. Consolidation with an Upward Bias.

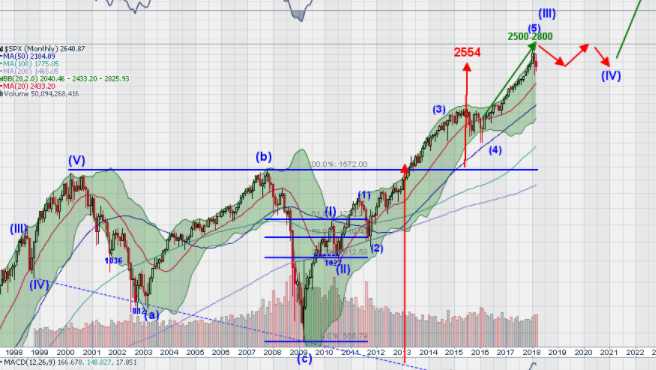

Heading into April options expiration, the equity markets poked above consolidation in a signal of strength but had trouble holding it Friday. Elsewhere, look for gold to consolidate with a bias higher while crude oil continues its run higher. The US Dollar Index continues to move sideways while US Treasuries consolidate with a bias higher. The Shanghai Composite and Emerging Markets look to continue to consolidate, with the Chinese market near lows and Emerging Markets at highs.

Volatility looks to continue to drift lower easing the pressure on the equity index ETFs SPY, IWM and QQQ. Their charts had pressed higher in the shorter time frame but printed an ugly Friday. On the longer time frame they look to be reversing higher though, a time divergence. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.